Seongnam Chamber of Commerce and Industry Surveys 145 Local SMEs

Economic Downturn Factors: "Rising Prices and Raw Material Costs 34.1%"

Seongnam Companies Urgently Call for Policies to Boost Domestic Demand and Financial Support

58.6% of Seongnam SMEs Expect Sales Growth Next Year

Most Companies Say "No Economic Recovery for the Time Being"

The Seongnam Chamber of Commerce and Industry (Chairman Jung Youngbae) conducted the '2026 SME Business Outlook Survey' targeting 145 small and medium-sized enterprises in the Seongnam area from December 19, 2025, to January 2, 2026.

According to the survey results, the ratio of companies reporting an increase and those reporting a decrease in sales performance for 2025 compared to 2024 was identical at 42.1%, indicating that the overall business environment remained stagnant.

The main factor cited for the decrease in sales in 2025 was a slump in domestic demand, accounting for 34.0%. This was followed by rising raw material prices (26.0%), and sluggish exports and a deteriorating global economy (18.0%), suggesting that weak domestic demand was the most significant burden on business operations.

In contrast, the business outlook for 2026 showed a somewhat positive trend.

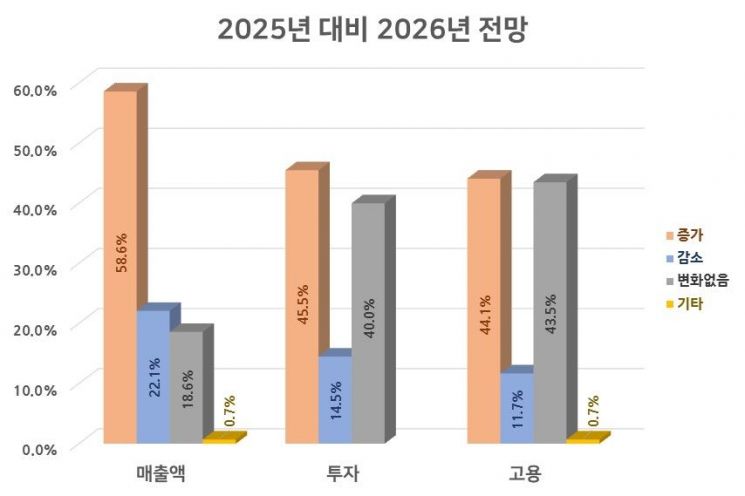

The sales outlook for 2026 was as follows: 58.6% of companies anticipated an increase, 22.1% expected a decrease, and 18.6% foresaw no change. The investment outlook was also positive, with 45.5% expecting an increase, 14.5% a decrease, and 40.0% no change. The employment outlook showed 44.1% expecting an increase, 11.7% a decrease, and 43.4% no change.

With the proportion of companies expecting increases in sales, investment, and employment in 2026 outpacing those expecting decreases, there appears to be growing optimism regarding the overall business environment.

Meanwhile, when asked about the factors expected to have the most negative impact on Korea's economy in 2026, respondents cited rising prices and raw material costs (34.1%), a slump in domestic demand due to weakened consumer sentiment (22.1%), labor shortages and increased labor costs (17.7%), a sharp rise in exchange rates (12.1%), trade disputes and declining exports (7.6%), and worsening funding difficulties due to interest rate hikes (5.2%), in that order. Rising prices and raw material costs were thus expected to be the main causes of an economic downturn.

Regarding the timing of domestic economic recovery, 35.8% of respondents answered that recovery would not occur for the time being, followed by the second half of 2026 (34.5%), 2027 (20.7%), and the first half of 2026 (9.0%). This indicates that most companies do not expect a rapid economic recovery.

In particular, the policies considered most necessary for revitalizing the economy in 2026 were: promoting policies to boost domestic demand (21.7%), alleviating financial cost burdens (20.6%), expanding tax support (16.3%), developing export markets and strengthening competitiveness (14.3%), supporting investment in technology development (R&D) (11.2%), easing corporate regulations (10.5%), and supporting talent acquisition (5.4%).

A representative of the Seongnam Chamber of Commerce and Industry stated, "Last year, local SMEs faced considerable burdens across all aspects of management due to a challenging industrial environment," adding, "In 2026, revitalizing domestic demand is expected to be the key task for economic recovery, and the government's role in alleviating corporate burdens through financial and tax support will become even more important."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.