Decline in Jeonse Loan Balances at Major Commercial Banks

Tighter Lending Regulations and Worsening Jeonse Shortage Overlap

Government Faces Criticism Over Accelerating Shift to Monthly Rentals

The outstanding balance of jeonse loans at major commercial banks has plummeted. This is due to the worsening jeonse shortage for Seoul apartments, driven by the government’s tightening of real estate regulations. The banking sector expects this trend to continue for the time being, as household lending regulations remain in place.

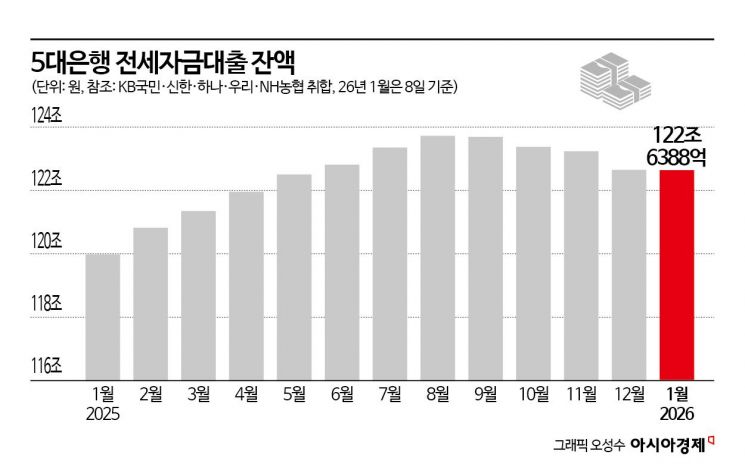

As of January 12, the outstanding balance of jeonse loans at the five major banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) stood at 122.6388 trillion won. This represents a decrease of 880.9 billion won compared to the end of October last year. In less than three months, nearly 1 trillion won has been withdrawn from the outstanding balance.

The outstanding balance of jeonse loans has been steadily declining since turning downward in September last year. As of the end of December last year, the five major banks’ outstanding jeonse loan balance was 122.6498 trillion won, down 585 billion won from the previous month. The monthly decrease has been widening: 34.4 billion won in September, 171.8 billion won in October, and 284.9 billion won in November.

This situation appears to have been influenced by tighter lending regulations following the October 15 measures last year, as well as a decrease in available jeonse properties. When jeonse loans for single-home owners were included under the Debt Service Ratio (DSR) regulation, loan limits were reduced. In particular, the entire city of Seoul was designated as a Land Transaction Permission Zone, imposing a two-year mandatory residence requirement. As so-called “gap investment”-buying properties with existing jeonse tenants-was blocked, the supply of jeonse properties also declined.

According to real estate big data firm Asil, as of January 10, the number of Seoul apartment jeonse listings stood at 22,702, a 27.7% decrease compared to the previous year (31,386 listings). This is also a 4.6% drop compared to the period before the October 15 real estate regulation (23,779 listings). According to the Korea Real Estate Board, as of January 5, the Seoul jeonse supply-demand index was 104.6, up 7.1 points from the previous year (97.5). A supply-demand index above 100 indicates that demand exceeds supply.

The outstanding balance of household loans at major commercial banks also declined at the end of last year for the first time in 11 months. The five major banks’ household loan balance at the end of December last year was 767.6781 trillion won, down 456.3 billion won from the end of November (768.1344 trillion won). This decrease is attributed to banks tightening their year-end management of household loan totals, including measures such as the temporary shutdown of mortgage lending. The banking sector expects this trend to continue for the time being. An official at a major commercial bank commented, “Not only is the supply of jeonse properties shrinking, but the authorities are also not welcoming an increase in jeonse loans.”

With growing criticism over the jeonse shortage and the acceleration of the shift to monthly rentals, the government also plans to pursue institutional improvements. At a recent inauguration ceremony for the Housing Supply Promotion Headquarters, Minister of Land, Infrastructure and Transport Kim Yoonduk told reporters, “We will prepare additional improvement measures regarding jeonse loans to reduce inconvenience for genuine end-users.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.