Analysis of the 2025 Digital Finance Usage Survey

Lower Digital Financial Literacy Linked to Higher Risk of Delinquency

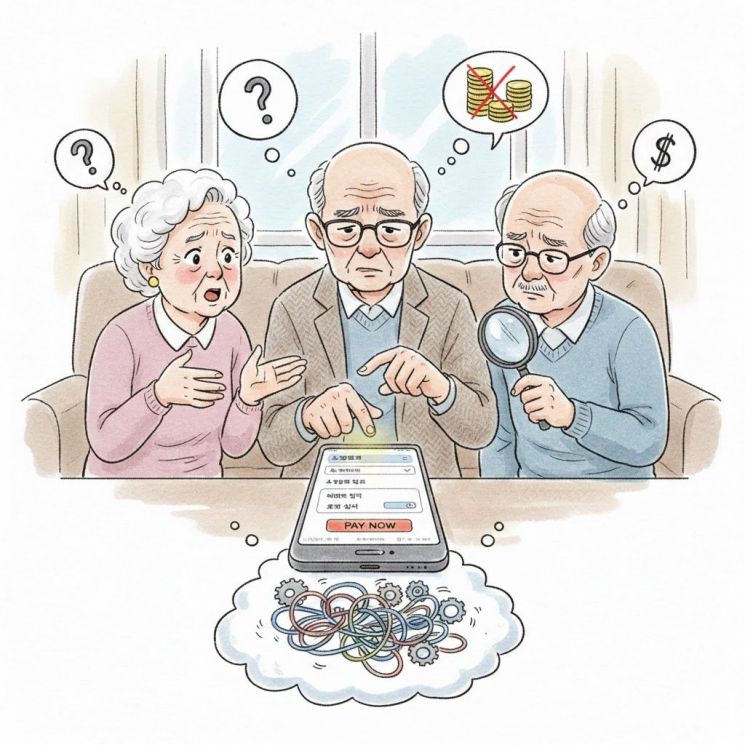

Need to Improve Digital Financial Literacy Among Vulnerable Groups

A recent study found that Koreans' understanding of digital finance is significantly lower than the standards recommended by the Organisation for Economic Co-operation and Development (OECD). Experts point out that there is a need to improve digital financial literacy, especially among vulnerable groups such as the younger and older generations.

According to the Capital Market Institute on January 12, the digital financial literacy score of Korean adults surveyed last year was 59.3, far below the OECD target score of 70. Digital finance refers to the full range of financial work conducted through digital technologies, including mobile banking, smartphone micropayments, and simple payment services.

According to the OECD, digital financial literacy is defined as an individual's ability to recognize and safely use digital financial services and digital technologies. Only 28.2% of those surveyed were classified as having high digital financial literacy, meeting the OECD's target score, while more than 70% fell into the low-literacy group.

The institute's analysis showed that digital financial literacy varied depending on age, experience with financial services, and income level. Financial literacy was lower among younger people, the elderly, and unpaid family workers, while those with experience using digital financial services demonstrated higher literacy.

Digital financial literacy was also found to be linked to actual financial well-being. The report analyzed how digital financial literacy scores affect the likelihood of delinquency among users of Buy Now, Pay Later (BNPL) services to examine the impact of digital financial literacy on real financial welfare. BNPL is a postpaid service designed to allow consumers with limited access to credit cards to use small-scale credit transactions, and is offered by platforms such as Naver Pay and Toss Pay.

The analysis showed that for every one-point increase in digital financial literacy, the probability of BNPL delinquency decreased by an average of about 0.1 percentage points. This suggests that digital financial literacy is closely linked to the outcomes of actual financial decision-making, beyond mere awareness. In addition, groups with lower digital financial literacy were found to experience a higher rate of financial losses during digital financial transactions, such as duplicate payments and refusal of refunds.

Jung Sumin, a research fellow at the Capital Market Institute, explained, "These results show that differences in digital financial literacy lead to differences in actual financial behavior, and that lower literacy is likely to result in lower financial well-being." Jung emphasized, "As digital financial services have already become the primary channel for financial transactions, digital financial education is no longer optional but essential. Comprehensive efforts are needed to create a safe digital financial environment, including expanding tailored financial education for vulnerable groups, upgrading industry security systems, refraining from dark patterns, and strengthening personal data protection."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)