Surge in Bets Just Before Secret Operation

$410,000 Profit Earned on Betting Platform

Growing Suspicions of Military Operation Leak

Just before the U.S. military's operation to arrest Venezuelan President Nicolas Maduro, it was revealed that an anonymous trader made a profit of over 400,000 dollars (approximately 570 million Korean won) by making large bets on Maduro's ousting on the cryptocurrency-based prediction market Polymarket. This has sparked suspicions of insider trading. On January 5 (local time), the Wall Street Journal (WSJ) reported that there are national security concerns regarding the possibility that an insider may have obtained classified information about the U.S. military's secret operation in advance and used it for trading on Polymarket.

Venezuelan President Nicolas Maduro arrested in a surprise military operation by the U.S. military. Trump Truth Social

Venezuelan President Nicolas Maduro arrested in a surprise military operation by the U.S. military. Trump Truth Social

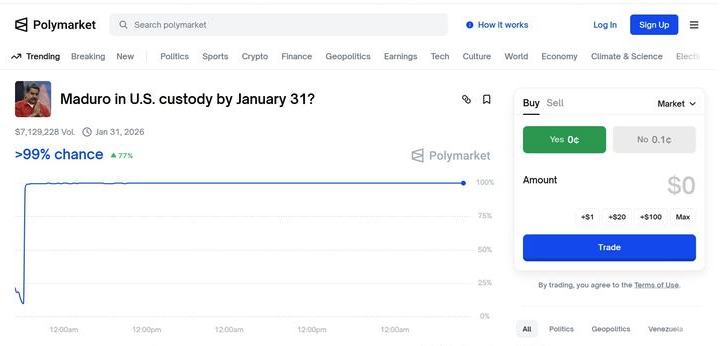

Polymarket is a cryptocurrency-based prediction platform where users can bet "Yes" or "No" on the outcomes of various events in politics, economics, and international affairs. The price of each contract ranges from 0 to 1 dollar, with the price reflecting the probability of the event occurring. According to the WSJ, the trader in question created an account last month and began betting on December 27. The trader focused investments on contracts that would yield profits if Maduro failed to remain the leader of Venezuela by January 31. Notably, at 9:58 p.m. Eastern Time on January 2, just before U.S. President Donald Trump ordered the operation to arrest Maduro, the trader placed a final large bet. At that time, the contract price was 8 cents, indicating the market estimated an 8% probability of the event.

However, just a few hours later, news broke that the U.S. military had launched an operation to capture Maduro, causing the contract price to surge. The trader, who had invested about 34,000 dollars, made a profit of approximately 410,000 dollars. More than half of the total betting amount was concentrated right before the operation. Experts believe there is a high likelihood of insider trading, as a new account made concentrated investments in a short period and earned massive profits at a time when there was little publicly available information about Maduro's ousting.

A graph related to the ousting of Nicolas Maduro on Polymarket, where the stock price surged to $1 (100%) following the arrest of Maduro by the U.S. military. Polymarket

A graph related to the ousting of Nicolas Maduro on Polymarket, where the stock price surged to $1 (100%) following the arrest of Maduro by the U.S. military. Polymarket

The U.S. government managed the operation with strict secrecy, and it is reported that the large-scale military operation involved more than 150 military aircraft across 20 locations. If the trader is a U.S. official, they could be subject to penalties under existing insider trading laws, but if the trader is a foreign national, jurisdictional issues may arise.

As the controversy grew, U.S. Representative Ritchie Torres announced plans to introduce a bill that would prohibit federal officials and executive branch employees from betting on prediction markets where they could access non-public information.

Polymarket has previously been embroiled in another insider trading controversy. Last month, a trader made millions of dollars by correctly predicting both the "most searched person on Google" and the release timing of the artificial intelligence model "Gemini 3," raising suspicions of being a corporate insider. This latest incident has heightened concerns that unregulated prediction markets could escalate into national security and information leakage issues.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.