Capital Market Institute: "Large-Scale Investments Increase, Number of Deals Declines"

Following VCs, Even Conservative PEs Begin Investing in AI

Over Half of Global Venture Capital Now Flows Into AI

As private equity (PE) firms, in addition to venture capital (VC) firms, are showing a full-fledged interest in investing in domestic artificial intelligence (AI) startups, expectations are rising that this year will see a more active inflow of venture capital into the AI sector. However, concerns are also being raised that as more capital flows in, polarization may intensify, with investments becoming increasingly concentrated in a small number of companies.

According to the Capital Market Institute on January 9, Senior Researcher An Yoomi stated in a recent report, "While large-scale investments are expanding, mainly centered on a small number of AI startups and small-to-medium-sized enterprises, the number of investment deals is on the decline." She added, "However, as private equity funds expand their investment scope into the AI sector, investments in 'growth capital' related to AI are expected to increase."

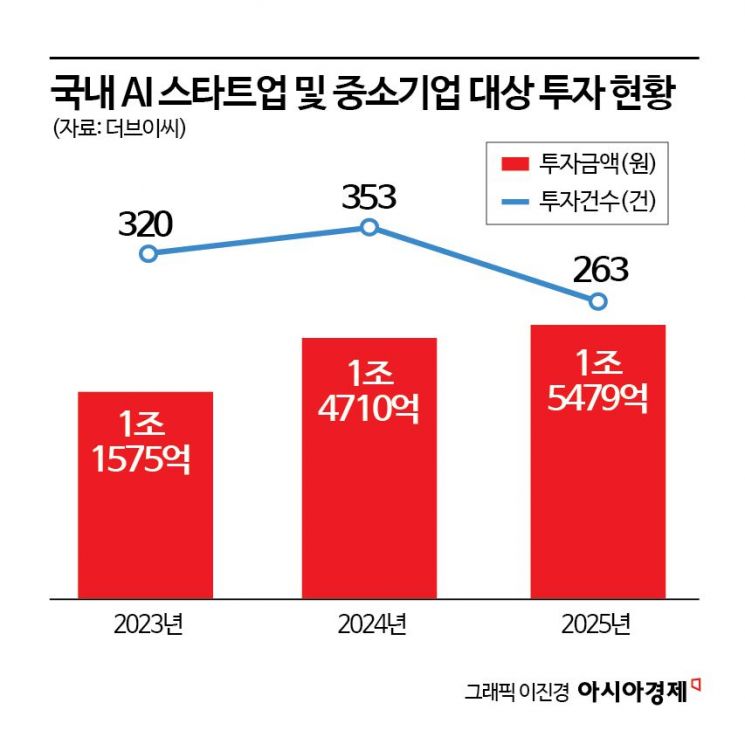

According to startup investment statistics from The VC, the total investment in domestic AI startups and small-to-medium-sized enterprises last year reached 1.5479 trillion won, up 27.1% from the previous year. In contrast, the number of investment deals dropped by 25.5%, from 353 in the previous year to 263 last year. The proportion of AI investments among all deals rose from 13.6% in 2022 to 22.8% last year in terms of the number of deals, and from 9.4% to 23.6% in terms of investment amount.

AI Investment Amounts Rise, Deals Decline... "Mega-Round Trend Clear Globally"

With the increase in investment amounts and the sharp decline in the number of deals, the average investment per AI company soared from 3.61 billion won in 2023 to 5.89 billion won last year. In November last year, half of the top 10 companies by investment raised in the domestic venture investment market were in the AI sector. Furthermore, the top two companies by investment size accounted for about one-third of all AI investments, highlighting both a growing concentration of venture capital in AI and a trend toward large-scale deals focused on a small number of companies within the AI sector.

The global market trend was similar. Last year, the cumulative investment in the global venture capital market for the first three quarters reached $309.64 billion, up 57% from the same period the previous year, but the number of deals dropped to 20,294, the lowest since 2016. The AI sector accounted for 51% of the total investment amount and 22% of the total number of deals.

Researcher An analyzed, "Global investment capital is shifting from unicorns (unlisted companies valued at over 1 trillion won) to decacorns, which have a corporate value of over 10 trillion won." She added, "Although the number of decacorn investments has nearly halved compared to 2021, the average investment per deal has increased by about 3.9 times, making the mega-round trend more pronounced."

"Growth Capital Expected to Expand... Side Effects of Capital Concentration Must Be Addressed"

However, this year, the diversification of both investors and investment scale is cited as a positive factor for domestic AI investment. This is attributed to increased demand for funding in the scaling-up phase and greater trust in AI technology compared to the past. Of particular note is the movement of domestic PE firms. Traditionally, private equity funds have been reluctant to invest in early-stage companies with high technological and market risks, but since last year, they have been increasing their share of investments in the AI sector.

Researcher An stated, "Private equity funds are expanding their investment scope into the AI sector." She continued, "The core of such AI investments is discovering high-value growth companies, and growth capital investments involving minority stakes in high-growth companies are likely to expand going forward." She further explained, "Global PE's M&A funds are shifting their focus from 'technology itself' to 'infrastructure and restructuring.' Rather than betting on new AI technologies, there is a growing trend to strengthen portfolio capabilities through additional acquisitions (add-ons) of specific companies."

A representative case is the participation of some private equity funds in the Series C bridge round of FuriosaAI. At that time, PE firms such as Keystone Partners (20 billion won) and PI Partners (13.2 billion won), along with policy financial institutions, acted as major investors. As a result, FuriosaAI became a unicorn based on its post-investment valuation.

Excessive capital concentration is cited as a challenge to overcome. Researcher An pointed out, "The phenomenon of capital concentration is not a short-term change but a structural shift resulting from the restructuring of the AI infrastructure supply chain." She warned, "If capital concentration accelerates further, new startups and non-AI industries may face worsening funding difficulties, which could become a constraint on growth."

An executive at a major VC firm commented, "While PE can support the scaling up of AI startups, private equity funds generally require board participation, so it will not be easy to rapidly increase investment volume in the short term." He added, "More important than simply having 'more money' is ensuring that the necessary funds are injected into promising AI companies at the right time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.