After the U.S. Treasury Secretary made remarks supporting the value of the Korean won, the won-dollar exchange rate sharply reversed course within a day, falling to the 1,460 won level. The oral intervention by the head of the U.S. Treasury signaled the possibility that Korean foreign exchange authorities might intervene directly in the market again, helping to curb the recent overheated trend. With continued real demand for dollars, ongoing net selling by foreign investors in the domestic stock market, and settlement flows from import-export companies, the won is expected to remain volatile for the time being. The government has launched a pan-government response team to crack down on illegal dollar outflows by exporters and individuals, aiming to defend the value of the won.

Scott Bessent, Secretary of the Treasury (left), and Koo Yoonchul, Deputy Prime Minister and Minister of Economy and Finance, are taking a commemorative photo on the 12th (local time) in Washington DC. Secretary Bessent X

Scott Bessent, Secretary of the Treasury (left), and Koo Yoonchul, Deputy Prime Minister and Minister of Economy and Finance, are taking a commemorative photo on the 12th (local time) in Washington DC. Secretary Bessent X

According to the Ministry of Economy and Finance on January 15, U.S. Treasury Secretary Scott Bessent pointed out the previous night that the recent depreciation of the won "does not align with Korea's strong economic fundamentals," emphasizing that "excessive volatility in the foreign exchange market is undesirable." His comments suggested that the recent weakness of the won is more attributable to market volatility than to concerns about Korea's economic fundamentals. He also reaffirmed, "Korea's strong economic performance in key industries that support the U.S. economy makes Korea a core partner for the United States in Asia."

Secretary Bessent's remarks came just two days after Deputy Prime Minister and Minister of Economy and Finance Koo Yoonchul met with him in Washington, D.C. on the 12th (local time) to discuss the recent situation in Korea's foreign exchange market. The bilateral meeting was held on the sidelines of the Group of Seven (G7) Finance Ministers' Meeting on critical minerals held the same day.

It is extremely rare for the U.S. Treasury Secretary to make remarks that intervene in another country's foreign exchange market. In April 2024, during the Group of Twenty (G20) Finance Ministers' Meeting, the finance ministers of Korea, the United States, and Japan jointly responded to exchange rate issues, but it was not a U.S.-led verbal intervention. In the past, when Japan's Finance Minister Shunichi Suzuki requested intervention to support the yen during Janet Yellen's tenure as U.S. Treasury Secretary, she expressed reluctance, stating, "The United States prefers exchange rates determined by market principles." U.S. interventions in other countries' currency values have typically focused on criticizing intentional devaluation or strong responses to currency manipulation, rather than support.

On the 12th (local time), Deputy Prime Minister and Minister of Economy and Finance Koo Yoon-chul and U.S. Treasury Secretary Scott Bessent held a meeting. (Source: Ministry of Economy and Finance)

On the 12th (local time), Deputy Prime Minister and Minister of Economy and Finance Koo Yoon-chul and U.S. Treasury Secretary Scott Bessent held a meeting. (Source: Ministry of Economy and Finance)

Given that Korean foreign exchange authorities have been continuing direct and indirect interventions to prevent one-sided movements in the exchange rate, Secretary Bessent's remarks are interpreted as supporting Korea's resolve to defend the won. The judgment is that excessive depreciation of the won could be a burden for both countries, especially since, following the results of Korea-U.S. tariff negotiations, annual investments of 20 billion dollars in the United States are to be implemented from this year.

The market responded immediately after the U.S. Treasury Secretary's comments supporting the won. On this day, the won-dollar exchange rate in the domestic foreign exchange market opened at 1,465.0 won, down 12.5 won from the previous session. The won-dollar exchange rate, which had been rising for ten consecutive days since the beginning of the new year, fell by nearly 10 won in after-hours trading immediately following Secretary Bessent's remarks. Compared to the previous day's closing price (1,477.5 won), it dropped by 13.5 won in less than a day.

The authorities are mobilizing all available means to defend the value of the won and focus on stabilizing the market. On this day, the Ministry of Economy and Finance activated the "Pan-Government Illegal Foreign Exchange Transaction Response Team," comprising six agencies including the National Intelligence Service, Financial Supervisory Service, Bank of Korea, National Tax Service, and Korea Customs Service, to manage the supply and demand of dollars, which have been flowing out of the country. Following foreign exchange inspections of export companies, the authorities plan to root out illegal foreign exchange transactions by individuals, aiming to block abnormal cases of dollars being sent overseas.

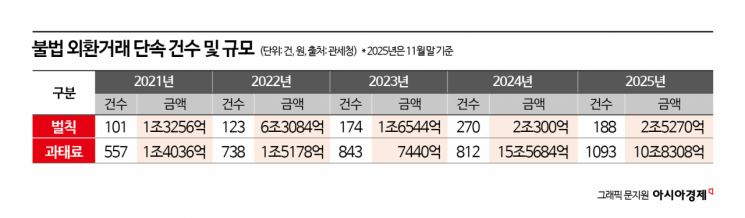

Starting with a kickoff meeting on this day, monthly meetings chaired by bureau directors will select collaborative tasks and carry out planned crackdowns. The main targets of investigation include so-called "hwanchigi" (cross-border remittances without using foreign exchange banks), export-import price manipulation, false reporting for overseas asset flight, offshore tax evasion and money laundering by abusing foreign exchange procedures. The government had previously operated a pan-government response team temporarily during the surge in exchange rates caused by the Legoland incident in 2022. A Ministry of Economy and Finance official noted, "Funds disguised as trade transactions or sent abroad through hwanchigi have increased rapidly in recent years." According to the Korea Customs Service, the number of illegal foreign exchange transaction cases cracked down on last year (as of the end of November) surged by more than 18% to 1,281, compared to 1,082 cases the previous year.

The government's decision to launch intensive investigations into companies and individuals is based on the judgment that illegal foreign exchange transactions surged as high exchange rates became entrenched last year. However, some point out that crackdowns alone cannot be a fundamental solution, as the sharp increase in overseas asset outflows reflects structural factors such as pessimism about the domestic market and increased U.S. investment by Korean companies. Since the end of last year, the government has introduced various foreign exchange market stabilization measures, including promoting dollar conversion by exporters, hedging by the National Pension Service, capital gains tax reductions for returning retail investors, and exemptions from foreign exchange soundness charges, but these measures have not been effective for even a month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)