End of Food Service Operations at LG Uplus and GS Engineering & Construction

LS Electric and LS Cable Contracts Transferred to LIG Home & Meal

Ourhome Adopts Aggressive Pricing Strategy in Catering and Ingredient Bidding

At Ourhome, which was acquired by Hanwha Group, the volume of food service contracts from companies affiliated with the broader LG family is steadily leaving. There is growing speculation that additional departures may occur around the time when contracts with affiliates of the LG Group, LS Group, and LIG Group expire this year. This development reflects concerns raised at the time of Hanwha's acquisition last year, which capitalized on the management dispute among the children of Ourhome's founder.

According to the food service industry on January 8, Ourhome ended its food service operations at the LG Uplus Jungang-dong office building in Jung-gu, Busan, and at GS Engineering & Construction’s Gran Seoul at the end of last year. Ourhome also recently lost LS Group contracts in succession. Starting this year, food service operations at the LS Electric Cheongju plant, previously managed by Ourhome, have been taken over by LIG Home & Meal, the food and beverage (F&B) specialist affiliate of LIG Group. LIG Home & Meal operates both group catering and restaurant and distribution businesses.

The operation rights for cafeterias at LS Cable’s Gumi and Indong plants, as well as the Gumi dormitory, previously managed by Ourhome, have also been transferred to LIG Home & Meal. Effectively, food service contracts from LS affiliates, classified as part of the broader LG family, have been lost.

The late honorary chairman Koo Jahak, founder of Ourhome, was the third son of Koo In-hwoi, the founder of LG Group. For this reason, Ourhome had long been classified as part of the broader LG family. According to industry sources, Ourhome had provided catering services to approximately 80 LG affiliates, 20 LS affiliates, and 10 GS affiliates, totaling around 110 business sites within the LG family. The annual catering revenue generated from these sites is estimated at about 300 billion won.

However, following a management dispute among the children of the late honorary chairman Koo, Ourhome was sold to Hanwha Group last year. Industry insiders have anticipated since the acquisition that food service contracts from LG family affiliates would sequentially be put out for bid as they expire, and that changes in service providers were likely.

An industry official said, "There were considerable expectations surrounding the food service volume from the LG family, but since each group has its own F&B affiliate or existing partners, competition for new contracts is fierce. After the split of the affiliates, it was inevitable that food service contracts would be reorganized." In fact, major food service companies such as Samsung Welstory and CJ Freshway participated in the bidding for LS Group affiliate business sites, but ultimately, affiliates of the LG family secured the operation rights.

Hanwha Affiliates Absorbed, Criticism Over Scaling Up Through Low-Price Bidding

On the other hand, Ourhome is steadily absorbing food service contracts from Hanwha Group affiliates. At the end of last year, Ourhome was selected as the food service provider for Hanwha TotalEnergies’ Jongno branch (Seoul office). The selection process for the food service provider at Hanwha TotalEnergies’ Seosan plant is also underway. Previously, this site had been operated jointly by Samsung Welstory and Hanwha’s own team. The industry expects that the portion previously managed by Samsung Welstory will be transferred to Ourhome.

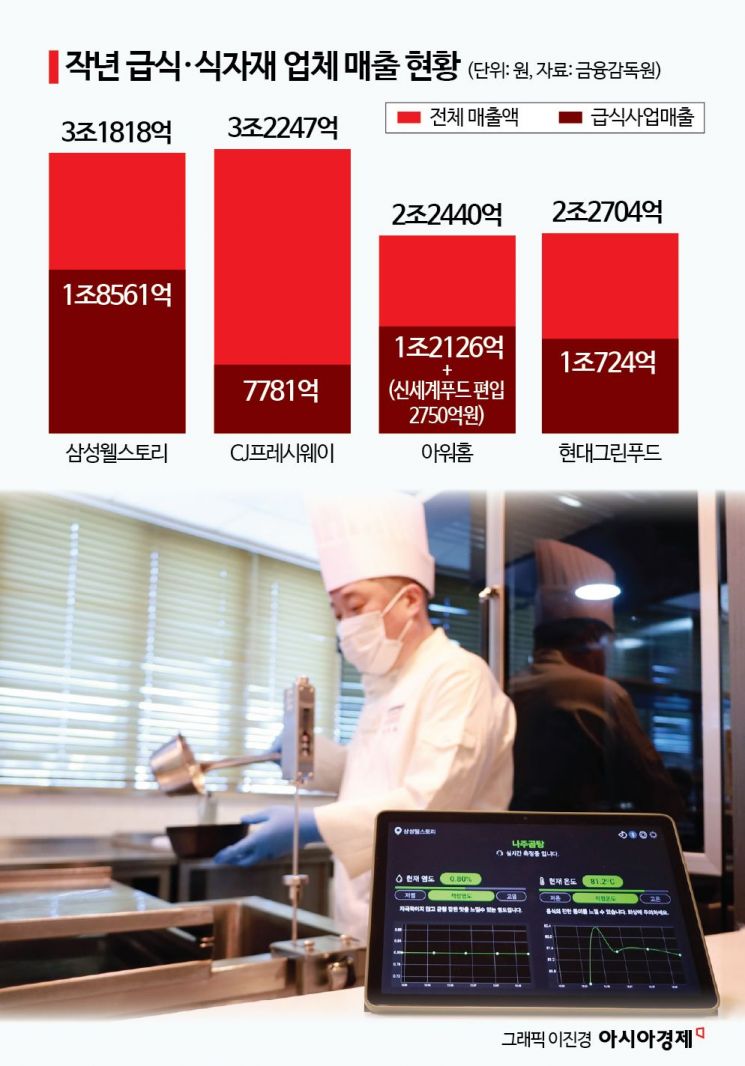

The market views Ourhome as pursuing aggressive expansion. Since the acquisition was led by Kim Dongseon, Executive Vice President for Future Vision at Hanwha Galleria and the third son of Hanwha Group Chairman Kim Seungyeon, Ourhome’s growth performance could be directly linked to Kim’s management track record. Last year, Hanwha Group invested about 1 trillion won to acquire Ourhome (approximately 870 billion won) and the food service division of Shinsegae Food (about 120 billion won). As a result, industry observers expect Ourhome’s market share in the food service sector to rise to over 20%.

The food service market, previously dominated by the “Big Five” (Samsung, Hyundai, Ourhome, CJ, Shinsegae), has been reorganized into a “Big Four” (Samsung, Ourhome, Hyundai, CJ) following the sale of Shinsegae Food’s food service division. Competition is intensifying further as latecomers such as Dongwon and Pulmuone join the fray. Ourhome has set targets of 5 trillion won in sales and 300 billion won in operating profit by 2030. New food service contracts up for bid this year alone are expected to amount to 600 billion won.

Ourhome is also employing an aggressive pricing strategy in food ingredient procurement, not just in food service. Last month, Ourhome was selected as the final provider in the bidding for food ingredients and kitchen consumables for the staff cafeteria at Grand Korea Leisure’s Seoul Dragon City branch. According to the national procurement platform, Ourhome’s bid was 779.52 million won, lower than Cheongmil (884.4 million won) and Hyundai Green Food (983.48 million won). This is significantly below Grand Korea Leisure’s estimated required budget of 1.09291 billion won. The estimated required budget is calculated by multiplying the average itemized bid prices submitted by at least three companies by the expected usage volume.

However, a closer look at the bidding process reveals a different picture. According to the “2026 Seoul Dragon City Branch Staff Cafeteria Food Ingredients and Kitchen Consumables Estimated Budget Calculation Statement” released by Grand Korea Leisure, Ourhome actually submitted the highest unit prices for individual items used in the average price calculation.

The calculation statement shows that for items such as chocolate, seasonings, processed foods, frozen foods, meat products, seafood, and kitchen consumables, Ourhome’s unit price quotes were higher than those of competitors. As a result, the average price per item was raised, but Ourhome submitted a much lower total amount in its final bid.

An industry official in the food ingredient sector said, "It appears that Ourhome has adopted an aggressive low-price bidding strategy to scale up its business. While this may help expand market share in the short term, there are concerns that it could disrupt market pricing order in the medium to long term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.