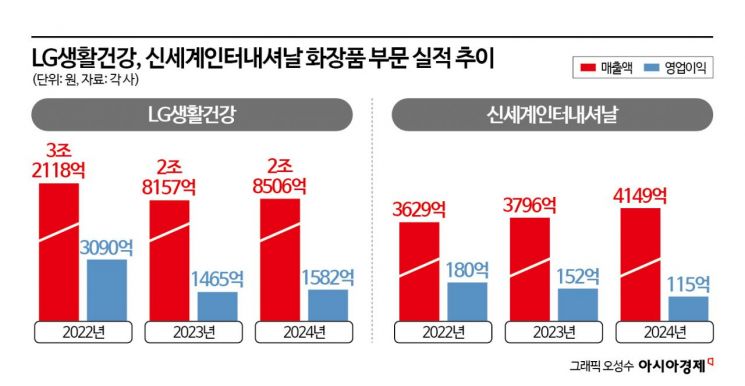

LG Household & Health Care Faces Stagnation, While Shinsegae International Scales Up Cosmetics

Appointment of L'Oreal-Trained CEOs with Proven Marketing Expertise

In the domestic beauty industry, the head-to-head competition between Lee Sunjoo, CEO of LG Household & Health Care, and Lee Seungmin, Head of the Cosmetics Division at Shinsegae International, is drawing attention. Both women, who earned reputations as "marketing strategists" at global beauty company L'Oreal, are now leveraging L'Oreal-style "speed management" to drive organizational transformation and accelerate growth within their respective large beauty corporations.

According to the retail industry on January 8, LG Household & Health Care appointed Lee Sunjoo as CEO in September of last year, entrusting her with the task of overhauling the company’s stagnating cosmetics business. The company explained, "As a former executive at global cosmetics company L'Oreal, she is the right person to lead the next step for our cosmetics business, drawing on her accumulated sense for brand marketing and business experience across diverse brands."

In the same month, Shinsegae International also appointed Lee Seungmin as head of its second cosmetics division, placing her in charge of managing key brands such as Vidivici and Amuse. This personnel decision is interpreted as a reflection of the company’s intention to grow its brands strategically and with speed, as the proportion of cosmetics sales has been rapidly expanding.

Although the two executives worked at L'Oreal Group during different periods, they share the distinction of having successfully built up individual brands through outstanding marketing capabilities. Their work styles are also known to prioritize speed and execution. It is widely recognized that they have internalized the "L'Oreal-style" approach to work, which emphasizes quick feedback and immediate action in the decision-making process.

Lee Sunjoo began her career in public relations and corporate communications at L'Oreal Korea, later serving as General Manager (GM) for the Yves Saint Laurent and Kiehl's brands. During her tenure, she implemented a large-scale sampling strategy targeting university districts and emphasized differentiated brand messaging, establishing Kiehl's as a leading moisturizing cream brand. She also reinforced professionalism and a premium image in offline stores by requiring staff to wear lab coats. As a result, Kiehl's domestic sales more than doubled, reaching the second-highest level globally after the United States.

Lee Seungmin is known in the industry as the "marketer who built Giorgio Armani Beauty." Until she moved to Amuse in 2019, she was responsible for Giorgio Armani Beauty marketing at L'Oreal Korea, boosting brand recognition with a focus on cushion and lip products. She quickly recognized the importance of Instagram celebrities and social networking services (SNS), implementing aggressive marketing strategies that enhanced both the brand’s popularity and buzz. After joining Amuse, she took direct charge of not only marketing but also investment and overall business strategy, leading the brand’s growth. Since becoming CEO in 2021, she has achieved more than a fivefold increase in Amuse’s sales.

Industry insiders expect both executives to take even more aggressive steps this year. Lee Sunjoo reorganized the existing beauty and HDB (Home Care & Daily Beauty) divisions into five new groups: Luxury Beauty (The History of Whoo, OHUI), Derma & Contemporary Beauty (CNP, Physiogel, Belif, The Face Shop), Cross-Category Beauty (Isa Knox, Beyond, Sooryehan), Neo Beauty (Dr. Groot, EucyMall), and HDB (Elastine, Tech, Homestar). In particular, the creation of the Neo Beauty division, which manages core brands Dr. Groot and EucyMall, signals an ambition to develop it into a global future growth platform by expanding from product brands such as hair care into services like diagnostics.

Similarly, after Shinsegae acquired Amuse in 2024, Lee Seungmin has been driving change while also overseeing Vidivici. She redefined Vidivici-a department store brand targeting middle-aged consumers-as a younger brand aimed at those in their 20s and 30s, and pushed for a rapid renewal. As a result, Vidivici’s sales at Olive Young surged more than thirteenfold in just one year as of last year.

Both executives face the common challenge of cultivating global brands by expanding overseas sales. As of the third quarter of this year, LG Household & Health Care’s cumulative overseas cosmetics sales reached 1.1405 trillion won, a slight decrease from 1.1526 trillion won in the same period last year. While the company is targeting the U.S. market with brands such as The Face Shop and CNP, a larger impact came from declining sales of The History of Whoo in China and adjustments in duty-free channel volumes.

Shinsegae International has entered the Japanese, Chinese, and European markets with brands like Vidivici, Amuse, and Yunjac, but overseas sales still represent a small proportion as these efforts are in the early stages. A cosmetics industry insider commented, "Both executives have honed their marketing experience in global organizations, so they are likely to inject new energy and change into their existing organizations. However, given their fast-paced and aggressive work styles, the process of adapting within their organizations will also be a key variable in determining their success."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)