Stock Price Rebounds After Correction

Operating Profit Expected to Surge 200% This Year

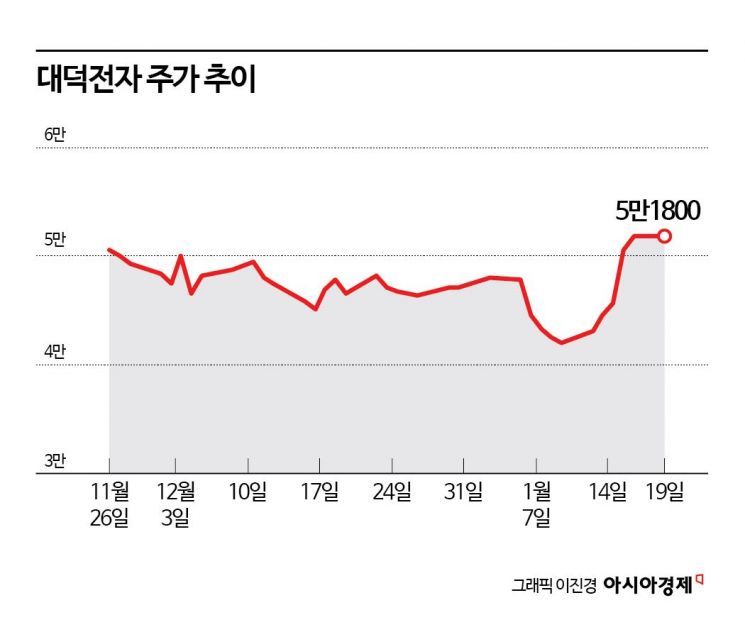

The stock price of Daeduck Electronics is on the rise again. After surging on expectations for artificial intelligence (AI) semiconductors until the end of last year, the stock paused for a breather around the year-end, but has recently shown signs of rebounding once more. The securities industry has analyzed that Daeduck Electronics' stock price trend is now aligning with expectations for this year's performance.

According to the Korea Exchange on January 20, Daeduck Electronics closed at 51,800 won the previous day. After falling to the 41,000-won range earlier this year, the stock has been rebounding. Last year, Daeduck Electronics recorded a gain of more than 200%.

Daeduck Electronics specializes in manufacturing high-layer printed circuit boards (MLB) for semiconductors. As the proportion of high-value semiconductor substrates for server CPUs, GPUs, and AI accelerators continues to grow, the company has been highlighted as a direct beneficiary, which led to a sharp increase in its stock price last year.

However, there was a slight correction starting from the end of last year. This was due to the global semiconductor market recovering more slowly than expected and continued inventory adjustments by client companies, which temporarily lowered earnings visibility. In addition, profit-taking following the rapid short-term rise also weighed on the stock price.

Recently, however, the market's attention has shifted back to Daeduck Electronics' mid- to long-term performance. The company's flip-chip ball grid array (FC-BGA) production line is believed to have reached breakeven at the end of the fourth quarter last year. This was driven by the expansion of models applying advanced driver-assistance systems (ADAS) and the recognition of mass production sales for new clients that began in the second half of last year.

In the case of graphics DRAM (GDDR), despite new competitors entering the value chain at the end of last year, Daeduck Electronics has maintained a high market share among existing clients while also securing new customers. As a result, there is a strong outlook for continued high growth this year compared to the previous year.

Lee Juhyung, a researcher at Eugene Investment & Securities, stated, "Although there are concerns about profitability across the substrate industry due to the sharp rise in major raw material prices, Daeduck Electronics is defending its profitability through a pricing strategy focused on high-capacity new products. As a result, the company is expected to post solid results in the first quarter, which is traditionally considered an off-season, compared to the fourth quarter of last year."

The full-year outlook for this year is also positive. According to financial information provider FnGuide, the consensus for Daeduck Electronics' performance this year is sales of 1.3143 trillion won and operating profit of 150.3 billion won. This represents an increase of more than 25% and 210%, respectively, compared to the previous year.

Park Kangho, a researcher at Daishin Securities, commented, "Demand for server semiconductor packages has increased more than expected, and the FC-BGA segment appears to have turned profitable quickly. In addition, after capacity expansion in the MLB segment, sales are increasing, and market share for server DDR5 is rising. As a result, Daeduck Electronics is expected to deliver differentiated results compared to competitors from the second quarter onward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.