Five Members Favor a Hold, One a Cut Over the Next Three Months...

Phrase 'Further Rate Cuts' Deleted from Policy Statement

Exchange Rate, Decisive Factor in Rate Hold Decision

"A High Level of Vigilance Is Needed"

Did Liquidity Injection Push Up the Exchange Rate?

"The Facts Are Wrong" - Unusual Rebuttal Briefing

At the first Monetary Policy Committee meeting of the Bank of Korea this year, the committee unanimously decided to keep the base interest rate unchanged at 2.50% per annum. Despite stabilization efforts by foreign exchange authorities, the decisive reason for maintaining the current rate was the renewed surge of the won-dollar exchange rate to the upper 1,400 won range at the start of the new year. Looking ahead to the next three months, five out of the six committee members, excluding the governor, also saw a high likelihood of maintaining the current rate, strongly favoring a hold. This has increased expectations that the rate freeze, which has continued since July last year, may be prolonged.

At a press conference following the monetary policy decision meeting on January 15, Bank of Korea Governor Lee Changyong explained this month's decision to hold, stating, "From a financial stability perspective, it is necessary to continue monitoring the foreign exchange and housing markets, so we judged it appropriate to maintain the current base rate while reviewing domestic and external policy conditions." He added, "This decision was made unanimously by all members of the Monetary Policy Committee."

Lee Changyong, Governor of the Bank of Korea, is answering reporters' questions at the monetary policy direction press conference held at the Bank of Korea in Jung-gu, Seoul on the morning of the 15th.

Lee Changyong, Governor of the Bank of Korea, is answering reporters' questions at the monetary policy direction press conference held at the Bank of Korea in Jung-gu, Seoul on the morning of the 15th.

Exchange Rate: Decisive Reason for This Month's Rate Hold... "We Must Remain Highly Vigilant"

The main factor behind this month's rate hold is exchange rate instability. At the end of last year, the won-dollar exchange rate surged above 1,480 won, but after stabilization measures by the authorities, it calmed to around 1,430 won. However, as the new year began, the upward trend resumed, pushing the rate back up to the upper 1,470 won range before a slight adjustment on the day of the meeting. Governor Lee emphasized, "It is undeniable that the exchange rate had a decisive impact on this rate hold decision," and stressed, "We must maintain a high level of vigilance."

Governor Lee cited several reasons for the renewed rise in the exchange rate this year: First, the recent strengthening of the US dollar and weakening of the Japanese yen, combined with heightened geopolitical risks such as the situations in Iran and Venezuela; Second, although overseas investments by the National Pension Service have decreased, the pace of overseas investments by other residents (such as individuals) has accelerated, matching the highest levels seen in October and November last year, resulting in continued supply-demand imbalances. He explained that individual investors have repeatedly made large-scale dollar purchases whenever the exchange rate drops to a certain level. Governor Lee analyzed that about three-quarters of the rise in the exchange rate to the 1,470 won range this year was due to external factors such as the strong US dollar, while the remaining quarter was due to internal factors such as supply-demand imbalances.

Lee Changyong, Governor of the Bank of Korea, is speaking at a press conference on the interest rate decision of the Monetary Policy Committee held on the 15th at the Bank of Korea in Jung-gu, Seoul.

Lee Changyong, Governor of the Bank of Korea, is speaking at a press conference on the interest rate decision of the Monetary Policy Committee held on the 15th at the Bank of Korea in Jung-gu, Seoul.

Overnight, US Treasury Secretary Scott Bessent made an unusual verbal intervention, stating that "a decline in the value of the won and excessive volatility inconsistent with Korea's strong fundamentals are undesirable." As a result, the exchange rate fell to around 1,460 won in the morning, but market concerns persist. Regarding Secretary Bessent's remarks, Governor Lee commented that the gap between Korea's fundamentals and the exchange rate is something everyone can agree on, and that there is nothing surprising about his comments.

Concerns also remain regarding the housing market and household debt. Although government measures announced on October 15 and the banking sector's management of total household loans have slowed the growth of household debt, expectations of further real estate price increases persist, raising concerns that the slowdown may be only temporary due to strong regulations. Governor Lee noted, "The housing market in the Seoul metropolitan area continues to see high annual price growth rates of around 10%, and balloon effects are appearing in some non-regulated areas, so we must pay close attention to the impact on household debt."

Did Liquidity Injection Push Up the Exchange Rate?..."The Facts Are Wrong" - Unusual Rebuttal Briefing

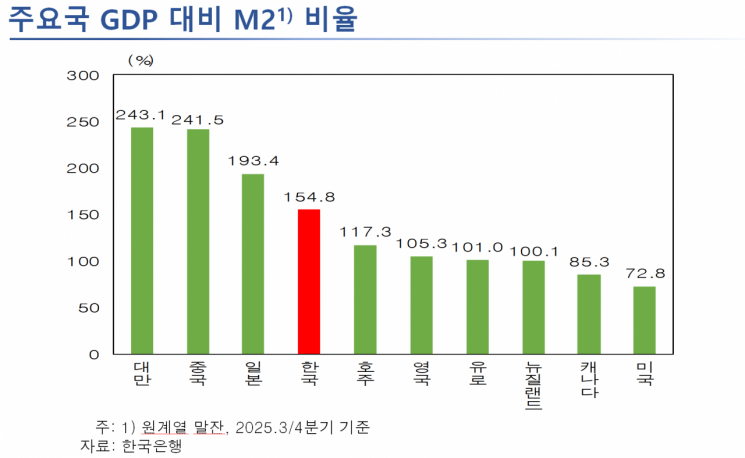

In response to recent criticism that the government and the Bank of Korea injected excessive liquidity into the market, causing the exchange rate to rise, Governor Lee flatly denied this, saying, "This is the most upsetting and infuriating claim recently." He continued, "Since taking office as governor, my top priority for the past three years has been to reduce household debt for financial stability. As a result, the growth of broad money supply (M2) has stopped, and it has not increased during my term." He added, "Some claim, without checking the facts, that the exchange rate rose because M2 increased, but this does not match the data. Such misinformation is spreading, and it is most troubling to hear that the Bank of Korea injected a lot of money and caused the exchange rate to rise." Governor Lee further emphasized, "Some compare Korea's M2-to-GDP ratio to that of the US and claim liquidity is excessive, but this depends on whether a country's financial system is bank-centered or capital market-centered. It is unheard of to claim that a high ratio alone means excessive liquidity."

Following the press conference, Deputy Governor Park Jongwoo held an additional, highly unusual briefing on the matter. Deputy Governor Park stressed that the recent M2 growth rate has rapidly declined and is now below historical averages, and that the M2-to-GDP ratio has also stopped rising and is moving sideways. He pointed out, "Contrary to some claims, the M2 growth rate has been falling rapidly since 2022. Although there has been a slight rebound recently, it remains significantly lower than the historical average." He added, "Claims that M2 growth drove the exchange rate higher were somewhat correlated before COVID-19, but the relationship has since changed direction. Recently, the M2 growth rate has dropped significantly, while the won-dollar exchange rate continues to rise, indicating there is virtually no correlation."

The higher M2-to-GDP ratio in Korea compared to the US is a result of the greater share of banks in the financial sector, and cannot be cited as a cause of high exchange rates. Deputy Governor Park explained, "In countries where banks play a large role in the financial sector, such as Korea, Japan, China, and Taiwan, this ratio is high, while it is low in Western countries with capital market-centered systems. The US has the lowest M2-to-GDP ratio among major countries, at about half that of Korea, because banks account for only about 23% of the total financial sector, compared to about 45-46% in Korea."

Governor Lee emphasized, "Many opinions circulating in the market are not based on accurate facts, and as these spread through various channels, they are fueling expectations of further exchange rate increases. I thought it was necessary to correct this, which is why I arranged this briefing."

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Committee plenary meeting held on the 15th at the Bank of Korea headquarters in Jung-gu, Seoul.

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Committee plenary meeting held on the 15th at the Bank of Korea headquarters in Jung-gu, Seoul.

Phrase 'Further Rate Cuts' Deleted, Changed to 'Supporting Growth Recovery'

The Monetary Policy Committee expects that the recent consumer price inflation, which has been above 2%, will gradually decline to the target level of 2.0% due to stable international oil prices. However, it also noted that the higher exchange rate could exert upward pressure on inflation, so caution is needed. The committee assessed that this year's growth rate will generally match the Bank of Korea's November 2025 forecast of 1.8%, but there is a growing possibility of higher growth due to a stronger global semiconductor market and better-than-expected growth in major economies. However, the committee also noted the need to be mindful of the so-called 'K-shaped recovery,' where the robust IT sector contrasts with continued weakness in non-IT sectors, resulting in a significant gap between sectors.

Not only did the committee members' outlook for the next three months favor a rate hold, but the wording of the monetary policy statement also reflected this stance. This time, the statement deleted references to "further rate cuts and the timing thereof," which had been included in November 2025, and was revised to emphasize "supporting growth recovery." Governor Lee added, "It is still difficult to make a definitive statement about the rate outlook six months from now or further into the future due to significant uncertainty. We will decide based on the data."

Meanwhile, the Monetary Policy Committee decided to extend the temporary special support program for six months for low-credit self-employed individuals and small and medium-sized enterprises located in provincial areas, considering the delayed recovery in the SME and regional sectors.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.