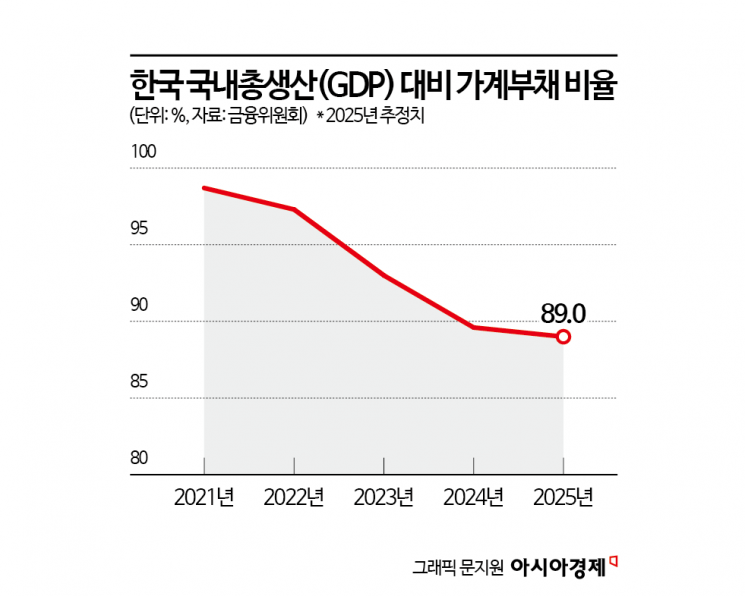

Household Debt-to-GDP Ratio at 89.0% at End of Last Year

6th Highest Among Major OECD Countries... Pace of Debt Improvement Slows

Financial Authorities: "DSR-Based Management to Remain Strong This Year"

Although the government has been strictly regulating household loans since last year, South Korea's household debt-to-GDP ratio still ranks among the highest in the world. The government plans to maintain its strong regulatory stance this year as well, aiming to continuously reduce the debt ratio.

Household Debt Ratio at 89.0% at Year-End... Pace of Improvement Slows

According to the Financial Services Commission on January 16, South Korea's household debt-to-GDP ratio was estimated at 89.0% as of the end of last year. The ratio, which stood at a world-leading 98.7% at the end of 2021, declined to 89.6% by the end of 2024 as the government took measures to manage household debt.

However, the pace of decline has recently slowed. The ratio dropped by 3.4 percentage points from 93.0% in 2023 to 89.6% in 2024, but only fell by 0.6 percentage points between 2024 and 2025. The slowdown in improvement is attributed to sustained high demand for mortgage loans, driven by rising housing prices in the Seoul metropolitan area.

In fact, the net increase in mortgage loans across all financial sectors last year was 52.6 trillion won, lower than the 58.1 trillion won in 2024, but still high compared to 27 trillion won in 2022 and 45.2 trillion won in 2023.

South Korea's household debt-to-GDP ratio remains among the highest globally. According to last year's statistics from the Bank for International Settlements (BIS), among 31 OECD member countries, South Korea ranked sixth after Switzerland (125.3%), Australia (112.7%), Canada (99.1%), the Netherlands (94.0%), and New Zealand (90.1%).

Household Loan Regulations to Continue This Year... Considering Additional Measures

The government believes that an excessively high household debt-to-GDP ratio can undermine economic growth and financial stability. According to research by the Bank of Korea, if the household credit-to-GDP ratio (cumulative over three years) rises by 1 percentage point, the GDP growth rate (cumulative over three years) declines by 0.25-0.28 percentage points after a lag of four to five years.

Statistics also show that an increase in household credit raises the probability of an economic recession (annual GDP growth rate turning negative) after a lag of three to five years. Bank of Korea Governor Rhee Changyong has assessed that a normal household debt-to-GDP ratio is around 80%. Financial authorities are also implementing household debt policies with a long-term target of 80%.

The government plans to continue its strong household debt containment policies this year, following last year’s approach. This is due to the continued rise in housing prices, especially in the Seoul metropolitan area, and the upward trend in rental prices, both of which are heightening public anxiety over housing stability.

The Financial Services Commission is considering additional loan regulation measures, focusing on the Debt Service Ratio (DSR) system. Options under review include applying DSR to policy loans or large-scale jeonse loans for those without homes, and lowering the current DSR cap, which is set at 40% for banks. However, specific regulatory measures and the timing of their announcement have not yet been finalized.

Shin Jinchang, Secretary General of the Financial Services Commission, stated, "This year as well, we will consistently and unwaveringly strengthen our management efforts to stabilize household debt," adding, "Under this strengthened management stance, we will develop additional measures to ease the concentration of funds into real estate and redirect capital toward more productive sectors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.