Lotte Mart to Open Ocado Partnership Logistics Center in First Half of Year

Advanced Facilities with AI and Robotics...Full-Scale Launch of Fresh Food Delivery

Targeting Customers in Yeongnam Region, Including Busan, the Group's Foundation

Dispel

Lotte is set to restore its pride as a leading retail group by focusing on Busan, which is both the foundation and symbolic base of the group, in the new year. The company plans to fully launch its online grocery business with an investment of approximately 1 trillion won, aiming to secure delivery competitiveness on par with Coupang, particularly in the Yeongnam region, and to expand this nationwide. This initiative is expected to become a key project that simultaneously targets the internalization of artificial intelligence (AI) and the strengthening of fundamental competitiveness, both of which were emphasized by Chairman Shin Dongbin in his New Year's address. In addition, the group is working to stabilize its financial structure in order to counter recurring rumors of liquidity crises across its affiliates.

Full-Scale Entry into the Online Grocery Market... Defending the Legacy of a Retail Giant

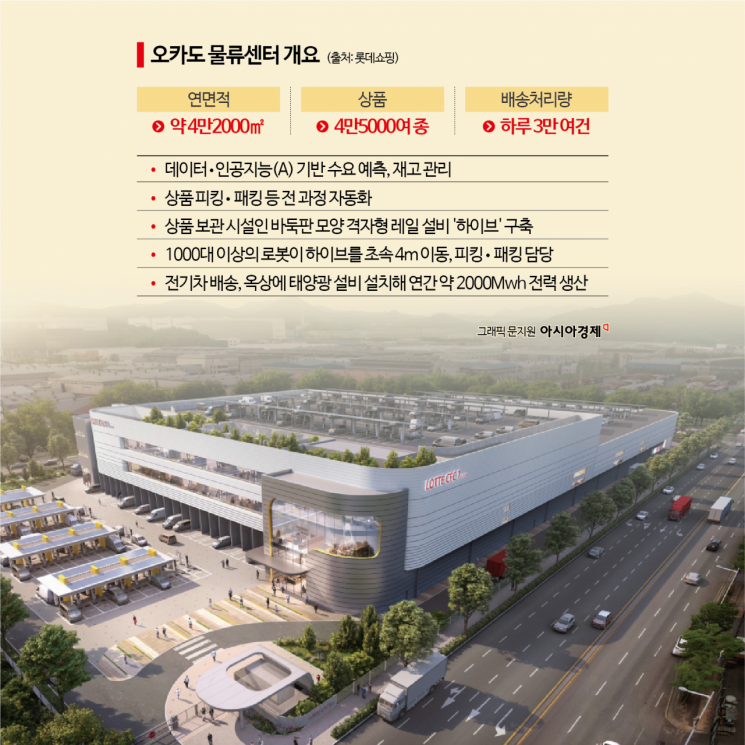

According to industry sources on January 7, the cutting-edge logistics center that Lotte is building in Busan in partnership with UK retail tech company Ocado is scheduled to begin operations in the first half of this year. Officially named the "Busan Customer Fulfillment Center (CFC)," this will be the first automated logistics center in the Busan area dedicated exclusively to online groceries. The facility, which is being built with an investment of 200 billion won, covers a total floor area of 42,000 square meters (approximately 12,705 pyeong) and is equipped with advanced technologies such as AI and robotics.

Utilizing a grid-shaped rail system called the "hive," the center will store more than 45,000 types of products, with AI used for demand forecasting and inventory management. All processes, including grocery picking and packing, as well as dispatching based on delivery routes, will be automated. The facility will be able to deliver over 30,000 orders per day, including fresh food and other items, to 2.3 million households in the Yeongnam region, including Busan, Changwon, and Gimhae.

Lotte transferred its e-grocery division from the Lotte Shopping e-commerce business unit to Lotte Mart and Super in 2024 to nurture its online grocery business and create synergy with offline channels. This move is aimed at securing dominance in the fresh food category, which is highly coveted by numerous online platform operators, including Coupang. In April of last year, Lotte launched "Lotte Mart Zeta," a grocery-specific application developed in collaboration with Ocado, thus laying the groundwork for grocery delivery.

An industry insider commented, "In Seoul and the greater metropolitan area, services like early morning and same-day delivery are already well established, making consumers accustomed to online shopping and making it somewhat disadvantageous for latecomers to compete. However, the Yeongnam region, which Lotte is targeting, still has significant growth potential for online groceries. The company also has strong ties with local residents, including through its professional baseball team, making it an ideal environment to launch new businesses and achieve results."

The improvement in performance for Lotte Mart and Super, which have borne the costs of building logistics centers and transferring the e-grocery business amid deteriorating market conditions, also depends on the success of the Busan CFC. In the third quarter of last year, domestic sales for Lotte Mart and Super were 1.3035 trillion won, an 8.8% decrease from the same period the previous year, while operating profit plummeted by 85.1% to just 7.1 billion won. Previously, Lotte Shopping announced a strategy to invest about 1 trillion won starting with Busan to build six CFCs nationwide by 2030 and achieve 5 trillion won in online grocery sales by 2032. At the groundbreaking ceremony for the Busan CFC, Chairman Shin stated, "By building six CFCs across the country, we aim to become the game-changer in the domestic online grocery market."

Dispelling Liquidity Crisis Rumors... Strengthening Financial Health

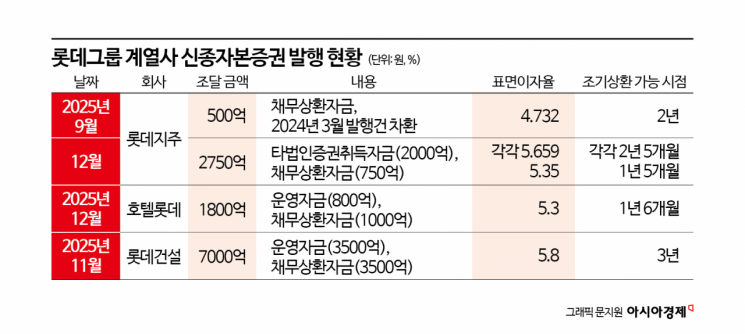

To dispel recurring rumors of a liquidity crisis that have surfaced annually since 2024, the group is also focusing on managing its financial structure at the group level. For example, Hotel Lotte decided on December 24 to issue hybrid securities worth 180 billion won. This came just two months after the company issued 130 billion won in commercial paper (CP) at an interest rate of 3% in October of the same year to secure funds for debt repayment, thus changing its method of fundraising. Of the funds raised this time, 80 billion won will be used for operating capital, while the remaining 100 billion won will be allocated for debt repayment.

Lotte Corporation also issued hybrid securities totaling 275 billion won in the same month. Of this, 200 billion won will be used to acquire securities of other companies, and 75 billion won will be used for debt repayment. Lotte Corporation plans to use these funds to participate in Lotte Biologics' 200 billion won paid-in capital increase. Hotel Lotte will also participate in Lotte Biologics' capital increase by acquiring approximately 214.4 billion won worth of forfeited shares.

Hybrid securities typically have a maturity of 30 years or are set as perpetual, meaning there is effectively no pressure for principal repayment. Issuers can defer interest payments, so these are classified as equity in accounting terms. Like regular corporate bonds or CP, they raise funds but are not recorded as debt, making them advantageous for managing financial indicators. However, they carry higher interest rates than corporate bonds, and after a certain period, the step-up structure increases the additional interest rate, resulting in greater interest burdens for long-term holders.

Lotte Corporation first issued hybrid securities in March 2024 and has since issued them a total of four times. In September of last year, the company reissued 50 billion won in hybrid securities to refinance those issued a year earlier. This year, it has issued hybrid securities twice, shifting its fundraising strategy toward capital-like bonds. In November of last year, Lotte Engineering & Construction also raised 700 billion won through the issuance of hybrid securities.

Lotte Group's actions reflect its determination to prioritize financial stability, even at the cost of higher expenses. A Lotte representative explained, "With the global economy slowing and industrial growth sluggish, we are managing financial soundness. Each affiliate is working to increase capital based on its specific circumstances and capital requirements."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.