Restoration of Korea-China Relations... Eased Export Procedures

Food Industry: "Limited Improvement in Performance"

China’s Food Market Poses Higher Barriers to Competition

The governments of South Korea and China have agreed on institutional cooperation to expand the export of K-Food to China, but the domestic food industry remains cautious. While improvements in policy environments, such as the simplification of export procedures, are seen as positive changes, there is a prevailing view that the possibility of a short-term rebound in performance is limited, given that the competitive landscape in the Chinese market has already changed significantly.

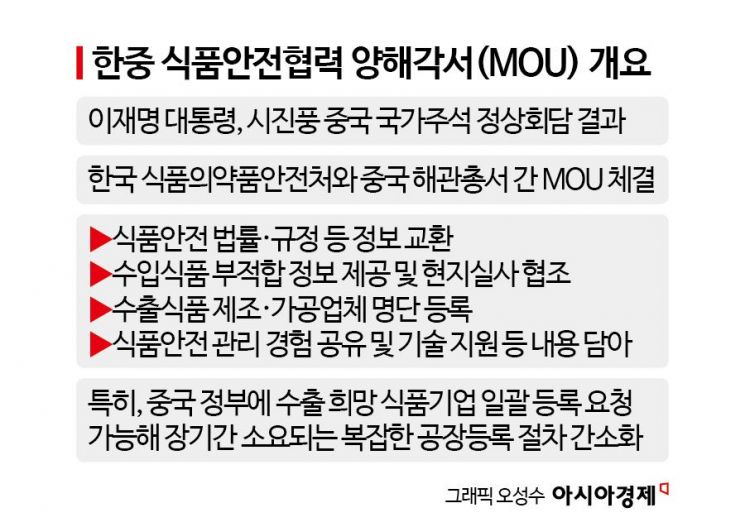

According to the food industry on January 9, the Ministry of Food and Drug Safety recently signed a memorandum of understanding (MOU) with the General Administration of Customs of China, focusing on food safety cooperation. The MOU includes the exchange of information on food safety-related laws and systems, the simplification of registration procedures for manufacturers and processors of export foods, sharing of management experience, and technical cooperation. With some of the administrative procedures that have been burdensome during the export process to China now eased, there is an assessment that export conditions themselves will improve.

China remains a key market for domestic food companies. As of 2024, Korea's food trade volume with China stands at approximately 12.3 trillion won, making it the second largest after the United States. Processed foods such as ramen and beverages account for a large proportion, and even amid sluggish domestic consumption, the Chinese market has played a significant role in supporting performance. From a policy perspective, this cooperation could be interpreted as a positive development for the industry.

However, the perspective on the ground is more sober. Even if export procedures are simplified, actual market performance ultimately depends on consumer choice and competitive dynamics. While domestic companies faltered after the implementation of the THAAD-related restrictions, Chinese local food companies grew rapidly. By leveraging price competitiveness and responding swiftly to trends such as low-sugar and zero-sugar products, their overall competitiveness in processed foods has greatly increased. This means that even if institutional barriers are lowered, the intensity of market competition does not decrease.

Major domestic food companies that have already entered China also do not see this measure as a short-term growth driver. Having already established basic market responses through local production and distribution networks, they believe that further institutional easing is unlikely to immediately lead to business expansion.

An official from a major food company stated, "Korean food is no longer a new or rare category in China," adding, "Even if some administrative procedures are improved, it is unlikely that the consumption structure itself will change significantly." The official further explained, "The key factors currently affecting performance are not policies, but rather the contraction of consumer sentiment and economic slowdown within China."

Another industry official commented, "Major brands have already secured a certain presence within Chinese distribution channels," and added, "We view this cooperation not as opening up new growth opportunities, but rather as somewhat reducing the uncertainty in the existing business environment."

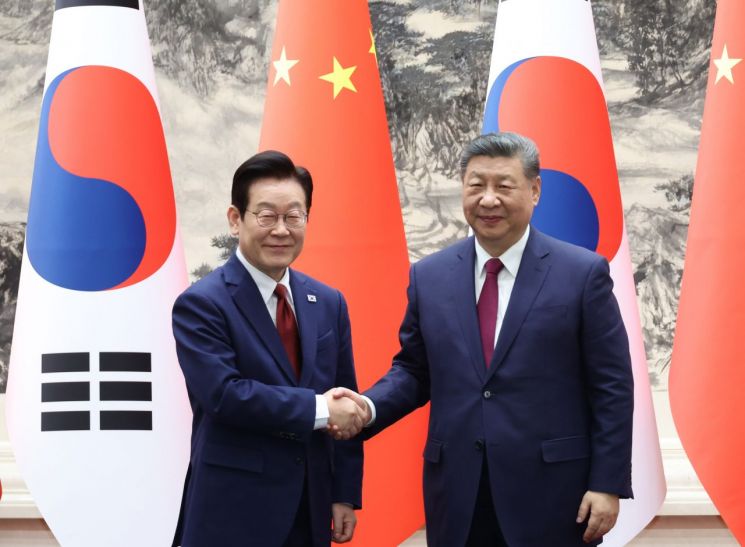

President Lee Jae-myung and Chinese President Xi Jinping shake hands at the Korea-China MOU signing ceremony held at the Great Hall of the People in Beijing on the 5th. Photo by Yonhap News

President Lee Jae-myung and Chinese President Xi Jinping shake hands at the Korea-China MOU signing ceremony held at the Great Hall of the People in Beijing on the 5th. Photo by Yonhap News

Among small and medium-sized food companies, there is a view that the burden outweighs expectations. As the structure of having to compete between domestic conglomerates with brand recognition and capital, and rapidly growing Chinese local companies, has become entrenched, it is pointed out that institutional improvements alone are unlikely to overcome the entry barriers.

However, the industry believes that the ripple effect could change if the THAAD-related restrictions are actually eased or lifted in the future. If Korean Wave content such as K-pop and dramas spreads again, the exposure effect could expand across all consumer goods, including food. Given the characteristics of the Chinese market, where cultural content consumption is closely linked, this could serve as a variable to mitigate the current growth stagnation.

A high-ranking industry official said, "Chinese consumers' perception of Korean food tends to move closely with cultural content," and added, "If Korean Wave content regains momentum, there is a possibility that the currently stagnant demand flow could change to some extent."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)