Strengthening European Defense Capabilities: Defense Stocks Like Rheinmetall Rally

Two European Defense ETFs Listed Domestically Draw Attention

"European Defense Companies Enter a Phase of Long-Term Growth"

As shifts in U.S. diplomatic and security policies intersect with rising geopolitical tensions, defense industry stocks are once again drawing attention in European equity markets. Concerns are mounting over the so-called "Donroe Doctrine," which combines the isolationism symbolized by the Monroe Doctrine with President Donald Trump's strategy of maximizing national interests. This has prompted a renewed push within Europe to strengthen its own defense capabilities. Among domestic investors, exchange-traded funds (ETFs) focused on European defense are being discussed as an alternative to individual stock picks. Of the ETFs listed in Korea, there are two products that invest exclusively in European defense: the ACE Europe Defense TOP10 ETF and the HANARO Europe Defense ETF.

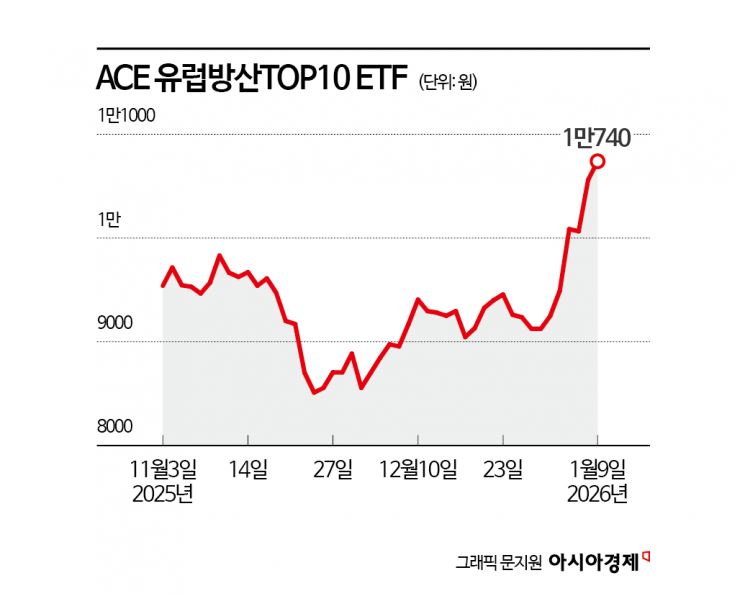

According to the financial investment industry on January 12, the ACE Europe Defense TOP10 ETF and the HANARO Europe Defense ETF have risen by 17.7% and 16.7%, respectively, since the beginning of this year. These returns outpace the 8.8% increase of the KOSPI index over the same period. This performance is attributed to the recent simultaneous rise in the share prices of leading European defense companies such as Germany's Rheinmetall, Sweden's Saab, and Italy's Leonardo.

The ACE Europe Defense TOP10 ETF selects its investment targets by combining market capitalization and 12-month expected sales growth among companies where defense industry sales account for more than 20% of revenue. It includes major European defense firms such as Germany's Rheinmetall, the United Kingdom's BAE Systems, Sweden's Saab, France's Thales, and Italy's Leonardo.

Rheinmetall manufactures ground force weapons such as tanks, self-propelled artillery, armored vehicles, and ammunition. Its order backlog has surged since the outbreak of the Russia-Ukraine war. BAE Systems produces fighter jets and naval vessel components essential for strengthening army, navy, and air force capabilities. The performance of Saab, a leading comprehensive defense company in Northern Europe, is also showing improvement.

The HANARO Europe Defense ETF is a product that diversifies investment across European defense companies. Its portfolio comprises European defense firms selected by Amundi, the largest asset management company in Europe. The fund is broadly diversified across France's Thales and Safran, the United Kingdom's Rolls-Royce and BAE Systems, and Germany's Rheinmetall. While its investment targets are similar to those of the ACE Europe Defense TOP10 ETF, the allocation by individual stock differs.

Industry experts analyze that recent geopolitical changes have become a powerful catalyst for European defense stocks. Mo Seyoung, Head of ETF Product Strategy at Korea Investment Management, explained, "Geopolitical uncertainty is growing, especially after President Donald Trump mentioned the possibility of a military occupation of Greenland. This is the reason for the sharp rise in European defense stocks." He added, "The North Atlantic Treaty Organization (NATO) has agreed to increase defense spending to 5% of GDP by 2035, and we estimate that Europe's total defense budget will rise to approximately 1,500 trillion won."

Kim Seungcheol, Head of ETF Investment at NH-Amundi Asset Management, said, "At the beginning of this year, the United States launched a military operation to arrest Venezuelan President Maduro. We anticipate changes in the global power structure, such as maximizing U.S. influence in North and South America while excluding interference from the Eurasian continent." He emphasized, "European self-defense investment is expected to expand further in anticipation of reduced U.S. security support."

As European defense emerges as a growth driver in the global defense market, ETFs that include both U.S. and European defense stocks are also attracting attention. The PLUS Global Defense ETF equally includes five U.S. defense stocks and five European defense stocks, aiming to pursue both stability and growth.

The asset management industry expects the European defense sector to continue its long-term growth. With geopolitical risks persisting and institutional increases in defense spending now confirmed, the European defense industry is said to have entered a structural growth phase that will last for at least the next decade. Kim Yongcheol, ETF Portfolio Manager at Hanwha Asset Management, analyzed, "The security and economic changes following the Russia-Ukraine war are prompting Europe to rearm and restructure its supply chains. We expect the European defense industry to enter a phase of sustained growth."

President Trump's emphasis on expanding the U.S. defense budget is also expected to contribute to the growth of the global defense market. Seo Jaeho, a researcher at DB Securities, explained, "President Trump insists that the defense budget should be increased to 1.5 trillion dollars, making it clear that military buildup is a key priority of the Trump administration."

However, given the nature of the defense industry, investors should be aware that volatility may increase in response to geopolitical news. Experts advise that, since the European defense sector has entered a structural growth phase expected to last for more than a decade, investors should carefully adjust their timing and allocation when investing.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.