All Big 4 Law Firms See Revenue Growth...

The Role of M&A Specialists Expands

Shifting Focus from Litigation to Corporate Advisory

Shin & Kim Grows 18%, Jumps from 5th to 3rd Place

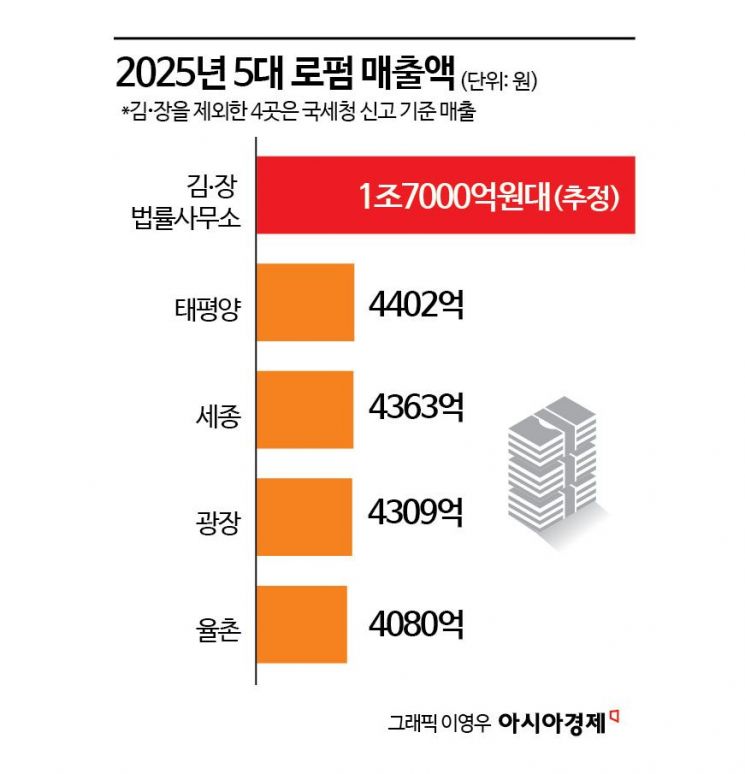

With the exception of Kim & Chang, the law firm with annual revenue in the 1 trillion won range, all of the so-called "Big Four" law firms have surpassed 400 billion won in annual revenue. As the role of law firms in areas such as mergers and acquisitions (M&A) continues to grow, the Big Four have been recording steady annual growth.

According to the legal industry on January 15, Kim & Chang is estimated to have recorded revenue of approximately 1.7 trillion won last year. The firm's revenue for 2024 is projected to be around 1.5 trillion won. Last year, Bae, Kim & Lee posted 440.2 billion won, Shin & Kim 436.3 billion won, Lee & Ko 430.9 billion won, and Yulchon 408 billion won in revenue. The revenue figures for the four major law firms, excluding Kim & Chang, are based on National Tax Service filings.

Shin & Kim's rapid growth is particularly notable. Having remained in the fifth position until 2024, Shin & Kim jumped to third place last year with an 18% increase in revenue compared to the previous year. The firm saw balanced revenue growth across all practice areas, with especially significant increases in M&A, ICT (cybersecurity), corporate litigation (civil and criminal), tax, and fair trade.

In the M&A sector, Shin & Kim's growth was driven by a surge in high-profile, complex transaction advisory work, such as the merger between HD Hyundai Heavy Industries and HD Hyundai Mipo (transaction value: 8.627 trillion won), the establishment of a joint online platform venture between Aliexpress and Shinsegae Group (6 trillion won), and the sale of K-Eco Plant's environmental subsidiaries, including Renewus (1.78 trillion won).

In the corporate litigation sector, Shin & Kim represented the Youngpoong-MBK alliance in the Korea Zinc management rights dispute and secured victories in major civil and criminal cases, such as Asiana Airlines' 250 billion won contract deposit lawsuit against HDC Hyundai Development Company. These achievements are seen as key drivers of revenue growth.

Bae, Kim & Lee reclaimed the second spot after remaining in third place, thanks to its leadership in complex cases involving multiple issues, such as the 13-year-long Lone Star international arbitration (ISDS) case, Samsung Bioepis's Eylea patent invalidation lawsuit, the Korea Zinc management rights dispute, and the Korea Electric Power Corporation KPS serious accident case.

In the M&A sector, Bae, Kim & Lee successfully advised on major transactions involving global private equity funds (PEFs) and large corporations. Key landmark deals included KKR's acquisition of SK Ecoplant's environmental subsidiaries, Affinity's acquisition of a rental car company, and the sale of SK Siltron. The firm's involvement in POSCO International's large-scale palm acquisition in Indonesia, LG Display's sale of its Guangzhou plant in China, and Korean Air's investment in a Canadian airline were also cited as factors driving revenue growth.

Although Lee & Ko dropped to fourth place, its revenue still increased by about 5% year-on-year. Analysts attribute Lee & Ko's relatively slower performance last year to its focus on improving group-specific expertise rather than simply increasing the number of attorneys, unlike the other Big Four firms.

Lee & Ko achieved more than 30% revenue growth in the M&A sector and, after significantly strengthening its criminal trial team, secured acquittals in major criminal cases involving Hanssem, SPC, and Kakao, demonstrating a strategy of selection and concentration. One of Lee & Ko's major achievements last year was securing a not-guilty verdict in the first trial for Kakao Chairman Kim Beom-su.

Yulchon recorded approximately 10% revenue growth last year and had the highest per-attorney revenue among the Big Four. Yulchon provided proactive advisory services in emerging industries such as artificial intelligence (AI) and defense, and saw an increase in overseas work, including regulatory compliance. The firm also achieved balanced growth in traditional areas such as tax, litigation, and fair trade, contributing to its revenue increase.

Additionally, Yulchon stood out in the M&A sector, successfully advising Naver Financial on its merger with Dunamu and participating in major M&A deals such as Woori Financial Group's acquisition of Tongyang Life Insurance and ABL Life Insurance. The firm also achieved significant results by representing SK Group Chairman Chey Tae-won and securing a remand verdict in a property division lawsuit.

An attorney at a major law firm commented, "Recently, companies are increasingly retaining law firms for proactive legal advice before issues arise. While there are limits to revenue growth from traditional civil and criminal litigation, demand for advisory services targeting corporate clients is expected to continue increasing in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)