Bank of Korea Releases Report on Export Competitiveness by Major Items

Last year, South Korea’s exports surpassed $700 billion for the first time in history, marking a significant achievement in terms of scale. However, an analysis has found that, among the country’s key industries supporting the economy, only semiconductors and automobiles have maintained or strengthened their competitiveness. The export base for steel has weakened considerably, and the market competitiveness of petrochemicals has declined as China has increased its self-sufficiency. Even for semiconductors and automobiles, there are growing concerns that market competitiveness could deteriorate due to intensified competition from Chinese products and the expansion of local production.

According to the “Evaluation of Export Competitiveness by Major Items” report released by the Bank of Korea on January 16, South Korea’s industrial competitiveness from 2018 to 2024 has grown mainly in a few sectors such as semiconductors, while exports of major non-IT items have shown a stagnant trend.

The Bank of Korea decomposed global market share by industry into item competitiveness and market competitiveness. Item competitiveness reflects factors such as price and cost competitiveness compared to rival countries, technological and quality standards, productivity, supply stability, and reputation or brand power. Market competitiveness refers to relative advantages in trade costs such as tariffs, the local competitive environment, geopolitical shocks, and logistics accessibility.

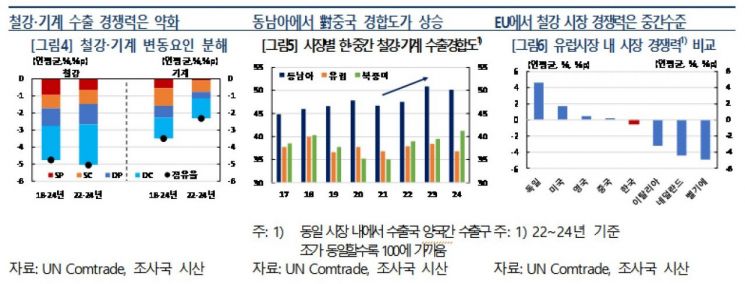

Steel Loses Ground to China, with Both Item and Market Competitiveness Weakening... Petrochemicals Face Deteriorating Market Conditions

Since 2018, South Korea’s steel and machinery exports have seen both item and market competitiveness weaken. The decline in item competitiveness is attributed to China’s mid-2010s capacity expansion and the supply glut following the 2021 real estate downturn (the Evergrande crisis), which led to a flood of low-priced Chinese products in the global market, eroding the price competitiveness of Korean products. Market competitiveness also fell, as competition with Chinese steel intensified in Southeast Asia. China’s sharp increase in direct investment in ASEAN countries has resulted in a massive influx of cheap steel into emerging markets.

The market competitiveness of the steel industry is at risk of further deterioration. This is because the European Union is set to fully implement the Carbon Border Adjustment Mechanism (CBAM) this year, which could significantly increase trade costs. Until recently, South Korea’s market competitiveness in Europe was relatively higher than that of Italy and the Netherlands among major steel exporters. However, with the introduction of CBAM, the increased cost burden of carbon emission rights may weaken price competitiveness, potentially narrowing South Korea’s position in the EU market.

Chemical industry products have seen their global market share decline since 2018, mainly due to a slowdown in global demand rather than competitiveness issues. During this period, item competitiveness has slightly improved. In response to China’s capacity expansion in the late 2010s and the emergence of commodity products using U.S. shale gas byproducts, the domestic industry has shifted toward increasing the share of specialty products over commodities. As a result, the proportion of fine chemicals among chemical products rose from 16.7% in 2018 to 24.7% last year, leading to improved item competitiveness.

However, from 2022 to 2024, market competitiveness has sharply declined, further widening the drop in market share. This is attributed to a significant increase in China’s self-sufficiency in major export markets such as battery materials. The completion of a self-sufficient system for commodity products through large-scale capacity expansion in China has also undermined South Korea’s market competitiveness. Major competitors in regions such as the Middle East are also building large-scale facilities using new equipment and processes, suggesting that the weakening trend in the competitiveness of chemical products is likely to continue. The processes being promoted in the Middle East are expected to greatly improve chemical product yields compared to existing methods, raising concerns that South Korea may lose out in price competition and see its item competitiveness weaken further.

Automobiles and Semiconductors Improve Item Competitiveness... Market Conditions Deteriorate

During the survey period, automobiles showed an upward trend in global market share, supported by favorable demand conditions and a slight improvement in overall export competitiveness. Item competitiveness was strengthened during this period. Breaking it down by vehicle type, internal combustion engine vehicles-whose quality has been steadily improved by domestic companies-contributed most to the gains in competitiveness. The competitiveness of electric vehicles also increased from 2022 to 2024, as Korean companies developed dedicated EV platforms. However, despite strong export growth, hybrids did not improve their competitiveness compared to rival countries.

On the other hand, market competitiveness lagged behind Mexico, especially in the United States, the largest export market, where it deteriorated. The expansion of local production by major automakers in Mexico has given them advantages in market access and cost, which has negatively affected South Korea’s exports to the U.S. From 2022 to 2024, market competitiveness in Europe also weakened compared to other European exporters such as Spain and Romania. This is also due to local companies gaining a competitive edge through lower logistics costs and cheaper labor.

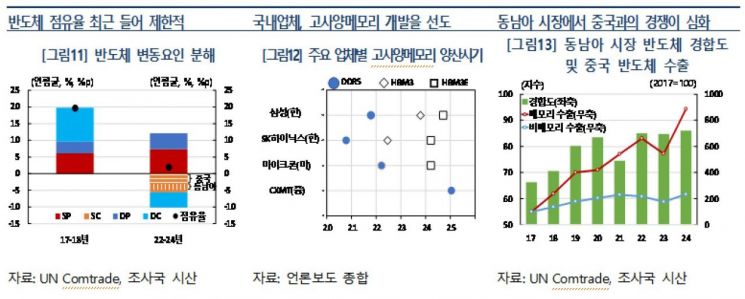

For semiconductors, a comparison of competitiveness during the boom years of 2017-2018 and the recent period of 2022-2024 shows that item competitiveness significantly improved in both periods, contributing greatly to the rise in global market share. In particular, item competitiveness surged recently as domestic companies developed and commercialized high-value-added products such as high-bandwidth memory (HBM) and DDR5 about a year ahead of competitors.

However, from 2022 to 2024, unlike previous semiconductor upcycles, market competitiveness has weakened, especially in China and Southeast Asia. This is due to China expanding its memory production capacity, accelerating import substitution for commodity products. Chinese companies have also significantly increased memory exports to Southeast Asia, intensifying competition with South Korea.

Jin Chanil, head of the International Trade Team at the Bank of Korea’s Research Bureau and lead author of the report, stated, “This year, overall exports are expected to show solid growth thanks to the semiconductor boom, but the polarization between sectors is likely to deepen as non-IT sectors continue to underperform. Future policies must be differentiated by precisely diagnosing changes in competitiveness for each item.” He added, “In the case of the chemical industry, it is important to proceed smoothly with ongoing restructuring and to quickly shift toward high-value-added specialty products. For the steel industry, companies should adjust the scale of commodity production facilities in line with the government’s advancement plans. For items such as semiconductors and automobiles, where competitiveness has been maintained or improved, it is crucial to support research and development (R&D) and strengthen technology security so that companies can proactively respond to changes in global demand and sustain their competitive edge.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.