Incorporation into Hyundai Motor Group's Robotics Value Chain

Expectations for Growth as a Robot Body Module Manufacturer

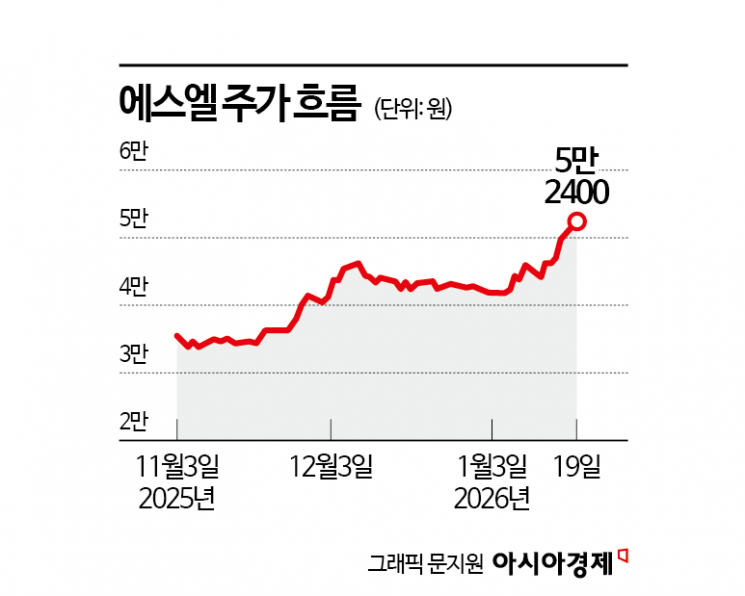

SL, a company that manufactures automotive lamps and electrification components, is expanding its business into the production of robot body modules. As expectations for rapid growth in the robotics market rise, SL's stock price is also showing an upward trend.

According to the financial investment industry on January 20, SL's stock price has risen by 22.3% since the beginning of this year. This outpaces the KOSPI's increase of 16.4% over the same period. SL's market capitalization has surpassed 2.4 trillion won. The stock closed at 52,400 won the previous day, marking its highest closing price ever.

In Yeouido's securities sector, analysts point to the possibility of SL being incorporated into Hyundai Motor Group's robotics value chain as the background for the stock's rise. Eunyoung Lim, a researcher at Samsung Securities, commented, "SL has been selected as a contract manufacturer for Hyundai Motor Robotics Lab's mobile robot 'MobED,' in addition to supplying existing LiDAR modules," adding, "The company is strengthening its presence in the robotics business."

According to Samsung Securities, Hyundai Motor Robotics Lab has set a target of producing 10,000 to 15,000 units of MobED over the next three years. If SL is responsible for producing LiDAR modules, battery packs, and finished products, it is expected to generate an annual revenue increase of about 70 to 80 billion won.

Investor attention is particularly shifting to Boston Dynamics' next-generation humanoid robot, Atlas. Samsung Securities pointed out that Atlas may be produced not by sourcing parts individually, but by assembling modules sourced from component suppliers. This would allow robot manufacturers to rapidly improve product completeness, and companies with established module supply chains would see greater earnings visibility.

Expectations are rising for SL to win the 'body module' contract. While Hyundai Mobis is reportedly responsible for the head module of Atlas, the supplier for the remaining body modules has not yet been disclosed. SL has built up a track record of supplying robot-related components and also owns a production base in North America. This is why it is being mentioned as a potential supplier of Atlas body modules.

The rationale for SL's expansion into the robotics business is gaining traction, as it is not seen as a one-off theme. DB Securities forecasts that after 2026, SL's growth axis will expand from lamps to electrification (SDV) and new robotics businesses. DB Securities researcher Nam Jooshin introduced, "SL supplies leg assemblies, lamps, and LiDAR to two global and two domestic clients in the robotics sector."

SL's core lamp business is also growing steadily. Kim Guyun, a researcher at Daishin Securities, analyzed, "This year, Hyundai Motor Group's volumes are expected to grow, especially in the United States and India," adding, "The benefits from local responsiveness will become stronger." He continued, "SL possesses integrated sensor lamps related to autonomous driving and a robotics lab within its R&D organization, which bodes well for future business investment capacity."

The market is now watching to see whether SL can evolve from a simple component supplier to a module-level production partner in the era of robotics. With the possibility of winning the Atlas body module contract coming into focus, expectations are rising that the upward trend in SL's stock price may continue.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)