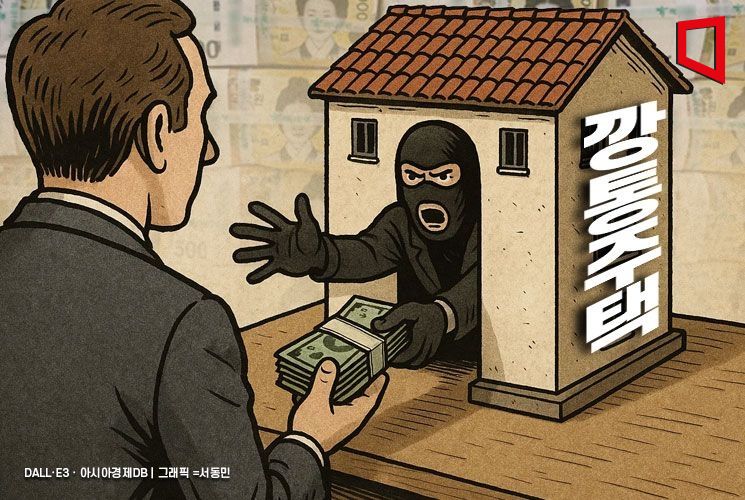

A group that defrauded young tenants and others out of 9.5 billion won in apartment rental deposits through a "jeonse scam" in Suncheon, South Jeolla Province, has been sentenced to lengthy prison terms.

On January 5, Presiding Judge Beom Sunyoon of the Criminal Division 2, Suncheon Branch of the Gwangju District Court, announced that real estate agent A and interior contractor B, who were indicted and detained on charges including large-scale jeonse fraud using a "zero-capital gap investment" scheme, were each sentenced to 10 years in prison.

Three other defendants, who were either real estate agents or licensed brokers, received prison sentences of three, five, and seven years respectively.

A and others were indicted for establishing a corporation in February 2020, then purchasing 218 apartments in Jorye-dong, Suncheon, South Jeolla Province, and defrauding 137 people out of a total of 9.5 billion won in deposits by January 2024.

The group, which included a married couple and their son, was found to have divided roles such as apartment acquisition, fund management, providing the corporate name, and recruiting tenants.

According to the prosecution's investigation, without any of their own capital, they purchased a large number of apartments in a short period using only borrowed money, loans, and rental deposits, and continued their real estate business by rolling over deposits from tenants in their 20s and 30s who had little experience with real estate transactions.

The Suncheon Branch of the Gwangju District Prosecutors' Office reported that a supplementary investigation focusing on the flow of deposits revealed the structure of the crime, the collusion among the perpetrators, and the net criminal proceeds, which amounted to 1.2 billion won.

The court stated, "The defendants purchased 218 apartments through a zero-capital investment method, relying only on borrowed funds and deposits, and set the rental deposits higher than the purchase price, creating a high-risk structure where it would be difficult to return the deposits if prices fell. They did not disclose the corporation's capital erosion or the existence of mortgages on the apartments to tenants, and deceived them into believing that deposit returns were possible, making a guilty verdict unavoidable."

Recently, in this apartment complex, there have been additional cases where tenants were unable to recover their deposits even after their rental contracts expired.

Twelve households were unable to recover deposits ranging from 48 million to 75 million won despite the end of their contract periods, and since the landlord owns more than 30 units, there are concerns that the damages will increase further.

This apartment complex, which has a large number of units around 33 square meters, consists of 2,794 units in total, with 619 units owned by corporations and 2,175 units owned by individuals.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.