Overall Creditworthiness of Financial Institutions Weakens Due to Sluggish Real Estate and Domestic Demand

Insurance Industry Faces Greater Burden from Accounting Standard Changes

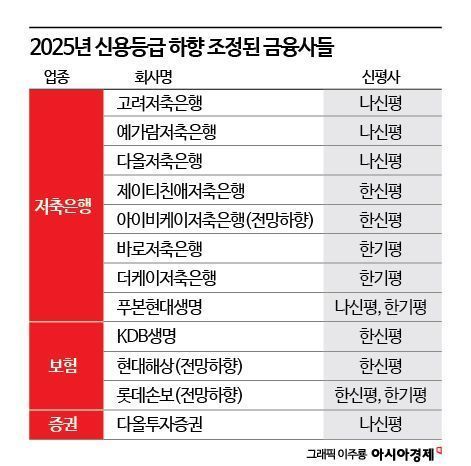

Last year, a significant number of financial institutions that received credit rating downgrades from major domestic credit rating agencies were savings banks and insurance companies. This trend was driven by concerns over the performance of some financial firms amid a sluggish real estate market and weak domestic demand. There are concerns that this trend may continue into this year.

Savings Banks Struggle Amid Real Estate Market Slump and Weak Domestic Demand

According to the credit rating industry on January 9, the sector that saw the most credit rating downgrades among domestic financial institutions last year was the savings bank sector. Many savings banks, including Koryo, Yegaram, Daol, JT Chinae, Baro, and The K, experienced credit rating downgrades. The savings bank sector faced poor performance due to the ongoing burden of bad real estate project financing (PF) loans. Although the real estate PF issue passed a critical point last year, it is still exerting downward pressure on the performance of some financial institutions, such as savings banks and real estate trust companies.

Among insurance companies, there were also cases of credit rating downgrades. The credit ratings of Fubon Hyundai Life Insurance and KDB Life Insurance were downgraded, while Hyundai Marine & Fire Insurance and Lotte Insurance had their credit rating outlooks lowered. Many life insurers saw declining profits due to deteriorating industry conditions, and some non-life insurers faced threats to their capital adequacy due to changes in government accounting standards.

In particular, Hyundai Marine & Fire Insurance, a major non-life insurer, had its insurance claims-paying ability and subordinated bond credit rating outlook downgraded from "stable" to "negative" by Korea Ratings last July. Korea Ratings explained the downgrade by stating, "The volatility of profits in the insurance segment has increased, leading to a decline in Hyundai Marine & Fire Insurance's overall profitability. With the transition to new accounting standards and annual loss of about 200 billion won in deposit and insurance premium differences, the company's average insurance profitability since 2023 has been 5.7%, which is below the industry average of 8.9% for the same period."

Lotte Insurance, which is in conflict with the government over capital adequacy, also received a downgrade in credit rating outlook from both Korea Investors Service and Korea Ratings last year. In November last year, the Financial Services Commission imposed a management improvement recommendation on Lotte Insurance as part of prompt corrective action, citing its weak capital adequacy.

Real Estate Trust Companies Also Face Downgrades Amid Real Estate Market Slump

In addition to savings banks and insurance companies, many real estate trust companies also experienced credit rating downgrades last year. Korea Trust, Korea Asset Trust, and Woori Asset Trust, among others, had their credit ratings or outlooks downgraded. The continued downturn in the real estate market led to poor performance for many trust companies.

Credit rating agencies expect that many financial institutions will continue to face difficulties this year due to the ongoing slump in the real estate market and deteriorating domestic demand. With only a weak economic recovery, rising delinquency rates are expected to persist, and many companies in the secondary financial sector-including savings banks, credit card companies, and capital companies-are likely to experience poor performance.

Lee Hyukjun, Head of Corporate Evaluation at NICE Investors Service, stated, "It is highly unusual for delinquency rates to continue rising more than a year after a significant base rate cut. This indicates that the stagnation in domestic demand is becoming deeply entrenched."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.