Share of Top 2 KOSPI Stocks Hits Highest Level Since 2010

KOSPI Rises 80% While KOSDAQ Gains Only 31%

Semiconductors and Shipbuilding vs. Petrochemicals, Construction, Steel, Batteries

Performance Gap Leads to Return Disparities, Entrenching Pola

This year, the so-called "K-shaped" polarization in South Korea's capital market is expected to intensify further. Although the KOSPI index continues its bullish trend, surpassing the 4,600 mark during intraday trading, the rally remains largely confined to certain sectors and top market capitalization companies, as was the case last year. In particular, with a clear divergence in industry outlooks-such as a downturn in petrochemicals and a boom in semiconductors-there are growing expectations that these disparities will be directly reflected in the domestic stock market.

"Korean Stock Market Rally Heavily Dependent on Select Sectors and Large Caps"

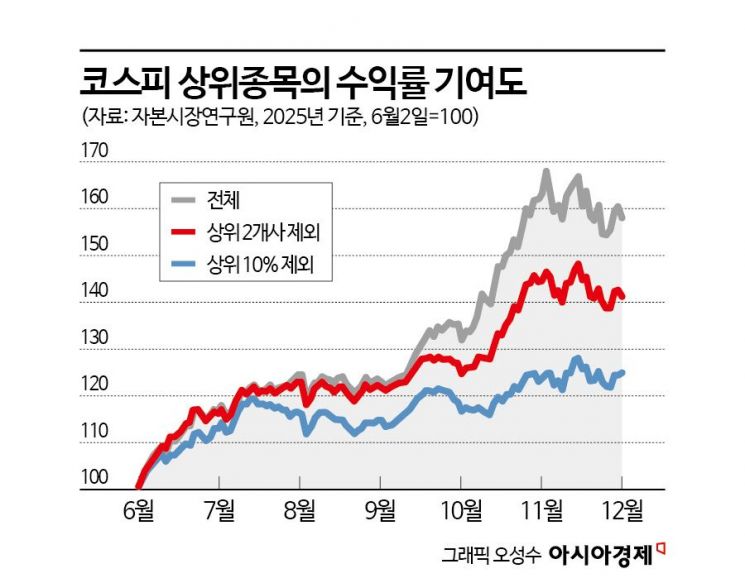

According to the Capital Market Research Institute on January 9, an analysis of trends in market capitalization tiers on the Korea Exchange since 2010 shows a sharp rise in the share held by top-ranked stocks in recent years. As of November last year, the combined weight of the top two companies-Samsung Electronics and SK Hynix-expanded to about one-third, marking the highest level since 2010. The cumulative return of the KOSPI, based on market-cap-weighted returns from June to early November, was approximately 66%. However, excluding the top two companies, this figure drops to just 40.6%.

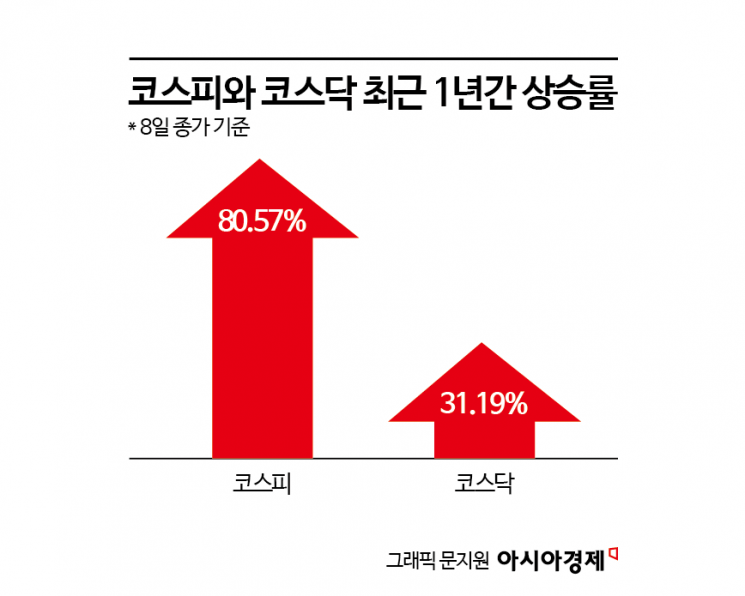

Kang Sohyun, Senior Research Fellow at the Capital Market Research Institute, explained, "The contribution of the top two companies accounts for about 38.5% of the total increase, demonstrating that index returns are highly dependent on a very small number of mega-cap stocks." Even when excluding the top 10% by market capitalization, the cumulative return for lower-tier stocks was only about 25%. This highlights that the stock market rally, which began in earnest last year, has not spread across the broader market. As of the previous day's closing price, the KOSPI posted a 12-month gain of 80.57%, while the KOSDAQ's increase was less than half of that, at just 31.19%.

Concerns are mounting that this polarization trend will persist throughout this year as well. Kang noted, "So far this year, as was the case last year, there is a concentration of gains in specific sectors and large-cap stocks. Unless a third group of stocks emerges, a similar pattern is likely to continue for the time being." A senior official at a securities firm also stated, "Since the index gains are not spreading across the market, the gap between the index performance and what investors actually feel is likely to widen further."

Behind Stock Market Polarization Lies 'Industry-Specific Performance Gaps'

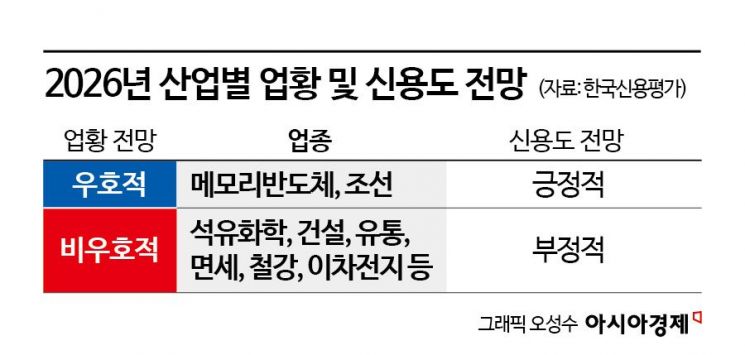

The most significant factor supporting the outlook for a deepening K-shaped polarization in the capital market is the widening gap in performance between industries. South Korean credit rating agencies, including Korea Ratings and NICE Investors Service, forecast that the Korean economy will see a K-shaped recovery this year, with widening performance gaps by industry. NICE Investors Service stated, "While average industry growth is expected to improve in 2026, the performance gap between the semiconductor and electronics industries and all other sectors will widen, resulting in a K-shaped improvement."

Korea Ratings presented an unfavorable outlook for the petrochemical, construction, retail, duty-free, steel, and secondary battery industries, and assessed the credit outlook for these sectors as negative. In contrast, the outlook for memory semiconductors, shipbuilding, and defense industries was positive, with expectations for both improved business conditions and credit ratings. Credit ratings are used for corporate loans and bond issuance. Jung Seungjae, Head of Evaluation Policy at Korea Ratings, said, "The K-shaped polarization caused by differences in industry structures and economic conditions will persist. There remains uncertainty in both domestic and external environments, including global tariffs, geopolitical risks, the boom in artificial intelligence (AI), domestic demand, and the real estate market."

Since industry outlooks serve as a leading indicator for corporate credit ratings, the deepening polarization of credit ratings will inevitably result in differentiated capital flows within the market. As a result, sectors with clear earnings visibility and financial stability will continue to see revaluation and inflows of investment capital, while industries suffering from poor business conditions will experience weakened investor sentiment due to earnings uncertainty and financial burdens. This is why many analysts believe the gap in returns between sectors will widen, further entrenching the K-shaped polarization in the stock market.

A senior official at a securities firm pointed out, "There is a risk that capital will become increasingly concentrated in a handful of sectors with strong earnings and credit ratings. Unless the performance gap between industries is resolved, structural polarization within the stock market is likely to persist." Some also express concern that government policies aimed at supporting growth recovery are focused not on the broader industry but on specific strategic sectors such as AI, which could further exacerbate the K-shaped polarization in the capital market.

Kang suggested, "Last year's rally, including the KOSPI surpassing 4,000, was certainly a meaningful milestone, but the concentration of gains among winners by size was a clear limitation. There needs to be greater diversification of industries and stocks, systematic support for research and development (R&D) and fundraising, as well as improvements in the quality of disclosures for small and mid-cap stocks, and more sophisticated criteria for restructuring underperforming companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)