Experts Call for a Multifaceted Response

Strategy Needed to Secure Tariff Exemptions

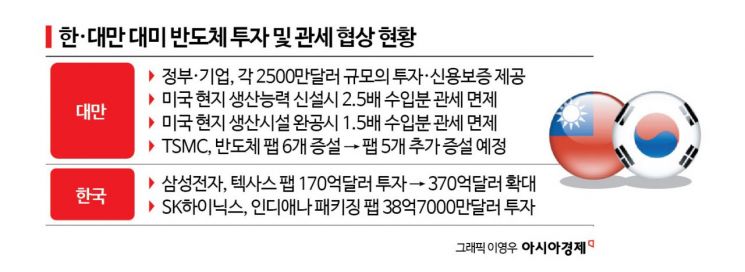

Leverage Existing Investments as Bargaining Chips, Like Taiwan

Broaden Negotiations to Cover the Entire Industry, Including Foundry

The U.S. government is actively leveraging semiconductor tariffs to attract investments from global companies. As the pressure strategy of effectively forcing “domestic production in the U.S.”-primarily targeting Samsung Electronics and SK Hynix-becomes more explicit, industry insiders and experts in Korea have suggested the need for a multifaceted response that uses existing investment commitments as negotiation leverage.

On January 16 (local time), U.S. Secretary of Commerce Howard Lutnick delivered a strong message, stating, “Semiconductor companies have two choices: pay a 100% tariff or manufacture in the United States.” This is interpreted as a strategy to rapidly expand domestic semiconductor production bases in order to maintain leadership in advanced technology.

Experts view this not merely as the imposition of tariffs, but as an “investment inducement measure.” Jang Sang-sik, President of the International Trade and Commerce Research Institute at the Korea International Trade Association, analyzed, “This is an American-style pressure tactic to encourage investment in the U.S. Advanced technology leadership is crucial to avoid falling behind China, and semiconductors are essential for this. However, domestic production bases in the U.S. remain weak.”

"Ongoing Investments Are the Key Card"... Focus Should Be on Securing Tariff Exemptions

Within the Korean semiconductor industry, there is a strong consensus that it is essential to highlight the fact that Samsung Electronics is already building a foundry plant in Texas worth $37 billion, and SK Hynix is constructing a packaging plant in Indiana worth $3.87 billion.

President Jang advised, “Instead of blindly demanding new memory investments, a strategy is needed to secure a certain level of tariff exemptions for the output from factories that are already operating or nearing completion in the U.S. Just as Taiwan used its domestic production volumes as a basis for negotiations, Korea should also leverage its existing production bases as bargaining chips.”

Ku Kibo, Professor of Global Commerce at Soongsil University, also commented, “Since we have already committed to investments in other areas, there may not be a need to do so much more. It is necessary to specify what percentage of semiconductor investments will be made and how much will be invested as a core investment sector.”

Broaden the Scope of Negotiations and Establish Safeguards Against Technology Leakage

There are also suggestions to broaden the scope of negotiations beyond memory semiconductors to include the entire industry, such as foundry (semiconductor contract manufacturing).

A trade expert proposed, “It is necessary to expand the scope of negotiations to include foundry, not just limit it to memory. When investments are made in the semiconductor sector, mechanisms should be put in place to ensure that companies can approach them as simple financial investors (FIs), so that they do not feel burdened by concerns over management stability or the leakage of technology and business secrets.”

Shin Wonkyu, Senior Research Fellow at the Korea Economic Research Institute, said, “We should prepare a Korea-U.S. advanced industry cooperation strategy similar to the second ‘Masuka’ (shipbuilding revival project), without unnecessarily provoking the U.S. government.” He also called for sophisticated measures to respond to legal and institutional pressures from the U.S., such as the International Emergency Economic Powers Act (IEEPA).

"Caution Against Weakening Domestic Foundations" vs. "Opportunity to Gain a Foothold in the U.S. Market"

There are concerns that expanding investments in the U.S. could shrink the domestic semiconductor ecosystem, turning it into a “zero-sum game.” Ahn Kihyun, Executive Director of the Korea Semiconductor Industry Association, cautioned, “The agreement with Taiwan could serve as both pressure and a guideline for Korea. We must secure competitiveness through domestic investment so that we are not tied down solely to U.S. investments.”

On the other hand, some believe that this should be seen as an opportunity to strengthen market dominance by taking advantage of local tax credit benefits in the U.S. Kyung Heekwon, Research Fellow at the Korea Institute for Industrial Economics & Trade, said, “Currently, the business environment in the U.S., including tax credit benefits for capital investment, is not bad. It may be the right path for Samsung Electronics and SK Hynix to expand facility investments and increase their production capacity in the U.S.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.