Response to Illegal Debt Collection, Expansion of the Debtor Representative System

Focus on Enhanced Initial Response and Customized Support

Announcement of Substantial Protection Measures for Victims of Illegal Debt Collection

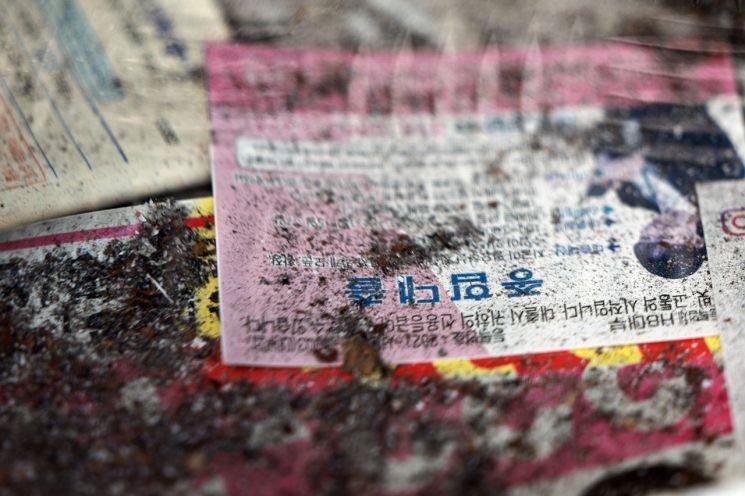

# Mr. A, who runs an interior design business, was introduced to Mr. B by a neighboring merchant and borrowed 13 million won at a monthly interest rate of 5% (60% annually). Due to his urgent financial situation, Mr. A did not draw up a formal loan contract. Even after repaying the full principal and interest, he was continuously pressured to pay additional amounts under the pretext of delayed payment and other charges. Mr. B repeatedly threatened and verbally abused Mr. A over the phone at night, and also threatened to inform people around him, causing Mr. A severe anxiety and psychological distress. As a result, Mr. A sought help from the Korea Legal Aid Corporation. The corporation appointed an in-house attorney as his debtor representative and provided Mr. A with guidance on how to respond to illegal debt collection practices, as well as on the subsequent complaint and evidence-gathering procedures. At the same time, the corporation notified the illegal private lender, Mr. B, of the appointment of the debtor representative and ordered him to cease the unlawful collection activities. This allowed Mr. A to escape from the unjust demands.

The Financial Services Commission and the Financial Supervisory Service announced on January 14 that they will release the '2026 Debtor Representative Appointment Support Program Operation Plan' and will focus their policies on providing substantial protection to victims until illegal collection activities are completely stopped.

Response to Illegal Debt Collection, Expansion of the Debtor Representative System

The debtor representative system is a relief program that allows victims of illegal private lending and illegal debt collection to appoint an attorney from the Korea Legal Aid Corporation free of charge to respond to unlawful collection activities.

Recently, as illegal private lending has spread and evolved, the government has been continuously improving and implementing the debtor representative appointment support program to ensure that victims of illegal private lending can receive faster and more substantial protection. As a result, a total of 12,162 cases were received last year, and 11,083 cases were supported for 2,497 individuals. This is more than a threefold increase from 3,096 cases in 2024.

When applicants for the debtor representative system are categorized by age, support was highest among those in their 30s (33%) and 40s (26%), followed by those in their 20s and younger (25%) and those in their 50s (13%).

The government plans to further expand and strengthen the related program this year. First, to ensure that harm caused by illegal collection is blocked quickly at an early stage, initial response measures before the appointment of a debtor representative will be significantly reinforced.

Currently, before the appointment of a debtor representative (which takes about 10 days), the Financial Supervisory Service sends a warning by text message to the illegal collector, notifying them of the impending appointment of a debtor representative and legal action. Going forward, Financial Supervisory Service staff will issue verbal warnings directly, and warning measures (initial response) will also be implemented for collectors operating via social networking services (SNS), to ensure there are no gaps in victim protection.

In addition, if an illegal private loan falls under an anti-social loan contract, where both the principal and interest are subject to invalidation, the Financial Supervisory Service will issue a certificate of invalidation in the name of the Governor and notify the illegal lender. If there is a risk of physical harm, such as assault beyond online threats, measures will be taken to ensure quicker police protection through administrative coordination with the police.

Focus on Substantial Protection for Victims through Enhanced Initial Response and Customized Support

In close connection with the one-stop comprehensive and dedicated support system scheduled for implementation in the first quarter of this year, tailored and hands-on support for victims will also be provided. When notifying the appointment of a debtor representative, victims will be informed of a contact phone number (representative or person in charge) in case of recurrence of illegal collection, as well as instructions on how to respond and the procedures for reporting damage. After the appointment, regular checks will be conducted to verify whether collection activities have actually ceased.

Furthermore, most illegal private lenders stop illegal collection activities as soon as they become aware of the appointment of a debtor representative. However, there are still cases where some continue to contact victims despite the notification. In response, regular investigations will be conducted to directly confirm whether collection activities have ceased and take appropriate measures.

Starting this year, victims who have used the debtor representative support program will be able to use it again if illegal collection persists, regardless of the number of times or duration. Previously, the system allowed only one extension to enable more low-income and vulnerable individuals to use the program compared to when it was first implemented. However, there were suggestions to improve the system so that it could be used as many times as necessary if illegal collection is repeated or prolonged. Accordingly, the limit on the number of times support can be used will be abolished, so that even if illegal private lenders resume collection or threaten victims in new ways, victims will not be left unprotected by the system.

From next month, the eligibility requirements for related parties will also be eased. The government had previously expanded the scope of support to protect not only the debtor but also family members and acquaintances who suffered from illegal collection. However, under the current system, support for related parties is often blocked if the debtor avoids applying due to psychological distress or reluctance, since the related party can only apply after the debtor has done so. This measure aims to address that issue.

An official from the Financial Services Commission stated, "Through these procedural improvements, we expect to be able to provide prompt support to more victims of illegal private lending," adding, "We will continue to regularly monitor the program's operation and make ongoing efforts to eradicate illegal private lending."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.