Government and Financial Sector to Launch Major Transformation Toward Inclusive Finance

Significant Expansion of Loans for Young People and Vulnerable Groups

Banks to Increase Supply of Sae Hope Hall Credit Loans

Five Major Financial Holdin

The government has decided to actively pursue a "grand transition to inclusive finance" that will significantly strengthen support for financially marginalized groups. The government will introduce a variety of new low-interest loan products for young people and socially disadvantaged groups, while banks will expand tailored loan offerings such as the Sae Hope Hall Loan to actively assist those facing financial hardship in getting back on their feet.

The five major financial holding companies plan to invest a total of 70 trillion won over the next five years to expand inclusive finance. The government will evaluate banks' inclusive finance performance and implement a system that applies differentiated contributions to the Korea Inclusive Finance Agency, thereby encouraging further expansion of inclusive finance.

Significant Expansion of Low-Interest Loans for Youth and Vulnerable Groups

On the morning of the 8th, the Financial Services Commission held the first meeting of the "Grand Transition to Inclusive Finance" at the Suwon Low-Income Financial Integration Support Center in Gyeonggi Province. The meeting was attended by officials from the Financial Services Commission, the five major financial holding companies, and experts in inclusive finance, who discussed the direction of inclusive finance to be jointly pursued by the government and the private sector in the future.

Lee Eokwon, Chairman of the Financial Services Commission, stated, "Since the launch of the new administration, the foundation for overcoming the livelihood crisis has been laid through measures such as the New Leap Fund and credit amnesty," adding, "Now is the time to promote a grand transition to inclusive finance for a more fundamental solution to issues such as financial exclusion, long-term delinquents, and aggressive debt collection."

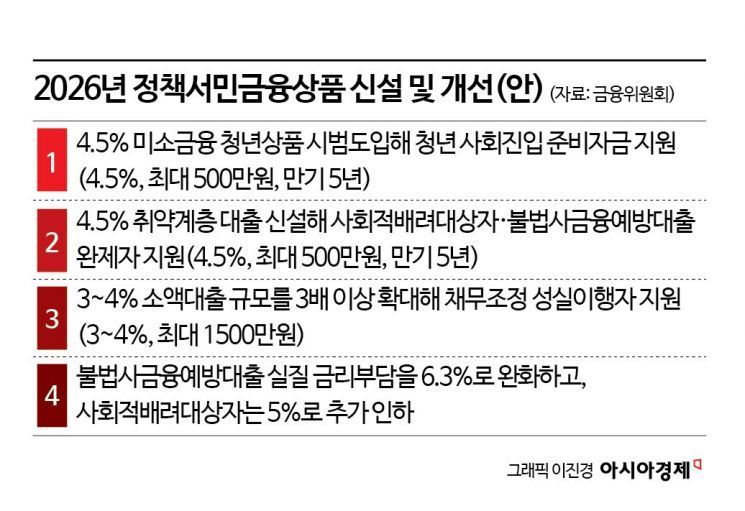

To this end, the government will work with the private sector to expand the supply of funds for low-income individuals. This year, various new policy-based financial products for low-income groups will be introduced to support the financially marginalized. First, a new youth product under Smile Microcredit will be launched for certain young people, such as high school graduates and the unemployed. Unemployed youth who need funds to enter society will be eligible to borrow up to 5 million won at an annual interest rate of 4.5% for expenses such as tuition and start-up preparation.

A new livelihood loan will also be introduced for financially vulnerable groups. Eligible recipients include those with an annual income of 35 million won or less, those in the bottom 20% of personal credit scores, socially disadvantaged individuals, and those who have fully repaid illegal private loan prevention loans. These individuals can borrow up to 5 million won at an annual interest rate of 4.5%.

The scale of loans for diligent debt adjustment repayment clients supplied by the Credit Recovery Committee will be significantly increased from the previous annual 120 billion won to 420 billion won starting this year. Diligent debt adjustment repayment clients will be eligible to borrow up to 15 million won at annual interest rates of 3-4%. In addition, the effective interest burden for illegal private loan prevention loans will be reduced from the current 15.9% to 6.3% in the future, and for socially disadvantaged individuals, it will be further lowered to 5%.

Differentiating Contribution Rates Based on Banks' Inclusive Finance Performance

Banks will gradually expand the supply of Sae Hope Hall Loans, a representative tailored loan product for low-income individuals, and will consider revising eligibility criteria and loan limits. Sae Hope Hall Loans are available to individuals with an annual income of 40 million won or less or those in the bottom 20% of personal credit scores with an annual income of 50 million won or less, allowing loans of up to 35 million won per year at an interest rate of 10.5% or less. Banks plan to increase the scale of Sae Hope Hall Loans from 4 trillion won as of last year to 6 trillion won by 2028.

For internet-only banks, the target proportion of new credit loans to mid- and low-credit borrowers will be raised from 30% this year to 35% by 2028.

To reduce the debt burden on vulnerable groups, the eligibility for liquidation-type debt adjustment support will be expanded. Previously, only those with principal debt of 15 million won or less were eligible, but the threshold will be raised to 50 million won to significantly alleviate the debt burden for vulnerable groups with insufficient repayment capacity.

On the morning of the 8th, Eunghwok Lee, Chairman of the Financial Services Commission, held the 1st Inclusive Finance Grand Transition Meeting at the Suwon Low-Income Financial Integration Support Center in Gyeonggi Province. He discussed the direction of inclusive finance that the government and the private sector should jointly pursue in the future with representatives from the government and related organizations, the five major financial holding companies, and private experts in inclusive finance. Financial Services Commission

On the morning of the 8th, Eunghwok Lee, Chairman of the Financial Services Commission, held the 1st Inclusive Finance Grand Transition Meeting at the Suwon Low-Income Financial Integration Support Center in Gyeonggi Province. He discussed the direction of inclusive finance that the government and the private sector should jointly pursue in the future with representatives from the government and related organizations, the five major financial holding companies, and private experts in inclusive finance. Financial Services Commission

A structure will also be established to differentiate the contribution rates to the Korea Inclusive Finance Agency based on banks' inclusive finance performance. Song Byungkwan, Director of the Inclusive Finance Division at the Financial Services Commission, explained at a pre-briefing the previous day, "If banks make strong efforts in inclusive finance on their own, their contributions to inclusive finance will be reduced, but if not, penalties will be applied. We are preparing such a system."

The system for purchased debt collection companies will also be improved to reduce the burden on low-income individuals regarding debt collection. Previously, financial companies or private lenders that met certain requirements could register with the authorities to engage in debt collection, but going forward, a licensing system will be introduced. Licensing requirements will be strengthened to prevent the proliferation of small-scale private lenders engaging in excessive debt collection. In addition, all purchased debts held by debt collection companies will be required to be registered with the Credit Information Center within six months, and non-compliance will result in sanctions.

Director Song stated, "Because anyone could enter the purchased debt collection business, management has been insufficient. We plan to switch from a registration to a licensing system to eliminate unqualified companies."

Five Major Financial Holding Companies to Invest a Total of 70 Trillion Won in Inclusive Finance

In line with government policy, the five major financial holding companies have decided to invest a total of 70 trillion won in inclusive finance over the next five years. KB Financial Group will support a total of 17 trillion won in inclusive finance over five years, including supporting KB Kookmin Bank's refinancing of loans from secondary financial institutions and private lenders, and alleviating financial burdens for individuals using high-interest loans due to poor credit by lowering interest rates.

Shinhan Financial Group, which will provide 15 trillion won, will implement inclusive finance through three major "value-up" programs: supporting the conversion of savings bank customers to low-interest bank loans (Bring-Up), significantly lowering interest rates for low-credit individuals using high-interest loans (Help-Up), and refunding a portion of interest to small business owners to support principal repayment (Virtuous Cycle).

Hana Financial Group also plans to invest a total of 16 trillion won. At the end of last year, it launched a youth Sae Hope Hall Loan with a preferential interest rate of 1.9 percentage points, and will continue to promote new inclusive finance initiatives such as Seoul-type business loan refinancing and Sunshine Loan interest cashback.

Woori Financial Group announced a plan to promote inclusive finance totaling 7 trillion won over five years. The group has introduced additional measures to strengthen inclusive finance, including a 7% cap on interest rates for credit loans, the launch of emergency living expense loans for the financially marginalized (100 billion won), the launch of refinancing loans from secondary financial institutions to banks (200 billion won), and the suspension of collection on loans overdue for more than six years and under 10 million won.

Nonghyup Financial Group will also provide 15 trillion won in inclusive finance, focusing on expanding loans for small business owners and self-employed individuals, strengthening financial support for low-income and vulnerable groups, and offering preferential interest rates for farmers.

The Financial Services Commission plans to continue holding meetings on the grand transition to inclusive finance and actively implement the tasks discussed. Chairman Lee stated, "A task force meeting will be formed with various experts and stakeholders to develop detailed plans for inclusive finance, and the improvement measures will be announced at the monthly meetings on the grand transition to inclusive finance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.