NCSoft Hits 52-Week High During Previous Session

Up Over 22% This Year on Expectations for Improved Earnings

Krafton Marks 52-Week Low During Session on January 8

Target Price Lowered Amid Poor Q4 Results and Diminished Outlook

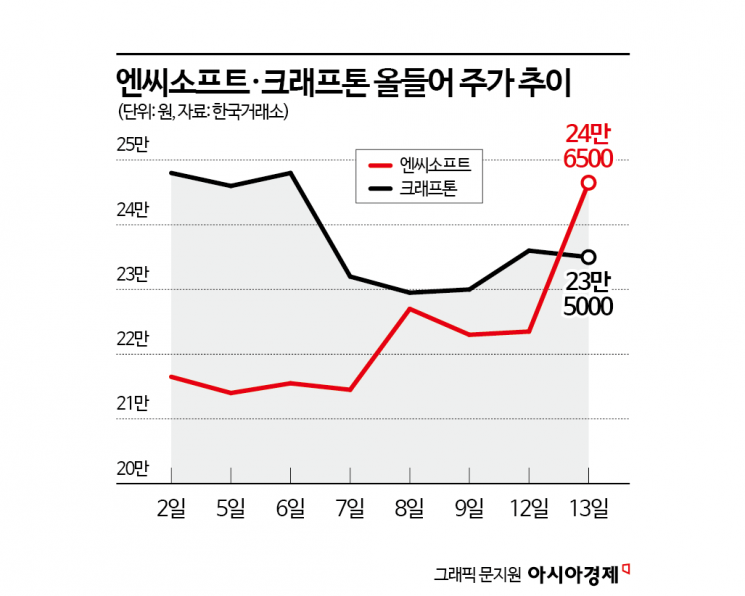

There is a stark contrast between Krafton and NCSoft, the leading game stocks. While Krafton has shown a sluggish trend, hitting a 52-week low at the start of the year due to expectations of poor fourth-quarter results last year, NCSoft continues its strong performance, reaching a 52-week high as expectations for improved results this year grow. This divergence is also evident in the outlooks of securities firms. Since the beginning of the year, NCSoft’s target price has been repeatedly raised, while Krafton’s target price has been lowered.

According to the Korea Exchange on January 14, NCSoft closed at 246,000 won on the previous day, up 10.29% from the previous session. During the trading session, it rose to 248,000 won, setting a new 52-week high. Since the start of the year, NCSoft’s share price has risen by 22.33%.

Krafton closed at 235,000 won, down 0.42%, reversing its upward trend after three days. On January 8, Krafton fell to 227,500 won during trading, marking a new 52-week low. Although it rebounded afterwards, it has not recovered its losses. Since the beginning of the year, Krafton’s share price has declined by 4.47%.

The primary reason for the contrasting stock performances of these two companies is their earnings. According to financial information provider FnGuide, Krafton’s consensus for last year’s fourth quarter (average of securities firms’ forecasts) is sales of 895.6 billion won, up 45.0% year-on-year, but operating profit of 170.7 billion won, down 20.8%. NCSoft’s consensus is sales of 437.6 billion won, up 6.9% year-on-year, and operating profit of 17.4 billion won, which is expected to turn to profit.

NCSoft is expected to see a significant improvement in results this year, driven by the success of 'Aion 2'. Additionally, momentum from new game releases is also a positive factor. Jung Hoyoon, a researcher at Korea Investment & Securities, analyzed, "Based on the success of Aion 2, we expect results to normalize starting this year. In the short term, we can anticipate new title momentum until the release of 'Lineage Classic' on February 7, and in the long term, if new titles in various genres succeed, the valuation will rise and so will the share price. This is currently the most noteworthy stock in the gaming sector."

Reflecting the improvement in performance, securities firms are raising their target prices for NCSoft one after another. Daishin Securities raised its target from 230,000 won to 300,000 won, Hana Securities increased its target from 300,000 won to 320,000 won, and Meritz Securities raised its target from 170,000 won to 183,000 won. Daishin Securities also upgraded its investment rating from 'market perform' to 'buy'. Lee Jieun, a researcher at Daishin Securities, explained, "We raised our operating profit estimate for this year by 25% to reflect the decrease in payment commission rates due to the increase in the proportion of direct payments for NCSoft games. Accordingly, we raised both our investment rating and target price."

Krafton’s sluggish share price is attributed to the burden of growth for its flagship title PUBG and the still-uncertain schedule for new releases. Lee Hyojin, a researcher at Meritz Securities, pointed out, "Krafton has acquired numerous game companies over the past five years, but has failed to demonstrate results. That is why goodwill impairment losses occur every quarter." She added, "Recently, Krafton has expanded its acquisitions to non-game companies. Acquiring non-game companies increases the revenue base but adds to the burden of growth after 2027 and lowers the valuation. As PUBG enters a challenging growth phase, the rapid expansion into non-game businesses is making even potential investors in the gaming industry hesitate."

Expectations are also declining. Samsung Securities lowered Krafton’s target price from 380,000 won to 310,000 won, and Daol Investment & Securities reduced it from 400,000 won to 360,000 won. Korea Investment & Securities cut its target from 390,000 won to 350,000 won, and NH Investment & Securities dropped it from 440,000 won to 350,000 won. Meritz Securities lowered its target from 510,000 won to 300,000 won. Oh Donghwan, a researcher at Samsung Securities, said, "We lowered the target price by 18.4% compared to the previous figure, reflecting intensified competition in the shooting genre and the uncertain schedule for new releases. For a valuation rebound, the sustainability of the PUBG intellectual property and visibility of new blockbuster releases are necessary, so we recommend buying after the new release schedule becomes more concrete."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)