Easing of Investment and Divestment Regulations

Expansion of CVC and Individual Investor Participation

Basis for Extending Parent Fund Duration

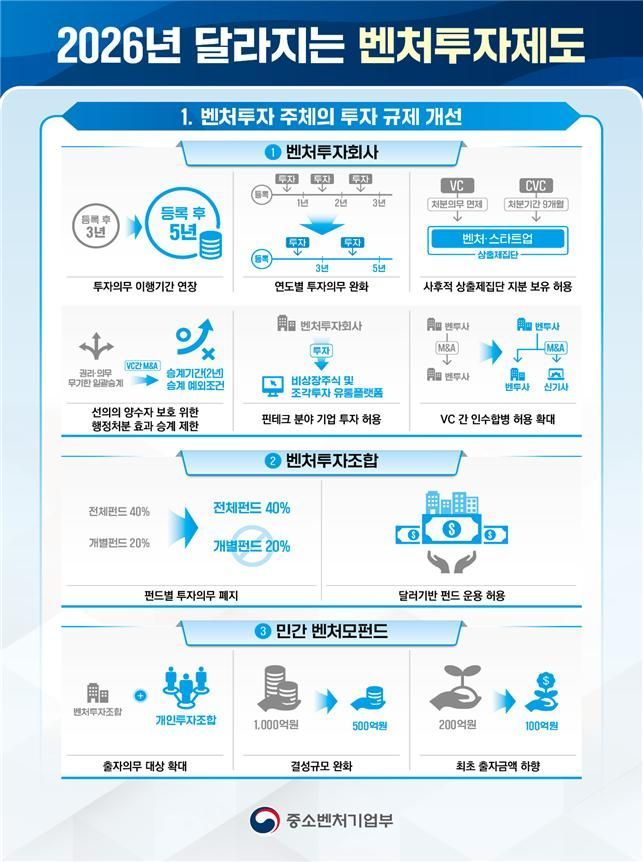

On January 6, the Ministry of SMEs and Startups announced the newly revised venture investment system for this year, based on amendments to the "Act on the Promotion of Venture Investment" and its subordinate regulations.

The legal and institutional reforms either took effect last year or are follow-up legislative tasks for the "Comprehensive Plan to Become One of the World’s Top Four Venture Powerhouses," which will be amended this year. The changes are largely divided into three categories: improvement of investment regulations for venture investment entities, expansion of tax support for venture investment, and strengthening the foundation of the venture investment ecosystem.

The Ministry of SMEs and Startups announced the newly changed venture investment system for this year. Ministry of SMEs and Startups

The Ministry of SMEs and Startups announced the newly changed venture investment system for this year. Ministry of SMEs and Startups

First, the mandatory investment period for venture investment companies and similar entities will be relaxed from the current three years to five years, and the annual investment requirements will be rationally adjusted. Previously, venture investment companies were required to make at least one investment each year for three years after registration. Now, they are required to make at least one investment within three years of registration, and one additional investment within five years, thereby reducing the initial burden.

If a company invested in by a venture investment company is later incorporated into a large business group subject to cross-shareholding restrictions, the obligation to sell the stake within five years will be abolished. If a company invested in by a corporate venture capital (CVC) entity is later included in the same business group subject to cross-shareholding restrictions, a nine-month grace period will be granted for the disposal of shares.

In the case of business transfers or mergers and acquisitions between venture investment companies, the period during which the administrative sanctions imposed on the previous venture investment company are succeeded will be adjusted from indefinite to two years. Exceptions to succession will also be established to protect bona fide transferees.

The scope of financial companies that venture investment companies may exceptionally invest in will be expanded to include unlisted stock trading and fractional investment distribution platforms, thereby supporting the growth of innovative financial startups.

The investment obligation for individual funds (20%) managed by general partners (GPs) will also be abolished. Only the investment obligation for the total fund (40%) will apply, allowing for the development of management strategies that reflect the characteristics of each fund. In addition, a legal basis has been established for foreign investors to contribute in US dollars without a separate currency exchange, improving the convenience of overseas capital for venture investment.

To promote the creation of private venture fund-of-funds, the minimum fund size has been lowered from 100 billion won to 50 billion won, and the initial contribution amount from 20 billion won to 10 billion won. The scope of entities required to contribute to private venture fund-of-funds has been expanded to include not only venture investment partnerships but also individual investment associations.

The investment obligation for individual investment associations with startup accelerators as GPs will be expanded to include companies in their fourth or fifth year without fundraising records, easing the funding burden for promising companies with technological capabilities. The upper limit for investments in listed companies by individual investment associations will be raised from 10% to 20%.

Startup accelerators will now be allowed to invest for management control purposes not only in early-stage startups they have directly selected and nurtured, but also in prospective entrepreneurs, thereby expanding the scope for establishing subsidiaries. The registration requirements for professional individual investors will also be relaxed, improving accessibility for individuals to participate in venture investment.

Furthermore, when a startup accelerator serves as the GP of an individual investment association, up to 30% of the fund can be contributed by corporations. If the primary purpose is to invest in early-stage companies located outside the Seoul metropolitan area, the limit will be raised to 40%. If a local government or public enterprise contributes 20% or more of the fund, the limit will be increased to a maximum of 49%, supporting venture investment in non-metropolitan companies.

The tax credit rate for corporate contributions to private venture fund-of-funds will be increased from 3% to 5% of the incremental contribution. When a venture investment partnership invests through a special purpose company (SPC), the same level of tax benefits as direct investment by a venture investment partnership will be granted.

The scope of statutory funds eligible to participate in venture investment will be expanded to include all funds under the National Finance Act, supporting the participation of various financial entities such as pension funds and public funds in venture investment.

A legal basis has been established to allow the duration of the parent fund, currently set until 2035, to be extended in ten-year increments. The extension process will begin in the second half of this year to ensure the continuation of various policy functions, such as expanding investment in strategic sectors like artificial intelligence (AI) and deep tech, and attracting private capital.

The regulation prohibiting the imposition of excessive joint liability on third parties other than investee companies will be expanded to cover startup accelerators, individual investment associations, and venture investment partnerships.

Minister Han Seong-sook of the Ministry of SMEs and Startups stated, "This institutional reform is a comprehensive overhaul to ensure that venture investment can be more flexible and sustainable in response to changes in the market environment," adding, "To become one of the world's top four venture powerhouses, we will continue to communicate closely with the industry and do our best to ease investment regulations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)