Succession Accelerates with Appointment of CEO Kim Hyunjung

Yoon Family's 20% Stake Remains a Key Variable

Samhwa Paint has launched its third-generation management system by appointing Executive Vice President Kim Hyunjung, the eldest daughter of the late Chairman Kim Jangyeon, as CEO and President. However, market skepticism over the company's ability to retain management control remains unresolved. This is due to the fact that the family of the late Yoon Heejung, the company's co-founder, holds more than 20% of the shares, and there are still hurdles such as the payment of hundreds of billions of won in inheritance tax.

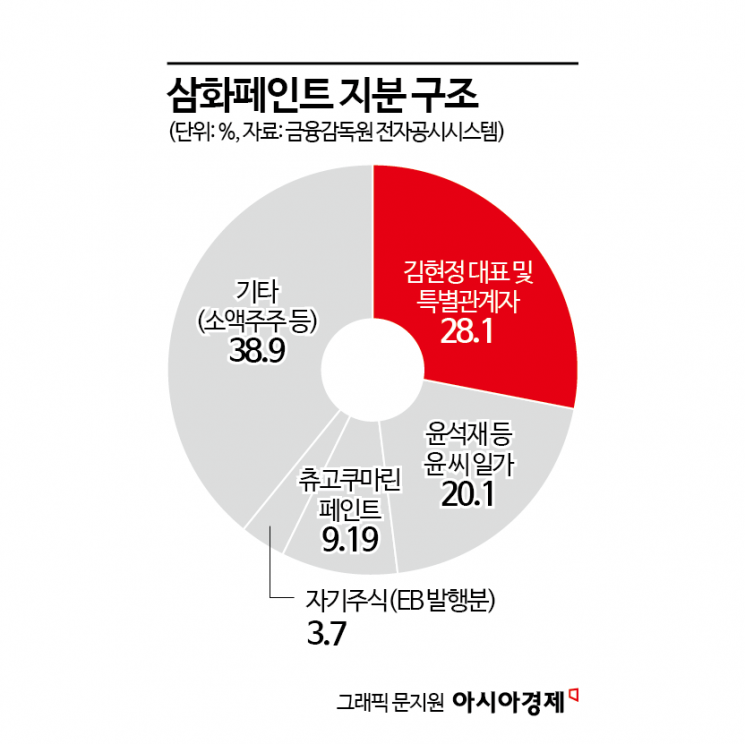

According to the paint industry on January 6, Samhwa Paint promoted Executive Vice President Kim to President the previous day, and the board of directors appointed her as the new CEO. As a result, Samhwa Paint has shifted to a co-CEO system with CEO Kim and CEO Bae Maengdal. On January 2, CEO Kim inherited all 6,192,318 shares (22.76%) of Samhwa Paint previously held by her late father, becoming the largest shareholder with a 25.80% stake. When combining her existing shares and those held by related parties, CEO Kim's side controls 28.1% of the company.

Although the appointment as CEO has secured management control, market attention is focused on the stability of the company's governance structure. The second-largest shareholder is the family of the late Chairman Yoon, holding approximately 20.1% of the shares. The gap between the two sides' shareholdings is only about 8 percentage points. The Yoon family stepped down from management in 2007 but was involved in a fierce dispute over management control in 2014, triggered by the issuance of bonds with warrants (BW).

With the gap between the largest and second-largest shareholders not being significant, the biggest burden for CEO Kim is the inheritance tax. If the current stock price trend (closing price of 7,240 won on January 5) continues, CEO Kim will need to prepare about 20 billion won in inheritance tax by the end of June.

The issue is that the options for raising funds are limited. It is known that about 47% (2.9 million shares) of the inherited shares are already pledged as collateral under a stock pledge agreement set up during Chairman Kim's lifetime. Although the loan amount is not large at 3 billion won, this may limit the possibility of additional stock-backed loans. While securing funds through dividends is also being considered, this could be seen as a defensive move to protect management control, which may be burdensome.

The market does not rule out the possibility of selling a portion of the shares. In this case, CEO Kim's side would not reach the mid-30% stake typically required to stably defend management control in a listed company. If the Yoon family, with its 20% stake, joins forces with activist funds to regain control, it would be difficult for CEO Kim to maintain her position.

However, Samhwa Paint recently increased its friendly shareholding by selling 5% of its treasury shares to its Japanese partner, Chugoku Marine Paint (CMP), through a block deal. CMP, which established the joint venture 'Chugoku Samhwa Paint' with Samhwa Paint in 1988, has maintained a strategic partnership for over 30 years and is considered a friendly shareholder to CEO Kim's side.

The regular shareholders' meeting scheduled for March is expected to be the turning point. Currently, under the company's articles of incorporation, the CEO also serves as chairman of the board, a role currently held by CEO Bae. There is interest in whether CEO Kim will also succeed to the chairmanship of the board, thereby increasing her control. An industry insider commented, "The key issue is whether CEO Kim can resolve the inheritance tax risk based on her expertise without diluting her stake."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)