Financial Services Commission Announces Household Loan Trends

Loan Growth Slows Year-on-Year Due to Household Loan Regulations

Government to Maintain Household Loan Regulation Policy This Year

Due to the government's household loan regulations, the overall increase in household loans across all domestic financial institutions last year saw a slight decrease compared to 2024. The household debt-to-GDP ratio also continued its downward trend. The government plans to maintain its policy of stabilizing household loans by continuing regulations this year.

Household Loan Growth Slows Year-on-Year Due to Regulations

According to the "2025 Household Loan Trends (Provisional)" report released by the Financial Services Commission on January 14, household loans across all financial sectors in 2025 increased by 37.6 trillion won (2.3%) compared to 2024. This is a reduction of 4 trillion won in the growth amount compared to the 41.6 trillion won (2.6%) increase recorded in 2024.

As a result, the household debt-to-GDP ratio fell from 89.6% at the end of 2024 to 89.0% at the end of last year. The government aims to lower the household debt-to-GDP ratio to around 80%.

Looking at the details of household loans across all financial sectors in 2025, mortgage loans increased by 52.6 trillion won year-on-year, a slower pace compared to the previous year's increase of 58.1 trillion won. Other loans decreased by 15 trillion won, with the reduction being less than the previous year's decrease of 16.5 trillion won.

By sector, household loans from banks (32.7 trillion won) saw a reduced increase compared to the previous year (46.2 trillion won). Household loans from non-bank financial institutions (4.8 trillion won) shifted to an increase, compared to a decrease of 4.6 trillion won in the previous year. Bank mortgage loans saw a smaller increase year-on-year (from 52.2 trillion won to 32.4 trillion won), while other loans shifted from a decrease to an increase (from -6.0 trillion won to 0.3 trillion won).

For non-bank financial institutions, household loans from credit card companies (-3.0 trillion won), insurance companies (-1.8 trillion won), and savings banks (-0.8 trillion won) decreased, while mutual finance institutions (10.5 trillion won) saw an increase, mainly driven by Saemaeul Geumgo (5.3 trillion won).

Government to Maintain Household Loan Regulations This Year

Looking only at last month, household loans across all financial sectors decreased by 1.5 trillion won compared to the previous month, reversing the increase seen in the previous month (4.4 trillion won) and the same month of the previous year (2 trillion won).

By loan type, mortgage loans increased by 2.1 trillion won, with the growth slowing compared to the previous month (3.1 trillion won). Other loans decreased by 3.6 trillion won, reversing the increase of 1.3 trillion won in the previous month.

By sector, household loans from banks shifted to a decrease compared to the previous month (from 2.1 trillion won to -2.2 trillion won), while the increase in non-bank financial institutions slowed (from 2.3 trillion won to 0.7 trillion won). Bank mortgage loans decreased by 700 billion won, reversing the previous month's increase of 800 billion won. Specifically, banks' own mortgage loans (from 100 billion won to -1.3 trillion won) and Bogeumjari Loans (from 100 billion won to -300 billion won) turned to decreases, while Didimdol and Butimok Loans (from 700 billion won to 800 billion won) saw a slight expansion in growth.

For non-bank financial institutions, the increase in household loans slowed compared to the previous month (from 2.3 trillion won to 0.7 trillion won). Mortgage loans saw a larger increase compared to the previous month (from 2.3 trillion won to 2.8 trillion won), while other loans shifted from a slight increase (40 billion won) to a decrease of 2.1 trillion won.

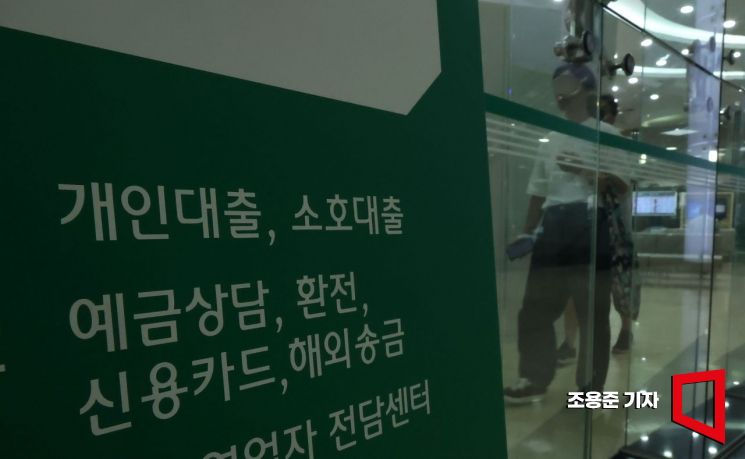

A loan information board is posted at a commercial bank branch in Euljiro, Jung-gu, Seoul. Photo by Yongjun Cho jun21@

A loan information board is posted at a commercial bank branch in Euljiro, Jung-gu, Seoul. Photo by Yongjun Cho jun21@

Shin Jinchang, Secretary General of the Financial Services Commission, stated, "Thanks to policy efforts such as strengthened household loan management measures and the implementation of the three-stage stress DSR, as well as the active cooperation of the financial sector, we were able to manage household loans stably." He emphasized, "This year, we will continue to consistently and unwaveringly strengthen management to stabilize household debt."

He added, "Under this strengthened management stance, we will prepare additional measures so that the concentration of funds in real estate is alleviated and the flow of funds can be redirected to productive sectors."

Meanwhile, at the household debt review meeting held on this day, the Financial Services Commission finalized detailed implementation plans for the revision of the contribution rate to the Korea Housing Finance Credit Guarantee Fund (Jushinbo). Specifically, for loans subject to Jushinbo contributions by financial institutions, if the loan amount is less than or equal to 0.5 times the average loan amount, a contribution rate (base rate) of 0.05% will apply; if it exceeds twice the average, a rate of 0.30% will apply.

After the system improvement, the total contributions paid by financial institutions (about 1 trillion won last year) are expected to decrease slightly compared to the previous year. The new system will be implemented from April after the revision of the Enforcement Rules of the Korea Housing Finance Corporation Act.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.