Samil PwC Releases Diagnostic Report on the Savings Bank Industry

There is a growing consensus that the savings bank industry has reached its limits and is now at a structural turning point. Analysts argue that fundamental changes are needed across the entire spectrum, including business models, asset structures, risk management, and supervisory systems.

On January 6, Samil PwC announced the release of a report titled "Savings Banks at a Turning Point: Directions for Restructuring and Innovation," which analyzes the changes surrounding the savings bank industry.

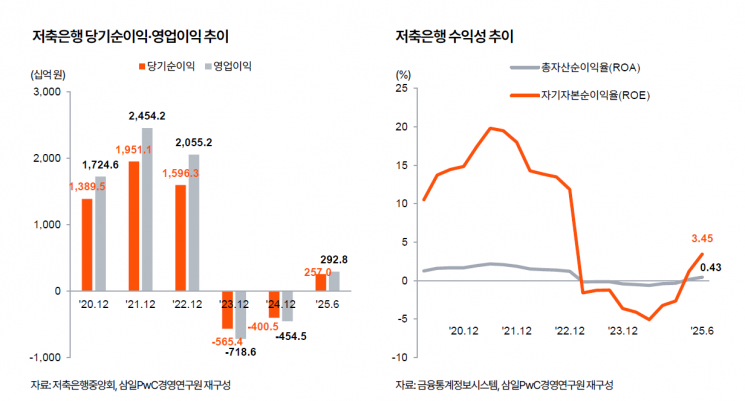

The report points out that the savings bank industry, which has traditionally supplied credit to low-income individuals and small business owners, now requires a fundamental reassessment. Structural vulnerabilities-such as increased reliance on real estate project financing (PF), portfolio concentration, higher funding burdens in a high interest rate environment, and widening gaps in digital competitiveness-are all materializing at the same time, raising questions about the industry's sustainability.

In particular, the report finds that recent environmental changes are not temporary shocks. It interprets these changes as signals that the existing balance in savings banks’ profit structures, asset composition, risk management methods, and supervisory systems is no longer sustainable. The report explains, "The deterioration of soundness and increased capital burdens observed during the real estate PF insolvency and resolution process are prime examples of the structural vulnerabilities facing the savings bank industry becoming a reality."

For this reason, the report emphasizes that the savings bank sector must go beyond simply maintaining asset size or supplementing existing business practices. It is time to comprehensively reassess risk management methods, business structures, and the consistency of policy and supervisory frameworks. In an environment where neither an economic rebound nor regulatory adjustments alone can restore overall industry stability, a redefinition of the traditional role of savings banks is required.

The report suggests several key agenda items for discussion: reviewing and gradually easing business area regulations; rationally adjusting deposit insurance fee structures based on the principle of "same function, same risk"; improving structure by facilitating voluntary mergers and acquisitions (M&A); building alternative portfolios to fill gaps left by PF; and overhauling management systems to strengthen internal controls. The full details of the report are available on the Samil PwC website.

Kim Kieun, Financial Industry Partner at Samil PwC, stated, "Without a strategic decision on how to restructure the savings bank industry in terms of its structure and role, it will be difficult to secure long-term stability. The changes currently facing the savings bank industry require not just a recovery from short-term business downturns, but a fundamental redefinition of the industry's role and business model itself."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.