Funding Provided for Credit Recovery Committee's "Saedoyak Loan"

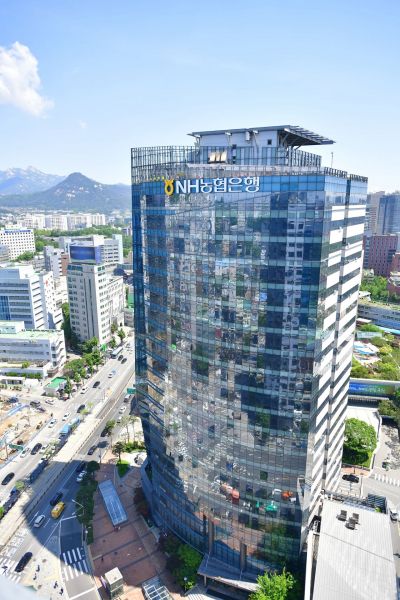

NH NongHyup Bank announced on January 5 that it has provided 20 billion won (with a maximum limit of 100 billion won) in funding to the Credit Recovery Committee's "Saedoyak Loan," a financial support program designed to alleviate the debt burden of vulnerable groups.

The Saedoyak Loan, overseen by the Credit Recovery Committee, is available to individuals who, after experiencing a delinquency seven years ago, have undergone debt restructuring and have been repaying the remaining debt for more than six months. The loan interest rate is set at an annual rate of 3-4%, which is comparable to the level of unsecured bank loans, and the maximum loan amount per person is 15 million won. By providing low-interest loans to those fulfilling their debt restructuring obligations, the program supports the recovery of vulnerable groups. The funds provided by NongHyup Bank will be used as resources for the Saedoyak Loan.

A representative from NongHyup Bank stated, "We hope that this funding will help establish a social safety net for vulnerable groups struggling with debt to make a fresh start," adding, "NongHyup Bank will continue to support the financially marginalized and fulfill its social responsibility."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.