Korea Automotive Journalists Association New Year Seminar on January 16

Yang Jinsu, Head of Mobility Industry Research Office, HMG Management Research Institute

HMG Management Research Institute, the think tank of Hyundai Motor Group, has diagnosed that the global automotive industry has entered a phase of "structural compound crisis" this year, with market competition and external policy risks acting simultaneously. The institute particularly emphasized that expanding local production to respond to tariffs does not necessarily lead to cost reduction, making strategic decision-making by automakers more important than ever.

On January 16, Yang Jinsu, Head of the Mobility Industry Research Office at HMG Management Research Institute, stated at the Korea Automotive Journalists Association New Year Seminar held at the Automobile Hall in Seocho-gu, Seoul, "The profitability deterioration of traditional automakers has deepened into a structural compound crisis, not only due to internal competition but also because of external risks such as tariffs and regulations."

He added, "This is not just a matter of short-term profit decline; it will become a fundamental crisis that increases uncertainty in securing resources for future investments."

Yang identified specific crisis factors, explaining that, in addition to internal market competition pressures such as the rapid rise of Chinese companies and the burden of investment in future vehicles, external policy risks like tariffs and fuel efficiency regulations are also acting simultaneously. In particular, the United States' tariff policies are directly impacting automakers' profitability. Toyota has estimated a decrease in operating profit of about 1.4 trillion yen for the fiscal year 2026, while Volkswagen also revised its operating margin outlook downward by 1.5 percentage points to 4-5% last year.

With protectionism intensifying, especially in the United States, automakers are facing what is being called a "double investment burden." In the United States, expanding local production and making new investments to avoid tariffs are inevitable, while outside the United States, restructuring existing export supply chains and incurring additional costs to stimulate markets are occurring simultaneously.

Yang explained, "Even if automakers establish local factories to avoid tariffs, there is a possibility that costs may actually increase compared to simply bearing the tariffs," adding, "This is not just an economic calculation but a complex outcome reflecting strategic decisions by management, such as the intention to reduce local risks."

On the 16th, Yang Jinsu, Head of the Mobility Industry Research Division at Hyundai Motor Group HMG Management Research Institute, is giving a presentation at the Korea Automotive Journalists Association New Year Seminar. Photo by Korea Automotive Journalists Association

On the 16th, Yang Jinsu, Head of the Mobility Industry Research Division at Hyundai Motor Group HMG Management Research Institute, is giving a presentation at the Korea Automotive Journalists Association New Year Seminar. Photo by Korea Automotive Journalists Association

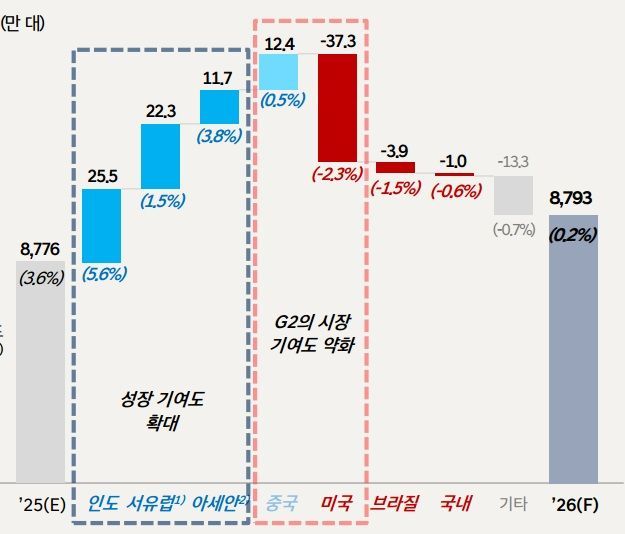

Regarding this year's automotive market outlook by region, Yang predicted that as growth momentum in the United States and China slows, the center of growth will shift to emerging markets such as India and ASEAN. With the Chinese market's growth rate, which had driven global demand until last year, expected to plummet from around 7% to 0.5%, automakers' reliance on emerging markets is expected to increase further.

He forecasted that this year, the main regional automotive market growth rates will slow in the United States (-2.3%) and China (0.5%), while India (5.6%) and ASEAN (3.8%) will continue to drive growth. Western Europe (1.5%) is also expected to see modest growth.

The region expected to see the greatest change is China. The Chinese automotive market recorded 24.34 million units last year, growing 7.8% year-on-year thanks to the strengthening of the "old-for-new" policy and base effects. However, this year, due to economic uncertainty and a lack of subsidy resources in some local governments, the market is expected to reach only 24.47 million units, up just 0.5% from the previous year. Yang stated, "From this year, as the Chinese government maintains its stance to curb overproduction and ease price competition, automakers are likely to adjust their production volumes."

In contrast, the Indian and ASEAN markets are expected to show relatively solid trends. The Indian market is projected to grow by 5.6% this year to 4.82 million units, driven by improved consumer sentiment following the revision of the Goods and Services Tax (GST) system. Yang explained, "The effect of lower tax rates will strengthen the momentum for small car sales, and the expansion of new SUV launches will drive market growth."

The ASEAN market is also expected to grow by 3.8% this year to 3.19 million units, reversing last year's 0.1% decline and returning to growth for the first time in four years. Yang analyzed, "The market will be revitalized as Chinese companies expand local investment and major automakers launch new models."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.