Solid Performance Despite Lower Interest Rates

Fee Income Growth in WM and IB Drives Results

Growth Momentum Expected to Slow Slightly This Year

The four major financial holding companies (KB, Shinhan, Hana, and Woori) are expected to once again set a new record for annual net profit, surpassing 18 trillion won last year. Despite a decline in net interest margin (NIM) due to the onset of an interest rate cut cycle and strengthened household loan management, profitability was driven by an increase in non-interest income, such as wealth management (WM). However, the nearly 2 trillion won penalty for the misselling of Hong Kong H Index (Hang Seng China Enterprises Index, HSCEI) equity-linked securities (ELS) is expected to be a variable.

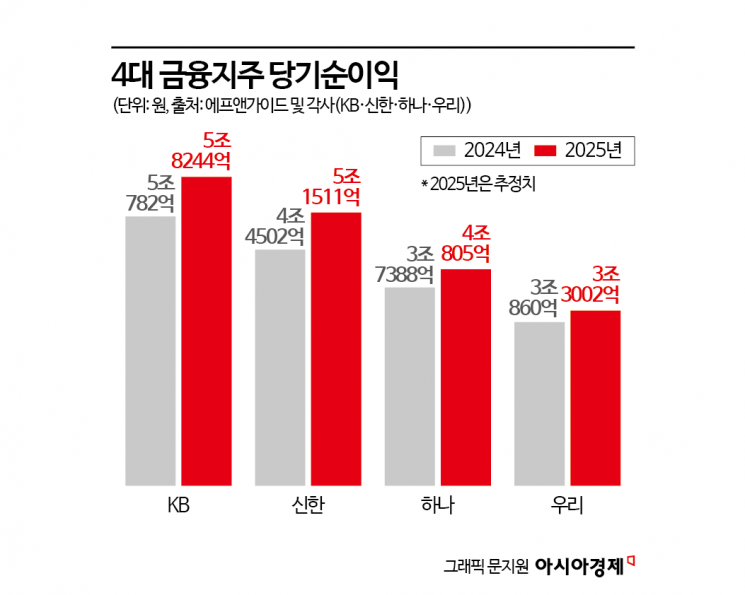

According to financial information provider FnGuide on January 9, the combined annual net profit of the four major financial holding companies for 2025 was tallied at 18.3562 trillion won. This represents a 12.24% increase compared to the combined net profit of 16.3532 trillion won in 2024, marking the largest figure ever recorded.

All four major financial holding companies are expected to achieve record-breaking results. The estimated annual net profit for KB Financial last year is 5.8244 trillion won. Just one year after becoming the first domestic financial holding company to join the "5 trillion won club" in 2024, it is now on the verge of entering the "6 trillion won club." Shinhan Financial is expected to join the "5 trillion won club" for the first time, with its annual net profit forecast at 5.1511 trillion won. In addition, Hana Financial is projected to post an annual net profit of 4.0805 trillion won, and Woori Financial is expected to achieve 3.3002 trillion won, both setting new record highs.

In terms of net profit growth rate, Shinhan Financial recorded the highest increase last year at 15.8%. KB Financial followed with a net profit growth rate of 14.7%. Hana Financial and Woori Financial are projected to see growth rates of 9.1% and 6.9%, respectively.

The main driver behind these record results is the expansion of non-interest income, centered on wealth management and investment banking (IB) divisions. While banks' net interest income declined due to the impact of interest rate cuts, the ongoing rate freeze policy helped mitigate initial concerns. As a result, the combined annual interest income of the four major financial holding companies last year is expected to reach 101.4737 trillion won, a decline of only 4.12% compared to 105.8306 trillion won in 2024. Improved performance by securities affiliates, buoyed by a bullish stock market, led to an increase in non-interest income, offsetting the decrease in net interest income and positively impacting overall results.

An industry insider commented, "Fee income increased significantly due to the stock market boom, and the resumption of bancassurance sales, as well as steady performance in non-interest income segments such as trusts, contributed to the results."

However, the penalty for the misselling of Hong Kong H Index ELS, which amounts to nearly 2 trillion won, is expected to be a variable for future performance. Previously, the Financial Supervisory Service had preliminarily notified banks of penalty amounts estimated at over 1 trillion won for KB Kookmin Bank, and around 300 billion won each for Shinhan Bank and Hana Bank. While the final penalty amounts may be reduced, they will inevitably impact net profit as they are recognized as accounting expenses. Unlike voluntary compensation, banks did not set aside separate loan loss provisions for the penalties, so they must be processed as expenses. The loss is expected to be reflected in the fourth quarter of 2025 or the first quarter of 2026. In this case, net profit could decrease by at least 100 billion won and up to 500 billion won.

There are also forecasts that it will be difficult to sustain this growth trend this year. This is due to an anticipated unfavorable business environment, including a shift toward productive finance, an increase in the education tax rate, and stricter regulations on additional lending rates. From this year, the education tax rate imposed on financial firms with profits exceeding 1 trillion won will rise from 0.5% to 1%. In addition, amendments to the Banking Act will prohibit banks from reflecting various statutory costs in additional lending rates, resulting in an estimated additional cost burden of over 3 trillion won. In fact, according to FnGuide, this year's combined net profit estimate for the four major financial holding companies is 18.8721 trillion won, with the growth rate expected to remain in the 2-3% range compared to 2025.

Jeong Junsub, a researcher at NH Investment & Securities, analyzed, "This year, the government's continued strict management of household debt will slow the loan growth rate for banks from 4.4% last year to 3.8% this year. The net interest margin of the five major financial holding companies is expected to decline until the first half of the year and rebound in the second half. Non-interest income is projected to increase, driven by rising WM income due to increased capital market investment demand and profit expansion in non-banking segments."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)