Tourism Balance Deficit Exceeds $10 Billion for Two Consecutive Years

Per Capita Tourism Revenue Rises, But Overseas Spending Grows Even Faster

Duty-Free Slowdown and Short-Stay Structure Undermine Revenue Model

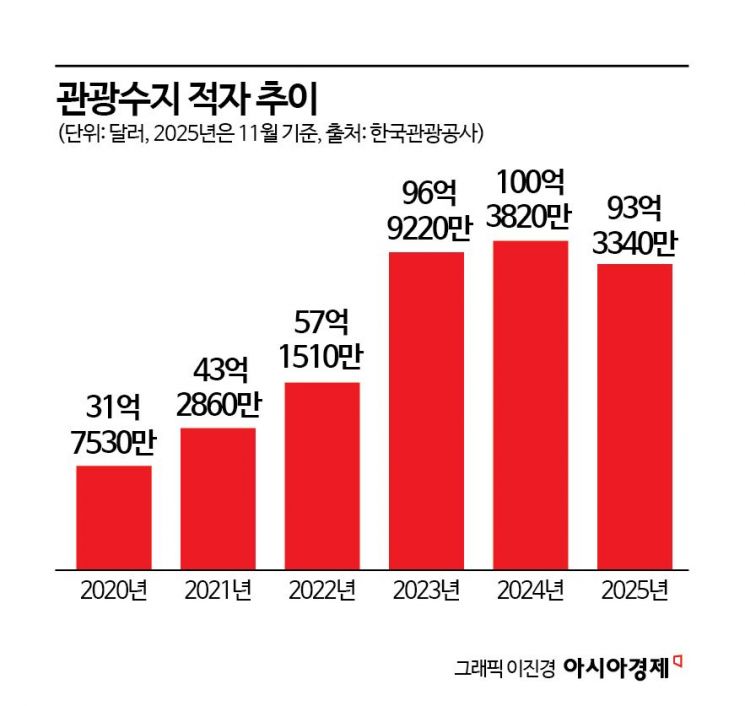

South Korea's tourism balance deficit is expected to surpass 10 billion dollars for the second consecutive year. While overseas travel has become a consumer trend among Koreans, inbound tourism by foreigners remains focused on short stays and shopping.

Travelers are bustling at Incheon International Airport Terminal 1. 2025.12.31 Photo by Kang Jinhyung

Travelers are bustling at Incheon International Airport Terminal 1. 2025.12.31 Photo by Kang Jinhyung

According to the Korea Tourism Organization on January 14, the tourism balance deficit for last year reached 9.3334 billion dollars (approximately 13.75 trillion won) as of the cumulative total through November. Given that the average monthly deficit is around 800 million dollars, it is highly likely that the annual tourism balance deficit will exceed 10 billion dollars for last year as well, following 2024, once the December figures are included.

Per Capita Income Rises, But Deficit Widens... 'Short Visits, Frequent Departures'

The widening tourism deficit can be seen as a structural result of increased overall spending. Last year, the per capita tourism income from foreign tourists was 1,011 dollars as of the cumulative total through November, a 2.6% increase from the same period the previous year (985 dollars). In contrast, per capita overseas tourism spending by Koreans reached 1,005 dollars, a 7.9% increase from the previous year's 932 dollars. Although there is a slight per capita surplus, the overall tourism balance inevitably recorded a significant deficit because the number of Koreans traveling abroad was nearly 10 million higher-26.8 million-compared to 17.42 million inbound foreign visitors.

The main reason for the worsening tourism balance is that overseas travel has shifted from being a luxury to an everyday consumer activity. In the past, overseas trips were typically taken only during vacation seasons, but now short trips to nearby countries like Japan and Southeast Asia on weekends or holidays have become commonplace. This consumption pattern has the effect of structurally raising the baseline for overseas tourism spending, regardless of economic fluctuations.

On the other hand, the consumption patterns of foreign tourists visiting South Korea remain limited. The repeated structure of short-term stays focused on shopping has prevented significant increases in both the length of stay and service consumption. When stays are short and spending is concentrated in specific commercial districts, it is difficult for the absolute scale of tourism income to expand rapidly, even if the number of visitors increases.

The duty-free and shopping-centric model, which once supported the upper limit of tourism income, is also losing its strength. As consumption patterns shift toward online and experiential spending, the impact of duty-free shopping is not what it used to be. Experts point out that unless this gap is filled by increased service consumption in areas such as accommodation, food and beverage, performances, medical care, and wellness, tourism income will remain structurally limited.

Sharp increases in peak-season accommodation costs, lack of accessibility to regional tourism infrastructure, and insufficient multilingual reservation and payment systems are all factors that make South Korea a short-stay destination. From the perspective of tourists, it is often more cost-effective and convenient to stay in South Korea for just a day or two before moving on to Japan or Southeast Asia. This creates a structure in which it is difficult to increase stay-based consumption that would boost tourism income.

Managing the Deficit Over Surplus... Shifting to Stay-Based Consumption

The industry believes the fundamental goal of tourism balance policy needs to be reset. Rather than aiming to achieve a surplus in the short term, it is more realistic for now to manage the deficit at a controllable level.

There is a growing argument that performance indicators for inbound tourism should shift from the number of arrivals to metrics such as length of stay, per capita service consumption, and regional spending ratios. Moving away from a shopping-centric model and increasing high value-added service consumption-such as accommodation, gourmet food, alcoholic beverages, performances, medical care, wellness, and MICE-are seen as necessary to improve the tourism income structure.

Additionally, designing itineraries that connect airports, Seoul, and regional areas; implementing one-stop reservation systems that bundle transportation, accommodation, and tourism products; and expanding nighttime consumption content in regional cities are all essential to expanding stay-based consumption. If there is no compelling reason for foreigners to extend their stay by even a few days, it will be difficult to fundamentally change the tourism balance structure.

There are limits to policy efforts aimed at curbing the now-routine demand for overseas travel. Instead, strategies are needed to buffer the surge in overseas spending by alleviating peak-season concentration and creating alternative demand for domestic travel.

This year as well, the tourism balance is likely to continue posting a significant deficit rather than showing marked improvement. The normalization of overseas travel is unlikely to reverse easily, and neighboring countries like Japan and Southeast Asia continue to offer strong price competitiveness. An industry official commented, "The tourism balance deficit can be seen as an indicator of what the Korean tourism industry is actually earning money from. Unless we move away from competing solely on visitor numbers and simultaneously change both the structure of stays and spending, the era of 10 billion dollar deficits is likely to become a new constant rather than a temporary phenomenon."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.