At the End of December Last Year, Foreign Exchange Reserves at 428.05 Billion Dollars... Down by 2.6 Billion Dollars

Increase in Foreign Currency Deposits at Financial Institutions

and Higher US Dollar Value of Non-Dollar Assets

Offset by S

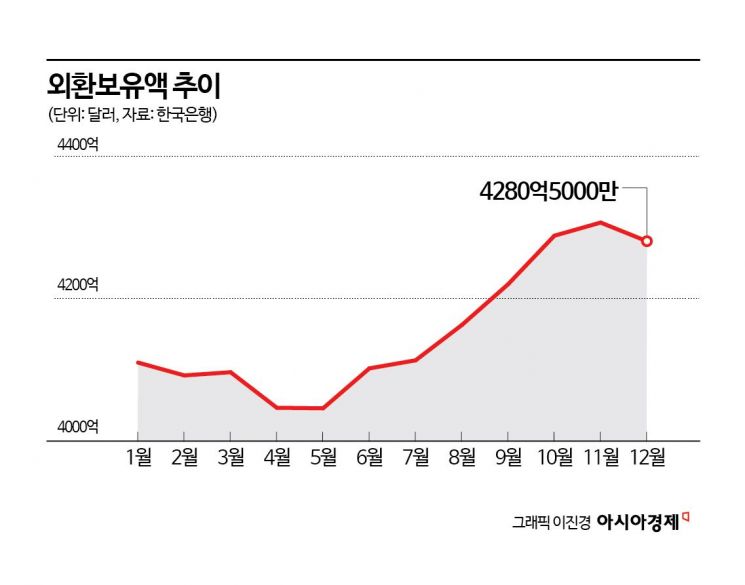

South Korea's foreign exchange reserves have declined for the first time in seven months, falling to the 420 billion dollar range. This shift is attributed to measures aimed at easing volatility in the foreign exchange market, following a sharp rise in the won-dollar exchange rate to above 1,480 won at the end of last year.

According to the Bank of Korea on January 6, South Korea's foreign exchange reserves stood at 428.05 billion dollars at the end of December last year, down 2.6 billion dollars from the previous month's 430.66 billion dollars. This is the largest decrease since April, when reserves fell by 4.99 billion dollars. While the increase in foreign currency deposits at financial institutions and the rise in the US dollar value of other currency-denominated assets at the end of the quarter contributed to higher reserves, these factors were outweighed by stronger measures to stabilize foreign exchange market volatility, resulting in the overall decline.

South Korea's foreign exchange reserves had steadily increased until the second half of 2021, peaking at 469.2 billion dollars at the end of October 2021. However, they began to decline due to the US Federal Reserve's interest rate hikes that started in earnest in 2022. From February to May last year, reserves fell below 410 billion dollars, but then increased for six consecutive months. In November, reserves surpassed 430 billion dollars, helped by higher investment returns. However, due to measures to ease market volatility in response to the sharp year-end rise in the exchange rate, reserves turned to a decline after seven months of growth.

An employee is organizing US dollars at the Counterfeit Response Center of Hana Bank in Jung-gu, Seoul. Photo by Yonhap News Agency

An employee is organizing US dollars at the Counterfeit Response Center of Hana Bank in Jung-gu, Seoul. Photo by Yonhap News Agency

In December last year, securities-which include government bonds, corporate bonds, and government agency bonds-fell sharply by 8.22 billion dollars from the previous month to 371.12 billion dollars. Securities accounted for 86.7% of total foreign exchange reserves, marking a decrease. In contrast, deposits (7.4%) increased by 5.44 billion dollars to 31.87 billion dollars. Special Drawing Rights (SDRs) from the International Monetary Fund (IMF) stood at 15.89 billion dollars (3.7%), gold was 4.79 billion dollars (1.1%), and the IMF position was 4.37 billion dollars (1.0%).

Meanwhile, as of the end of November last year, South Korea maintained its position as the world's ninth-largest holder of foreign exchange reserves. Among the top ten countries, only India (ranked fifth) and Taiwan (ranked sixth) saw their reserves decrease, by 1.8 billion dollars and 400 million dollars, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)