Expanding Dock Capacity and Designing Remote Work Systems in the U.S.

WSJ Cites Statement from Hanwha Defense USA CEO

Considering Additional U.S. Shipyard Acquisitions... Strong Commitment to Scaling Up Production

Hanwha is actively reviewing plans to expand its production capacity, including the potential acquisition of additional shipyards in the United States. With the docks at the already acquired Philadelphia Shipyard quickly filling up due to a surge in orders, the company has determined that it needs more space to accommodate further contracts. Hanwha Ocean is also focusing on organically connecting its global production facilities, for example by developing technology that enables shipyard operations in the United States to be performed remotely from Korea using welding robots and gyro remote controllers.

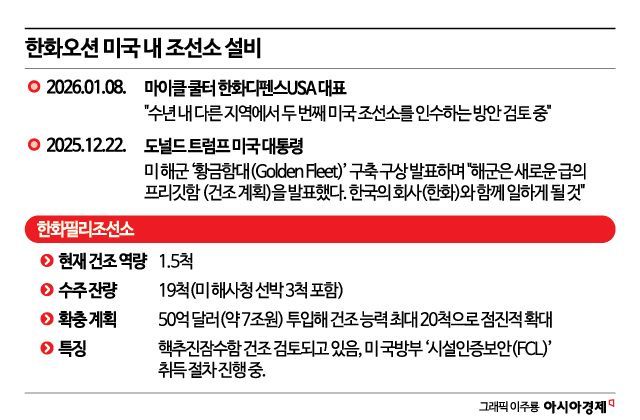

According to industry sources on January 9, Hanwha is pursuing both an increase in production space in the United States and a transformation of its work processes. Michael Coulter, CEO of Hanwha Defense USA, stated in an interview with The Wall Street Journal (WSJ) on January 8 (local time) that the company intends to introduce modern manufacturing methods, such as the robots currently in use at Korean shipyards, to its U.S. operations. The goal is to leverage the expertise of skilled Korean workers to improve production efficiency at U.S. sites.

It has also been reported that Hanwha Ocean, in collaboration with Hanwha Robotics, is planning a remote work system based on collaborative robots operated via gyro remote controllers. A gyro remote controller is a device that detects rotational angles to determine direction. This would allow skilled workers in Korea to monitor and control processes remotely, without having to travel to the U.S. site. An industry official explained, "By utilizing state-of-the-art welding robots, operators at the Korean control tower can manage the process, and the instructions will be directly reflected in the robots at the U.S. site."

The WSJ reported that Hanwha is in discussions with federal, state, and local government officials about accessing unused or underutilized docks near the Philadelphia Shipyard. The company is also considering the use of docks at other shipyards to handle excess orders. In the long term, Hanwha is keeping open the possibility of acquiring additional shipyards in the United States. In the interview, CEO Coulter said, "We are seriously considering acquiring a second U.S. shipyard in another region within the next few years." He cited the fact that the production capacity at the Philadelphia Shipyard is being exhausted more quickly than anticipated as the main reason for this consideration.

Currently, the Philadelphia Shipyard has an annual shipbuilding capacity of about 1.5 vessels, but its order backlog reportedly stands at 19 ships. This includes three vessels ordered by the U.S. Maritime Administration (MARAD). After acquiring the Philadelphia Shipyard in December 2024, Hanwha set out a plan to invest $5 billion (approximately 7.2 trillion won) to increase its annual shipbuilding capacity to as many as 20 vessels. However, since the shipyard currently only has two docks, there are concerns about its ability to handle the increasing volume of orders in the short term.

The Philadelphia Shipyard has also been mentioned as a potential site for building nuclear-powered submarines to be delivered to the Korean Navy in the future. However, the two governments of South Korea and the United States have differing views on the construction location. CEO Coulter told the WSJ, "Hanwha has the capability to build submarines in either the United States or Korea, and the final decision rests with both governments."

Hanwha Defense USA is also expanding its local partnerships in the field of unmanned surface vessels. In collaboration with U.S. maritime drone software company HavocAI, the company aims to supply hundreds of unmanned surface vessels capable of missile launches, cargo transport, and surveillance and reconnaissance missions. The Trump administration recently allocated more than $3 billion in defense spending to strengthen the mid- and small-sized unmanned surface vessel fleet.

Industry observers note that the increasingly fierce competition among Korean shipbuilders for the U.S. Navy market is closely linked to Hanwha's recent moves. HD Hyundai Heavy Industries has succeeded in securing additional contracts for maintenance, repair, and overhaul (MRO) of U.S. Navy vessels, while Samsung Heavy Industries has begun the relevant certification process as it prepares to enter the U.S. defense industry market. Hanwha's public mention of potential shipyard expansion is seen as a preemptive measure in anticipation of additional orders.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.