Rising Demand for Safe-Haven Assets Amid Global Instability

Gold Banking Balances at Major Korean Banks

On the Verge of Surpassing 2 Trillion Won

Due to factors such as international political instability, demand for gold, a safe-haven asset, is increasing. Yonhap News

Due to factors such as international political instability, demand for gold, a safe-haven asset, is increasing. Yonhap News

Gold prices are on the rise again amid growing international political instability. As geopolitical uncertainty increases, including the United States extraditing Venezuelan President Nicolas Maduro, demand for gold as a safe-haven asset is rising. Demand for gold banking at major domestic commercial banks is also steadily increasing, with balances up by more than 1 trillion won compared to last year.

According to the Korea Exchange on January 8, the price of pure gold per gram closed at 209,280 won on the KRX gold market the previous day. Although this represents a slight decrease of 0.95% from the previous trading day, gold prices have shown strength this year, rising from 208,800 won on January 2 to 211,280 won on January 6. Compared to a year ago, on January 7 last year (127,250 won), the price has risen by more than 80,000 won. According to Korea Gold Exchange, the purchase price for 3.75 grams (one don) of pure gold is 911,000 won, bringing the era of "one don at 1 million won" ever closer.

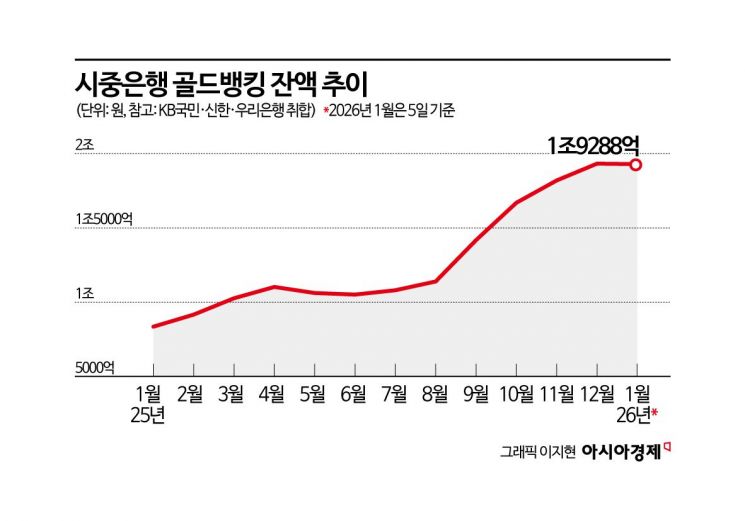

Demand for gold investment continues to grow. According to the banking sector, as of January 5, the gold banking balance at KB Kookmin Bank, Shinhan Bank, and Woori Bank totaled 1.9288 trillion won. This represents an increase of 1.0935 trillion won compared to January last year. Gold banking is a product that allows customers to buy and sell gold in units as small as 0.01 grams. When funds are deposited into these accounts, gold is purchased at the current market price, and upon withdrawal, the gold is sold at the prevailing rate and the proceeds are returned in Korean won.

Gold banking balances have shown a clear upward trend since the second half of last year. The combined gold banking balance at the three banks surpassed 1 trillion won for the first time in March last year. After maintaining a similar level for some time, the balance surged again in September last year, surpassing 1.4 trillion won, and is now on the verge of reaching 2 trillion won this year. The number of gold account subscriptions has also steadily increased each month. According to Shinhan Bank, as of January 5, the number of Gold Rich accounts stood at 188,752, an increase of more than 20,000 over the past year.

There are projections that gold prices will reach new all-time highs again this year. According to the Financial Times, the average year-end gold price forecast from 11 financial industry experts is $4,610 per ounce. Although the rate of increase is expected to slow compared to last year (64%), many analysts believe there is a high likelihood that gold prices will set new records again this year.

However, experts advise that caution is necessary, as gold is a highly volatile and unpredictable asset. A representative from a commercial bank commented, "Rather than making large lump-sum investments by following the crowd, it is advisable to manage risk through diversified investments."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)