National Pension Subscribers Drop 6.5% in One Year... Equivalent to Total Workforce at SK Ecoplant

DL E&C Sees Largest Cut at -14.1%... Hyundai Engineering Launches First-Ever Voluntary Retirement

Domino Effect from Major Firms... 130,000 Constructi

It has been revealed that the number of employees at the top 10 major construction companies, which support the domestic construction industry, decreased by more than 3,600 in just one year. This figure is equivalent to the entire workforce of SK Ecoplant, one of the top 10 construction firms. This represents an "employment shock" tantamount to the disappearance of a large construction company as a whole.

Even companies that had managed to maintain their workforce and withstand the sluggish market conditions until 2024 appear to have reached their limits and are now engaging in full-scale layoffs. There are growing concerns that job cuts at major construction firms could trigger a "domino effect" of employment collapse, leading to the disappearance of jobs at partner companies and related industries.

Even Major Firms Hit by 'Employment Shock'... From 'Stability' in 2024 to 'Plunge' in 2025

In September last year, Yoonduk Kim, Minister of Land, Infrastructure and Transport (second from left), inspected the construction site of a youth housing complex in Yongsan-gu, Seoul, together with Younghoon Kim, Minister of Employment and Labor (third from left). Ministry of Land, Infrastructure and Transport.

In September last year, Yoonduk Kim, Minister of Land, Infrastructure and Transport (second from left), inspected the construction site of a youth housing complex in Yongsan-gu, Seoul, together with Younghoon Kim, Minister of Employment and Labor (third from left). Ministry of Land, Infrastructure and Transport.

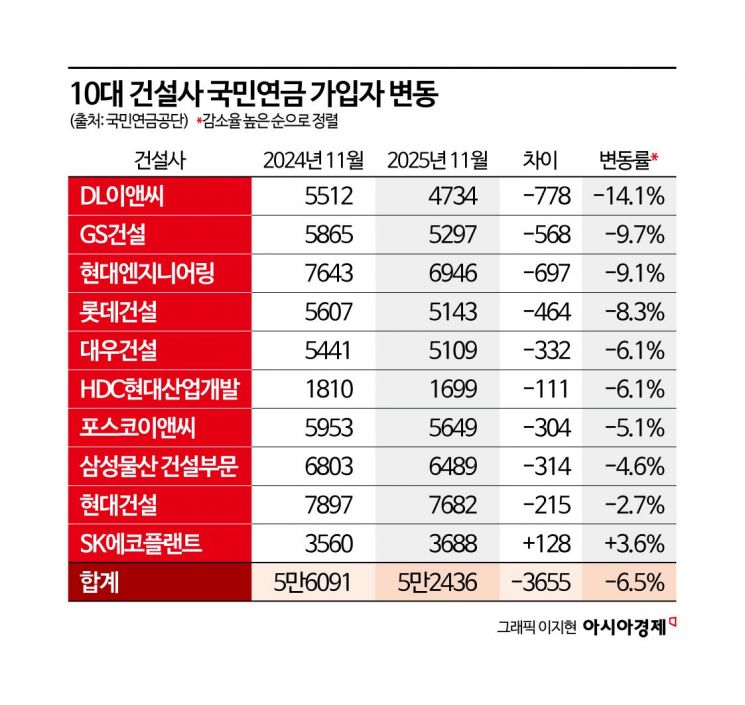

According to a comprehensive review of the National Pension Service workplace subscriber data for the top 10 construction companies by construction capability as of January 9, the total number of subscribers stood at 52,436 as of November last year. This represents a decrease of 3,655 people (-6.5%) compared to November 2024, when the number was 56,091. The number of National Pension subscribers is an indicator that allows for monthly tracking of a company's employment status.

The company with the largest reduction in workforce was DL E&C. Its workforce shrank from 5,512 to 4,734 in one year, a decrease of 778 people (-14.1%). A DL E&C representative explained, "The total number of construction sites decreased by about 10% compared to the previous year, which naturally led to a reduction in field-hired contract workers." Since Park Sangshin took office as CEO in 2024, DL E&C has been defending against declining profitability by improving cost ratios and focusing on a strategy of "selective order-taking."

The company with the next largest decrease in employees was Hyundai Engineering, which saw its workforce drop from 7,643 to 6,946, a reduction of 697 people (-9.1%). After the Sejong-Pocheon Expressway bridge collapse in February last year, Hyundai Engineering halted new orders in its housing and infrastructure divisions for nearly a year. Samsung C&T Engineering & Construction Group (-314), Daewoo Engineering & Construction (-332), and GS Engineering & Construction (-568) also implemented workforce reductions in the hundreds. Among the top 10 construction companies, only SK Ecoplant increased its workforce, adding 128 employees (3.6%).

Until 2024, major firms had managed to maintain their workforce. The number of employees at the top 10 construction companies decreased by only 1.6%, from 57,028 in November 2023 to 56,091 in November 2024. Considering the sluggish market conditions, this was a relatively strong performance. However, with the accumulated increase in construction costs and the drought in new project starts reaching a critical point last year, nine out of the top 10 construction companies are now experiencing a "cliff" in employment, with large-scale layoffs.

Partner Companies Hit Hard as 130,000 Construction Jobs Disappear... Domino Effect of Job Losses

The biggest cause is the disappearance of "on-site" projects. According to the Ministry of Land, Infrastructure and Transport, the number of housing project starts from January to November last year decreased by 12.3% compared to the previous year. As a result, non-regular, fixed-term workers hired on a project basis were hit the hardest. Commonly referred to as "field-hired contract workers," these employees account for about 30% of the total workforce, though the proportion varies by company.

The problem is that the reduction in direct employment at major construction companies is not the end of the story. The construction industry has a high employment multiplier effect, so when a major company's project site shuts down, dozens of partner companies and material and equipment suppliers are also hit in a domino effect. According to the National Data Office, the total number of employed people in the construction industry decreased from 2,087,000 in November 2024 to 1,956,000 in November last year, a drop of 131,000 (-6.3%) in just one year. In percentage terms, this is similar to the rate of decline in employment at the top 10 construction companies (-6.5%) over the same period, indicating that the employment freeze at major firms has spread throughout the industry.

POSCO E&C Reduces Executives by 20%... Four of Top 10 Construction Firms Hired No New Employees

Moves to streamline organizations are also accelerating. In response to slowing performance and a shrinking order backlog, Hyundai Engineering launched its first-ever "Career Rebuilding" program at the end of last year, targeting employees aged 45 to 60 for voluntary retirement. The program offers a transition allowance equivalent to 50% of the remaining period until retirement (up to 30 months of base salary), as well as educational support for children (up to 30 million won). A Hyundai Engineering representative stated, "There are quite a few internal applicants."

POSCO E&C is also tightening its belt for management efficiency, merging its plant and infrastructure divisions and reducing its executive ranks by 20%. The company recorded an operating loss of nearly 200 billion won in the first to third quarters last year due to the aftermath of safety accidents. In addition, four of the top 10 construction companies-DL E&C, Hyundai Engineering, POSCO E&C, and SK Ecoplant-did not hire a single new employee last year.

Major institutions such as the Bank of Korea and the Korea Development Institute (KDI) forecast that construction investment will rebound by around 2% this year. However, there are concerns that even if the construction market recovers slightly, it will be difficult for the job market to rebound immediately.

Lee Eunhyeong, a senior research fellow at the Construction Policy Research Institute, analyzed, "The recent forecasts from institutions are overly optimistic and do not reflect the cold reality at construction sites. Even if the indicators improve, there is a significant time lag between order receipt, permits, project commencement, and actual hiring, so it will be difficult to see a meaningful recovery in employment for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)