DRAM Prices Up 46% from Previous Quarter

Unprecedented Price Surge for HBM3E

Record-Breaking Profits Possible If Technology Leadership Maintained

Brokerages Project Annual Revenue of 438 Trillion Won

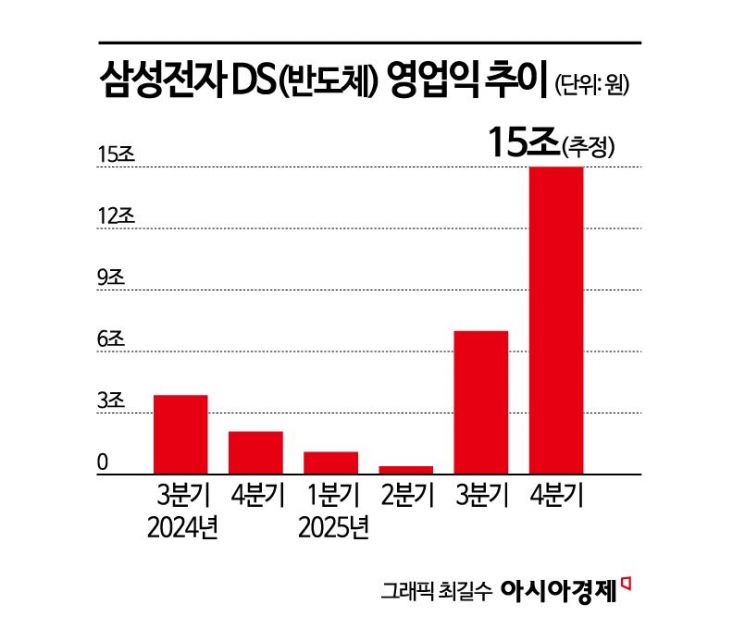

Samsung Electronics achieved its highest-ever quarterly performance largely due to a sharp increase in memory prices. As memory demand surged and supply shortages emerged, a significant price hike began in the second half of last year. According to market research firm DRAMeXchange on January 8, the price surge for the widely used general-purpose product "DDR4 8Gb 1Gx8," found in smartphones, PCs, and various electronic devices, started in April of last year. At that time, the average fixed transaction price was only $1.65. After a steady upward trend through December, the average fixed transaction price reached $9.3. This figure surpasses the previous record high of $8.19 set during the so-called memory supercycle in 2018. The rebound in operating profit for Samsung Electronics' Device Solutions (DS) division, which hit a low of 400 billion won in the second quarter of last year and then rose to 7 trillion won in the third quarter, closely aligns with this price trend. Park Yuak, a researcher at Kiwoom Securities, stated, "The operating margin in the DRAM segment rose to 53% as general-purpose DRAM prices soared," adding, "Improved profitability in the DS division likely drove overall company performance growth."

Among memory products, high-bandwidth memory (HBM), traditionally considered a high value-added product, also joined the price surge, further boosting DS division profits. HBM is expected to enter a transition period this year as the sixth-generation HBM4 enters mass production, yet demand for the previous generation, HBM3E, has not decreased, resulting in an unusual price increase. Nvidia's decision to equip the H200, which has regained export access to China, with HBM3E has created a need for mass production, and large orders from global big tech companies such as Google and Amazon Web Services (AWS) have also had a significant impact. In the market, the price of HBM3E 8-layer is reportedly around $300, while the HBM3E 12-layer is between $300 and $500. In response, it is reported that the contract price of HBM3E has been raised by about 20% this year compared to previous levels.

The price of general-purpose DRAM rose by approximately 46% compared to the previous quarter, likely amplifying profitability even further. Kim Rokho, a researcher at Hana Securities, stated, "Currently, server-centric order strength is extremely high," adding, "The average price increase for DRAM is estimated to be 31%, and for NAND, 18%, compared to initial expectations."

In addition, Samsung Electronics' emphasis on restoring technological leadership also contributed to its performance. Jun Younghyun, Vice Chairman leading the semiconductor supply to clients, mentioned in his recent New Year's address, "Clients have commented that 'Samsung is back.'" Samsung Electronics is particularly recognized for reaching a technological turning point in both HBM and foundry (semiconductor contract manufacturing).

With prices continuing to rise and current technological capabilities maintained, there is growing anticipation that Samsung Electronics could achieve an unprecedented annual operating profit of 100 trillion won. Securities firms forecast that Samsung Electronics' annual sales this year will reach about 438 trillion won, with operating profit estimated between 113 trillion and 150 trillion won.

This year, HBM, which has reached a turning point, is expected to see its total shipment volume triple compared to the previous year as HBM4 enters mass production for Nvidia's next-generation AI platform "Rubin." The prevailing view is that increased NAND sales revenue and improved profitability in the foundry business will further enhance overall profitability. For NAND, prices for specific module products such as enterprise solid-state drives (eSSD) and universal flash storage (UFS) are expected to rise by 25% to 35%, potentially generating profit effects comparable to those of memory. The foundry division signed a supply contract worth about 23 trillion won with Tesla in the United States in July last year, and is reportedly close to securing an order for 2-nanometer chips from AMD, indicating the potential for a dramatic improvement in profitability.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.