Stable Cash Flow from Franchise Royalties

Potential for Overseas Expansion Driven by K-Food Popularity

Relatively Easy Resale Adds to the Appeal

Despite a sluggish mergers and acquisitions (M&A) market, private equity fund (PEF) managers are showing strong interest in food and beverage (F&B) assets. These assets are highly valued for their steady cash generation and potential for overseas expansion.

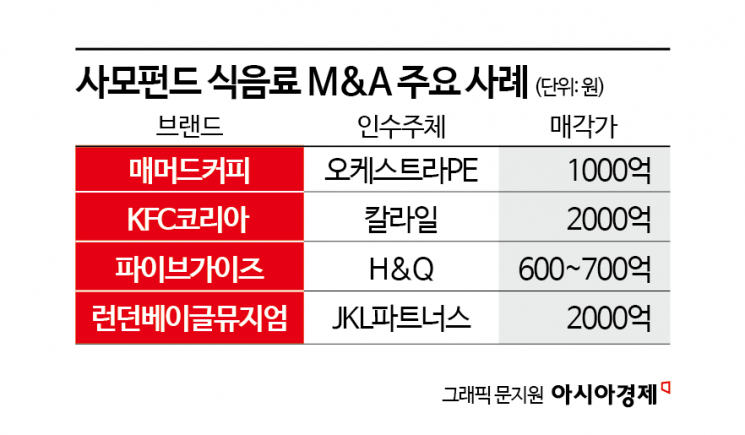

According to the investment banking (IB) industry on January 13, a series of M&A deals involving F&B assets took place at the end of last year and the beginning of this year. Last month, H&Q Korea acquired FG Korea, the Korean operator of the handmade burger brand Five Guys, for between 60 billion and 70 billion won. KFC Korea was acquired by the global private equity firm Carlyle Group for over 200 billion won. Earlier this year, Orchestra Private Equity Partners acquired Mammoth Coffee, a low-cost coffee franchise, continuing the wave of M&A activity.

Consistent Cash Generation Even During Downturns

The greatest appeal of F&B assets is their stable cash flow. High-growth companies in sectors such as IT and biotech require significant investment periods before generating revenue. To expand sales, they must build more factories, which takes at least several years. However, F&B companies can generate sales immediately by preparing and selling food, and even during economic downturns, the decline in sales is relatively small since people cannot skip meals.

This appeal is even greater for brands operating franchise businesses. Franchise headquarters can collect various fees and royalties from franchisees without having to cook themselves. Additionally, since they do not directly hire employees or pay rent for stores, the operational burden is relatively low, which is another attractive factor.

Steady cash generation allows PEFs to easily implement portfolio management strategies such as dividends. For example, Dining Brands Group, which operates the chicken brand BHC, paid out a total of 489.7 billion won in dividends from 2021 to 2024. This amounts to about 82% of its net profit. MBK Partners formed a consortium in 2021 to acquire management rights of Global Restaurant Group, which owns BHC, and Dining Brands Group is a subsidiary of Global Restaurant Group.

An IB industry insider explained, "In the case of F&B, the predictability of cash flow is high, making it advantageous to use both leverage and dividend strategies." The insider added, "The easiest way to increase cash flow is to expand the number of franchise stores. This is why PEFs often switch from directly operated stores to franchise models after acquisition."

Easy to Scale Up and Sell

The active M&A activity in F&B assets is also due to the relative ease of expanding overseas operations.

It is reported that H&Q, which acquired Five Guys last month, highly valued its potential for overseas expansion. Rather than focusing solely on domestic hamburger sales, they saw the potential to use the Japanese market as a stepping stone for further international growth.

FG Korea, which operates Five Guys, established its Japanese subsidiary FG Japan GK in January last year and carried out a capital increase of 5 billion won for FG Korea, preparing for business expansion. H&Q expects that if they successfully transfer the proven operational expertise from Korea to Japan, the resale value could exceed the EV/EBITDA (enterprise value to earnings before interest, taxes, depreciation, and amortization) multiple of 7 times that was recognized at the time of acquisition.

There are many cases where successful overseas expansion has led to profitable resales. A notable example is the milk tea brand Gong Cha. UCK Partners acquired Gong Cha Korea in 2014, secured franchise rights in Japan, and pursued an aggressive global expansion strategy, increasing the number of stores worldwide by nearly tenfold. In 2019, UCK resold Gong Cha to the U.S.-based PEF TA Associates, earning more than five times their investment.

Numerous F&B Assets Awaiting Sale

There are many F&B assets currently awaiting sale in the market. VIG Partners has begun the process of selling Bonchon. In 2018, VIG became the largest shareholder by acquiring a 55% stake in Bonchon Chicken using its third fund. Since then, the company has grown into a franchise operating about 500 stores in 10 countries worldwide.

Norang Tongdak, which nearly reached the sale stage last year, is also a major asset. The shares of Norang Tongdak (corporate name Norang Food) are 100% owned by Q Capital and KStone Asia through the special purpose company Norang Holdings. Mom's Touch, which KL& Partners had been preparing to sell, has recently shifted to a long-term strategy through refinancing of about 560 billion won.

An IB industry insider commented, "Although there are many F&B assets on the market, competitiveness in overseas markets is a crucial factor. It is also important to develop a localization-based reverse export structure that goes beyond simple export strategies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.