Limited Trickle-Down Effect in Semiconductors, Industry Polarization

Equipment Makers Await Customer Investments and Recovery

Set and Component Makers on High Alert to Protect Profitability

Recently, domestic semiconductor materials company A has been facing growing concerns. The company made large-scale investments to secure inventory in advance, responding proactively to requests from memory manufacturers such as Samsung Electronics and SK Hynix. However, these efforts have not led to actual orders. As Samsung and SK Hynix remain cautious about investing in memory production facilities, materials companies are left with increasing inventory management costs. A company representative lamented, "We have increased our inventory, but prices are actually falling, and as our customers delay their investments, our profitability continues to deteriorate."

While Samsung Electronics and SK Hynix have both posted record-breaking results, ushering in a 'golden age of memory,' the so-called 'trickle-down effect' is not being felt within the semiconductor ecosystem. In fact, the semiconductor equipment industry is suffering from intensified price competition for orders. Paradoxically, as manufacturers' performance improves, equipment prices are being pushed down even further.

Inverse Performance: Equipment Companies Suffer as Samsung Electronics Thrives

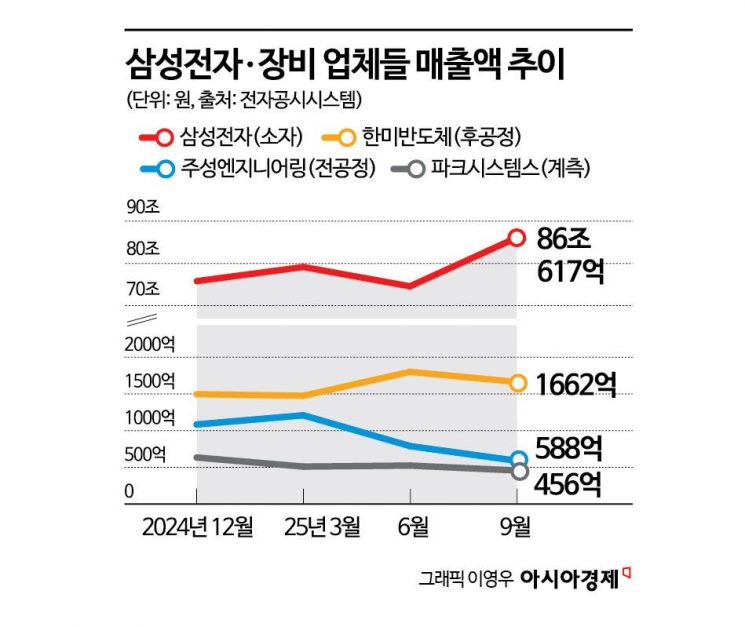

According to industry sources and the electronic disclosure system on January 16, the performance gap between memory manufacturers and equipment companies in the downstream sector has become stark. Contrary to expectations that a memory boom would benefit materials, components, and equipment companies, the polarization within the industry has only become more pronounced, with the trickle-down effect effectively blocked.

Comparing the third quarter to the second quarter of last year, Samsung Electronics' operating profit nearly tripled from 4.6761 trillion won to 12.1661 trillion won. In contrast, during the same period, the operating profit of Hanmi Semiconductor, a leading domestic equipment company specializing in back-end processes, fell from 86.4 billion won to 67.8 billion won. Jusung Engineering, which focuses on front-end processes, saw its operating profit drop by half, from 6.6 billion won to 3.4 billion won. Even compared to the semiconductor (DS) division of Samsung Electronics, equipment companies continue to feel relatively deprived. Samsung Electronics' DS division turned a profit in the first quarter of last year, recording 1.91 trillion won, which then surged to 6.45 trillion won in the second quarter. The division continued its sharp recovery, posting 3.86 trillion won in the third quarter. In the fourth quarter, boosted by the full-scale supply of high-bandwidth memory (HBM) 3E and a further increase in memory prices at the end of the year, operating profit is estimated to have reached the 5 trillion won range.

A representative of a domestic equipment company stated, "Things are improving little by little, but it has not yet translated into securing profits or raising prices. Only when supply becomes tight again will prices be able to rise." Another equipment company official commented, "If Samsung Electronics and SK Hynix ramp up their equipment orders, it will be reflected in our performance, but that is not the case yet."

Materials and Equipment Industry: "Time Lag Before Results Show... Hoping for HBM Effect"

On the second day of CES on the 7th (local time), RAM equipped with SK Hynix memory was exhibited at a Chinese company's booth at the Las Vegas Convention Center (LVCC) in Nevada, USA. Photo by Yonhap News

On the second day of CES on the 7th (local time), RAM equipped with SK Hynix memory was exhibited at a Chinese company's booth at the Las Vegas Convention Center (LVCC) in Nevada, USA. Photo by Yonhap News

In contrast to the spectacular comeback of semiconductor manufacturers, materials and component companies in the downstream sector are currently experiencing what could be described as a "mirage." The aftermath of aggressive price-cutting competition, which was undertaken to secure customer orders during the previous industry downturn, continues to hold them back.

A representative from a semiconductor materials company explained, "Although memory manufacturers are increasing their utilization rates, low-priced supply contracts signed during the previous slump are still in effect. For now, we are focusing on regaining market share and securing volume, watching for a real opportunity to rebound, rather than improving profitability." Equipment companies are also enduring a "lean period" as manufacturers remain cautious about process miniaturization and expanding new production lines, resulting in a time lag before actual orders are reflected in their performance.

Experts, however, note that the surge in demand for data centers driven by the artificial intelligence (AI) boom represents a structural change, not a temporary phenomenon. Demand for high-value-added products such as HBM and DDR5 continues to soar, and analysts believe that the massive profits accumulated by memory manufacturers will inevitably lead to increased capital expenditures (CAPEX).

Park Jaekeun, President of the Korean Society of Semiconductor and Display Technology and Professor at Hanyang University, said, "There is usually a time lag of more than six months before orders are reflected in sales. Only after equipment is delivered and operational will material inputs increase, forming a structure where the performance of the lower ecosystem follows."

"Chip Prices Are Intimidating": Set and Component Companies Struggle with Cost Pressures

On the 9th, busy construction work is underway at the Yongin Semiconductor Cluster General Industrial Complex construction site in Wonsam-myeon, Cheoin-gu, Yongin-si, Gyeonggi-do. Photo by Yonhap News.

On the 9th, busy construction work is underway at the Yongin Semiconductor Cluster General Industrial Complex construction site in Wonsam-myeon, Cheoin-gu, Yongin-si, Gyeonggi-do. Photo by Yonhap News.

The rise in memory prices is hitting set companies that manufacture finished products such as smartphones, TVs, and home appliances hard. As memory, which accounts for a high proportion of production costs, becomes more expensive, these companies are scrambling to defend their profitability.

Lee Cheong, President of Samsung Display, recently hinted at the possibility of cascading cost pressures on related component industries, such as displays, due to rising memory prices at 'CES 2026,' the world's largest electronics and IT exhibition held in the United States. Roh Taemoon, President of Samsung Electronics, also expressed his concerns, saying, "We are deeply troubled by the need to adjust smartphone prices due to rising chip costs."

Kim Jeonghoe, Vice Chairman of the Korea Semiconductor Industry Association, analyzed, "When the price of a component with a monopoly position, such as Nvidia's graphics processing unit (GPU), rises, demand-side companies are left with no options. Given the current market structure, there is no immediate solution to this problem."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)