Continued Reduction of Fixed Costs Through Subsidiary Mergers

Sales Decline Due to Decrease in Internal Advertising Volume

Lotte Group's strengthened liquidity management policy has had a direct impact on Daehong Communications. Daehong Communications, which has been responsible for the group's advertising, has seen a sharp reduction in orders from affiliated companies and has launched intensive efforts to improve its financial structure.

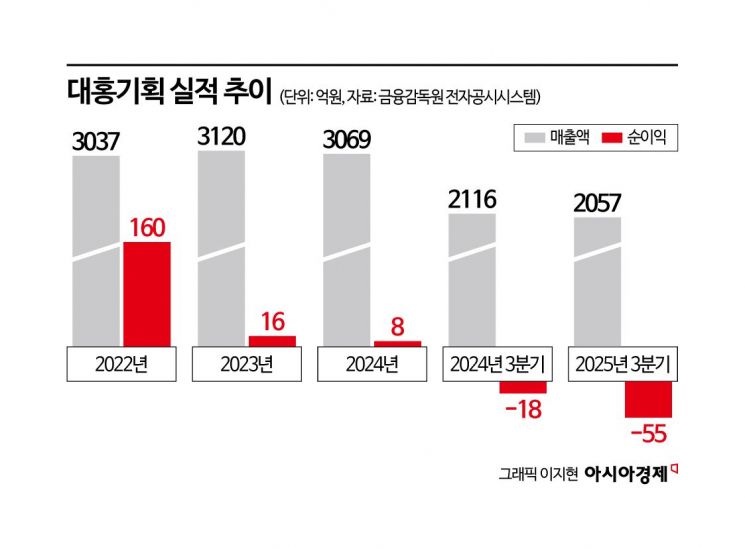

According to the distribution industry on January 16, Daehong Communications' sales up to the third quarter of last year reached 205.7 billion won, a decrease from 211.6 billion won in the third quarter of the previous year. During this period, net loss increased from 1.8 billion won to 5.5 billion won. Both sales and profitability have been declining since 2023.

Typically, advertising agencies under large conglomerates maintain stable performance based on internal group advertising volume. However, as the group overall has pursued cost-cutting measures, internal advertising execution has declined, putting additional pressure on the company’s revenue structure. Lotte Holdings owns a 68.7% stake in Daehong Communications. Lotte Group has faced liquidity concerns in recent years due to continued poor performance at its core affiliate Lotte Chemical, as well as a delayed recovery in its distribution sector caused by weakened consumer demand.

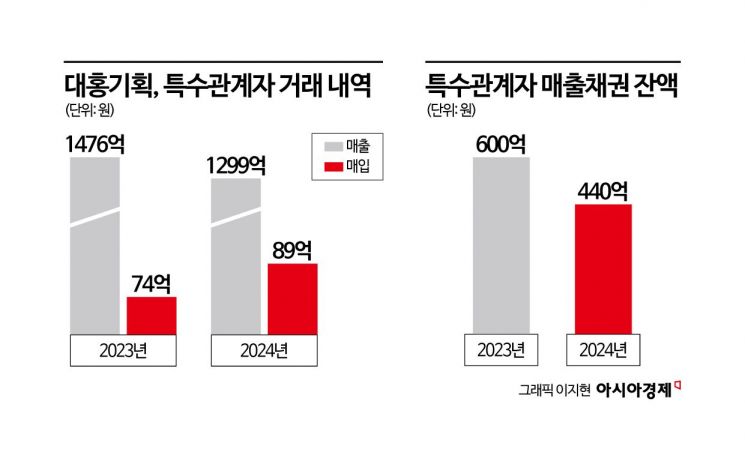

In fact, Daehong Communications' related-party transaction records show that advertising revenue from Lotte affiliates decreased from 147.6 billion won in 2023 to 129.9 billion won in 2024. Revenue from transactions with affiliates represents the fees Daehong Communications receives for providing advertising and marketing services to group companies. The decline in this figure indicates that the scale of internal group advertising has itself shrunk.

It is also noteworthy that accounts receivable from related-party transactions have decreased. As of the end of 2024, accounts receivable from affiliates stood at 44 billion won, down from approximately 60 billion won at the end of the previous year. This decrease is interpreted as being primarily due to a reduction in the overall scale of advertising execution, rather than an increase in collections. Last year, purchases from related parties amounted to only about 8.9 billion won.

The deterioration in profitability has also led to reduced dividends. Daehong Communications' dividend per share dropped from 980,000 won in 2023 to 324,000 won in 2024, and total dividends decreased from 4 billion won to 1.4 billion won. As a result, the dividend cash secured by the largest shareholder, Lotte Holdings, is also believed to have declined significantly.

For this reason, Daehong Communications recently relocated the office of its wholly owned subsidiary Spoon (formerly Mhub) to the vicinity of Seoul Station, where Daehong Communications' headquarters is also located. Spoon is a subsidiary responsible for digital content production and media solutions. In June of last year, after Daehong Communications CEO Kim Deokhee also assumed the role of Spoon CEO, the two offices were integrated.

Daehong Communications has been gradually working to improve its financial structure. In 2023, it merged the digital advertising company Mobizap Media with Spoon, and last year, it also restructured by absorbing the digital marketing company Stick Interactive into Spoon. At the time of the mergers, both Mobizap Media and Stick Interactive were operating at a loss. Mobizap Media recorded an operating loss of 260 million won up to the merger in April 2023, while Stick Interactive posted an operating loss of 260 million won through the first half of 2024.

A Daehong Communications representative stated, "Our revenue structure has improved since last year, thanks to a combination of portfolio diversification and operational efficiency strategies," adding, "In particular, performance in 2025 is showing solid growth, exceeding previous years."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.