Research Alarm has launched an investment advisory service based on an analysis of the actual market influence of domestic securities firm analysts.

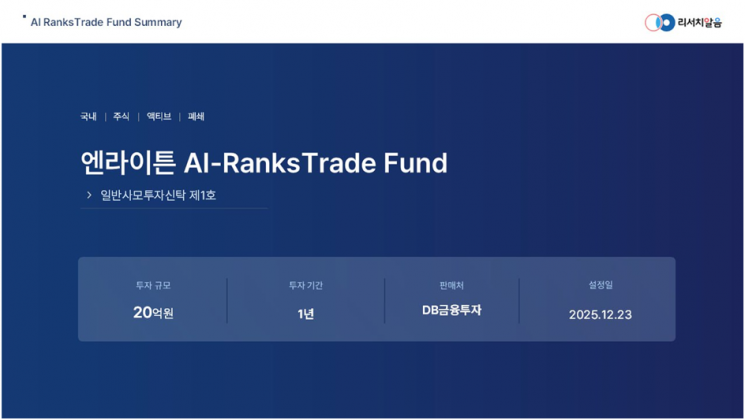

Research Alarm announced on January 5 that it applied an AI investment advisory model trained on star analyst data and launched the 'Enlighten AI Rank Trade General Private Investment Trust No. 1' on December 23 of last year. This fund is managed by Enlighten Asset Management, with Research Alarm's AI model providing investment advisory services.

The core of the fund lies in the AI's analysis of accumulated analyst reports over several years and the stock price reactions following the publication of those reports, which is then reflected in trading strategies. Unlike the traditional approach of determining whether a target price will be reached based on medium- to long-term outlooks, this strategy quantitatively analyzes how the market reacts immediately after a report is released, selecting analyst reports with proven performance.

The strategy is based on the '2025 Star Analyst' analysis. Research Alarm evaluated analysts who published at least one report per month by calculating the average peak return on the day of report publication compared to the opening price, thereby aggregating the market response for each analyst. This method is differentiated from traditional evaluation approaches in that it assesses actual influence based on data from the day of publication, when short-term supply and demand and investor sentiment are most sensitive, rather than focusing on whether the target price is reached or long-term performance.

According to the results, Kim Sunghwan, an analyst at Bookook Securities, ranked first with an average return of 6.85%. Over the past year, Analyst Kim analyzed 15 stocks and achieved the highest average performance in terms of stock price movement on the day of report publication.

By securities firm, analysts from Hana Securities were prominently represented among the top performers, standing out in terms of short-term results.

Research Alarm is actively utilizing the analyst peak return analysis not just as statistical data, but as a key component of its actual investment strategies. This data is incorporated into the AI model training for the Enlighten AI Rank Trade Fund, serving as an objective indicator of market response to inform trading decisions.

Choi Sunghwan, CEO of Research Alarm, stated, "This analyst return analysis is not just for reference, but is part of the data actually applied in fund management," adding, "The goal is to enhance the efficiency of investment decisions by focusing on market response rather than simply the buzz generated by reports."

The analyst rankings and full reports used in the analysis are available on Research Alarm's stock analysis platform, STOCK9330.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)