K-Beauty Expands into Haircare

Hair Product Exports Reach $430 Million

Scalp as Skin: The Rise of the "Skinification" Trend

The global phenomenon of 'K-Beauty' is expanding beyond skincare into the realm of haircare. With growing global demand for Korean haircare products such as shampoos and scalp essences, last year’s exports of hair products reached an all-time high.

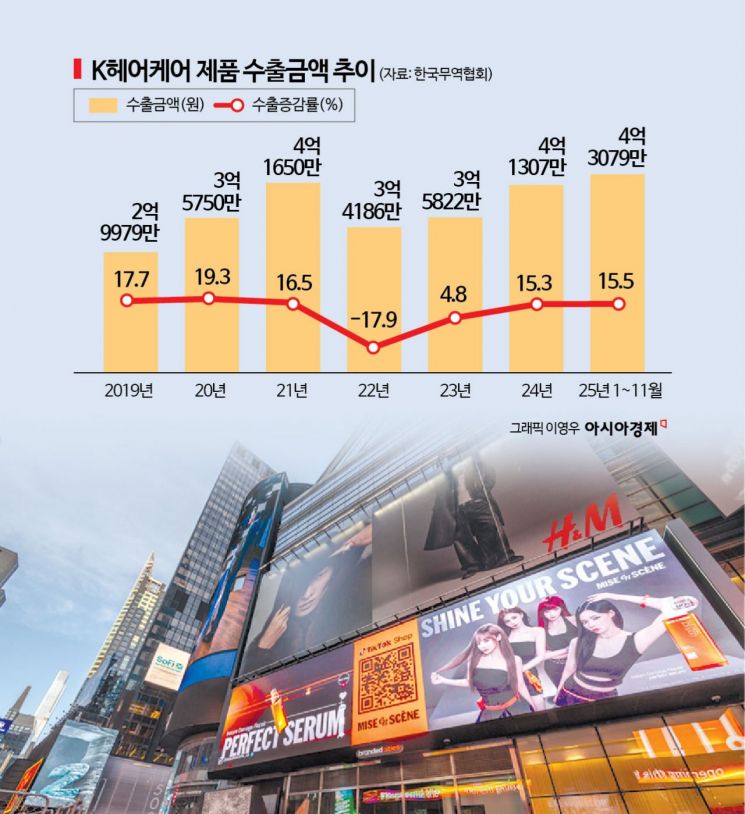

According to the Korea International Trade Association’s statistics site (K-STAT) on January 18, exports of hair products from January to November last year totaled 430.78 million dollars, a 15.5% increase compared to the same period the previous year. This figure already surpasses the total annual exports for 2024 (413.07 million dollars), marking the highest annual export value ever recorded.

This growth is driven by the 'skinification' trend, which treats the scalp with the same care as facial skin. While exports previously focused on cleansing shampoos and treatment products, there is now rapidly increasing demand for treatments, essences, and hair loss management products with 'derma' (dermatological science) functions tailored to different scalp types and concerns.

The rise of K-haircare is attributed to the growing popularity of K-beauty. As Korea has established itself as a powerhouse in skincare, expectations have risen that scalp products will also offer advanced functionality. Reasonable pricing and product diversity have also contributed to competitiveness.Brands with low-irritation ingredients, dermatological formulations, and skincare expertise have been continuously launching scalp care products, naturally drawing the attention of global consumers.

In June of last year, The Founders, which operates the skincare brand Anua, launched the haircare brand Fromlabs and began targeting the U.S. market. Amorepacific’s subsidiary COSRX also designated haircare as a new growth sector by introducing the 'Peptide-132 Ultra Perfect Hair Bonding' in July last year. VT (VT Cosmetics), known for its Riddle Shot, is selling hair ampoules containing PDRN, and Able CNC’s beauty brand A’pieu is selling its hair vinegar line on Amazon.

Especially in overseas markets, the 'haircare routine' is becoming firmly established. Just as K-beauty popularized step-by-step skincare products such as serums, ampoules, and creams, haircare routines are evolving from simply using shampoo and treatments to more segmented approaches, including hair packs, scalp essences, and specialized hair loss essences. An industry insider explained, "As the perception of the scalp as an extension of the skin spreads, interest in Korean products is growing," adding, "This is due to the spread of efficacy-focused content and the image of Koreans who value shiny and healthy hair."

By country, export growth is most prominent in regions where K-beauty is already popular. From January to November last year, exports to the United States were the highest at 95.02 million dollars, up 28% year-on-year. Exports to Japan reached 34.95 million dollars, an 8.3% increase, while Hong Kong saw a 29% rise to 20.17 million dollars.

Korean companies are also seeing notable results in the U.S. market. Amorepacific’s 'Mise-en-Scene Perfect Serum' ranked first in sales in the hair styling oil category during Amazon’s Black Friday period last year. Sales during this period surged 65% year-on-year. The Perfect Serum is gaining popularity among North American consumers for its immediate effectiveness in improving damaged and frizzy hair.

LG Household & Health Care’s scalp care brand 'Dr. Groot' also expanded its sales channels by launching its 'Scalp Revitalizing Solution' line of shampoos and treatments in Costco’s offline stores in the United States, Canada, and Mexico in October last year. In the first half of last year, online sales growth in North America reportedly approached 800%.

K-haircare is also experiencing rapid growth in emerging markets such as South America and the Middle East. Brazil and Saudi Arabia ranked 10th and 11th, respectively, in hair product exports, with export values of 7.1 million dollars and 5.93 million dollars. Although the market size is still small, growth rates reached 216% and 124%, respectively. Amorepacific’s Mise-en-Scene is also recording high growth in Brazil (273%), Canada (48%), and Russia (21%). Cosmetics ODM company Cosmax is advancing its technology to target the global curly hair market, which has grown to a scale of 17 trillion won. Focusing on the U.S. and South American markets, which have different hair types from Asia, the company plans to develop customized haircare products segmented by curliness and scalp condition.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.