Results of Gwangju Chamber of Commerce and Industry Survey

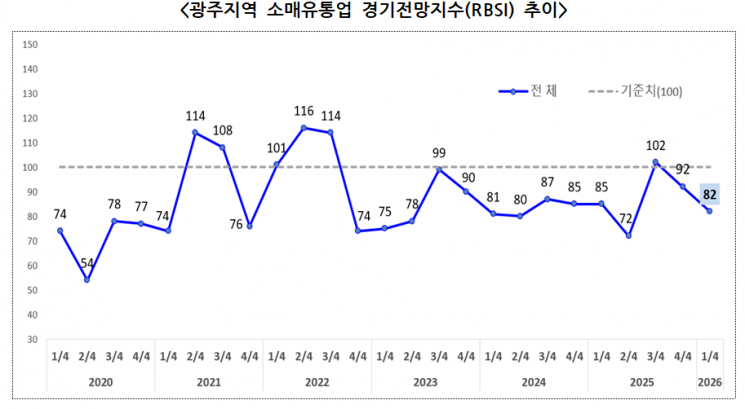

Trend of the Retail Distribution Business Outlook Index in the Gwangju Area. Provided by the Gwangju Chamber of Commerce and Industry

Trend of the Retail Distribution Business Outlook Index in the Gwangju Area. Provided by the Gwangju Chamber of Commerce and Industry

The business sentiment among retail and distribution companies in the Gwangju area has continued to decline for the second consecutive quarter.

On January 12, the Gwangju Chamber of Commerce and Industry announced the results of its survey of 47 retail and distribution companies in the Gwangju area for the "Retail Distribution Business Outlook Index for the First Quarter of 2026," which recorded a score of 82, down 10 points from the previous quarter’s 92.

This figure falls below the baseline of 100 for the second consecutive quarter. The decline appears to be the result of a combination of negative factors, including weakened consumer sentiment due to persistent high inflation, the seasonal off-peak period with the onset of winter, and the end of the consumption coupon program.

By category, the sales outlook index (84→76) continued its downward trend as consumer sentiment weakened due to a decrease in foot traffic during winter and ongoing economic uncertainty caused by high exchange rates and inflation. In contrast, the profit outlook index (80→87) rose slightly compared to the previous quarter, reflecting expectations for a short-term sales recovery driven by the upcoming Lunar New Year holiday. However, it still remains well below the baseline of 100, indicating that profitability is difficult to improve as the burden of fixed costs continues to rise due to increases in labor and utility expenses.

Outlook varied by business type, depending on expectations for the holiday season. Large discount stores (50→100) recovered to the baseline, reflecting anticipated increases in demand for gift sets and ceremonial goods ahead of the Lunar New Year holiday. Department stores (100→100) are expected to remain flat compared to the previous quarter, supported by holiday consumption and the stable purchasing power of loyal customers.

On the other hand, convenience stores (94→71) are expected to see a deterioration in business sentiment due to reduced outdoor activity in winter and diminished consumer spending power caused by high inflation. In particular, supermarkets (109→67) recorded the largest decline, as the end of the consumption coupon program directly led to a significant drop in customer traffic.

Local retail and distribution companies cited "delayed recovery of consumer sentiment" (40.4%) as the most pressing issue and challenge for their business operations in the first quarter of 2026. This was followed by ▲cost burden (23.4%), ▲intensifying market competition (12.8%), ▲rising purchase prices for goods (8.5%), and ▲persistently high interest rates (6.4%), indicating that local retail and distribution companies are facing a dual challenge of sluggish domestic demand and a high-cost structure.

Chae Hwaseok, Executive Vice President of the Gwangju Chamber of Commerce and Industry, stated, "It is a very concerning sign that business sentiment among community-based retailers such as supermarkets has cooled rapidly despite the holiday season. The data clearly shows that the end of the consumption coupon (local currency) program has directly resulted in a sales cliff for local businesses. Therefore, there is an urgent need for policy flexibility and institutional improvements to preserve consumers’ real purchasing power and protect small business owners, who are the lifeblood of the local economy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)