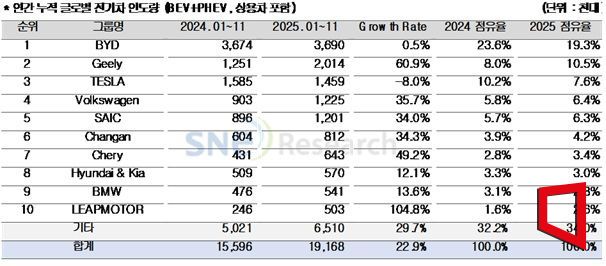

19.16 Million Electric Vehicles Delivered from January to November

Hyundai and Kia Rank Eighth with 570,000 Units

Last year, the number of registered electric vehicles worldwide approached 20 million. Chinese companies BYD and Geely Group ranked first and second in sales, highlighting the continued China-centric growth trend.

According to SNE Research on January 7, the total number of electric vehicles registered in countries around the world from January to November last year was approximately 19.16 million units, an increase of 22.9% compared to the same period of the previous year.

BYD sold about 3.69 million electric vehicles, up 0.5% year-on-year. This is attributed to the company's ongoing efforts to boost brand recognition, leveraging its proprietary battery technology and competitive vehicle production costs.

BYD is responding to changes in tariffs and subsidy policies by simultaneously establishing and expanding factories, particularly in Europe (Hungary, Turkey) and Southeast Asia (Thailand, Indonesia, Cambodia). The company is also diversifying its portfolio by adding commercial and compact vehicle lineups, moving beyond a passenger car-centric structure.

Geely Group followed by selling 2.01 million vehicles, achieving a remarkable 60.9% growth compared to the same period last year. The company is targeting consumers with a portfolio centered on the 'Starwish' model, the premium brand Zeekr, and the hybrid-exclusive brand Galaxy. Geely is also accelerating the development of proprietary technologies and strengthening production capabilities in batteries, electronics, and software.

Tesla sold about 1.45 million vehicles, a decrease of 8.0% year-on-year. Sales of the Model 3 and Model Y declined by 6.3% to 1.41 million units. In the European market, sales dropped 19.9% to 230,000 units, while in China, sales fell 7.4% to 530,000 units, confirming a downward trend across all major key markets. In North America, the end of consumer tax credit benefits led to a 7.3% decrease, with sales totaling 550,000 units.

Hyundai Motor Group ranked eighth, selling about 570,000 electric vehicles, up 12.1% year-on-year. In the battery electric vehicle (BEV) segment, the Hyundai Ioniq 5 and Kia EV3 led the performance, while compact and strategic models such as the Casper (Inster) EV, EV5, and Creta Electric also received positive responses in major global markets. However, existing flagship models such as the EV6, EV9, and Kona Electric showed a slowdown in sales.

In the North American market, Hyundai Motor Group delivered about 150,000 units, ranking third after Tesla and General Motors. SNE Research noted that maintaining results that surpass major global competitors is a meaningful achievement.

The global electric vehicle market showed contrasting trends depending on regional policy environments and differences in demand.

In China, 12.31 million electric vehicles were sold, up 21.0% year-on-year, accounting for 64% of the global electric vehicle market. However, concerns about intensified price competition and oversupply have emerged, indicating a departure from the previous high-growth phase.

In Europe, sales reached 3.74 million units, a 32.8% increase year-on-year, representing 19.5% of the global market. Recently, policy uncertainty surrounding the transition to electric vehicles has been highlighted, with adjustments to the timeline for phasing out internal combustion engines. As a result, companies such as Volkswagen, Mercedes-Benz, and BMW are either gradually scaling back their electrification strategies, adjusting the pace, or reconsidering certain strategies.

In North America, sales totaled 1.65 million units, a 0.3% increase compared to the same period last year. After the expiration of consumer tax credits under the Inflation Reduction Act (IRA), the possibility of weakening demand is growing, especially for mid- to low-priced models that are more sensitive to price changes.

In Asia, excluding China, sales increased by 54.8% year-on-year to 1.09 million units. In India, the spread of affordable electric vehicles and intensified competition led by local companies are notable trends. Thailand and Indonesia are strengthening their roles as production and export bases rather than consumer markets. Major Southeast Asian countries are shifting policy focus from growth centered on imported vehicles to emphasizing local assembly and fostering domestic industries.

An SNE Research official stated, "Global automakers are shifting their focus from simply expanding electric vehicle sales to optimizing the electrification mix and pursuing cost-efficient strategies. In the future, the key to competition will not be technological superiority alone, but also operational resilience and supply chain control that can ensure stable profits despite policy volatility."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.