Export-Import Bank of Korea's Overseas Economic Research Institute Analysis

Production Capacity Constraints Amid Expanding AI Investment...

Export Boom Expected to Continue

There is an outlook that South Korea's semiconductor exports will once again hit a record high this year, significantly increasing compared to last year. It is expected to be a year in which not only memory semiconductors, the country's mainstay, but also non-memory (system) semiconductors regain their competitiveness. The key variable cited is the United States' semiconductor tariff policy.

AI Investments Continue to Grow, But Limited Production Capacity Sustains Strong Exports

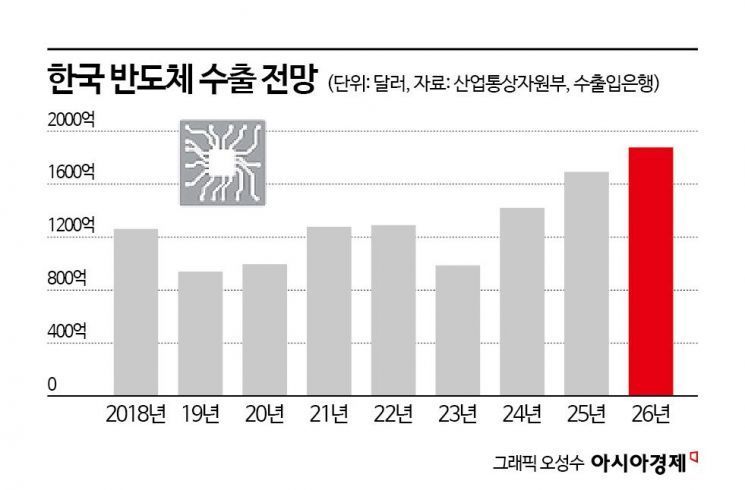

According to the "2026 Semiconductor Industry Export Outlook" report released on January 5 by the Export-Import Bank of Korea's Overseas Economic Research Institute, South Korea's semiconductor exports this year are projected to reach $188 billion, an 11% increase compared to last year. This would mark a new all-time high for the second consecutive year.

Last year, a surge in global investments in artificial intelligence (AI) servers and data centers led to an explosive increase in demand for high value-added memory semiconductors, pushing South Korea's semiconductor exports above $170 billion. The research institute expects this strong export trend to continue this year.

The institute forecasts that the global memory semiconductor market will grow by more than 30% this year compared to last year. Samsung Electronics and SK hynix hold a 70% share of the global DRAM market and over 50% of the NAND flash market. The analysis suggests that as the global memory semiconductor market expands, exports by domestic semiconductor companies are also highly likely to increase.

This year, it is estimated that not only high-bandwidth memory (HBM) but also general-purpose DRAM and NAND flash are experiencing growing demand, driven by increased AI inference needs. In particular, memory semiconductor companies are maintaining a "disciplined expansion" strategy focused on profitability, unlike in the past, which is expected to sustain the upward trend in semiconductor prices.

In 2018, domestic semiconductor companies rapidly expanded production capacity in response to soaring memory demand amid a race to build out cloud data centers. However, when demand plummeted due to an economic slowdown in 2019, they faced significant difficulties. The assessment is that, in this cycle, companies are taking a more cautious approach to capacity expansion to avoid repeating past mistakes.

Imi Hye, Senior Researcher at the Export-Import Bank of Korea's Overseas Economic Research Institute, said, "Since semiconductor companies are maintaining a conservative investment stance, it will be difficult to expand production capacity in the short term, making it unlikely that the supply shortage will be resolved even by the end of this year." She added, "Production capacity is being prioritized for HBM and high-capacity DDR5, which is reducing the ability to produce consumer chips for PCs and mobile devices. In addition, except for Samsung Electronics, DRAM manufacturers are facing constraints in expanding capacity due to a lack of space to install equipment."

System Semiconductor Exports Also Expected to Recover Competitiveness

The research institute also projects that, in addition to domestic memory semiconductors, exports of system semiconductors will increase this year, driven by greater use of Korean foundry (semiconductor contract manufacturing) services and improved foundry competitiveness.

This year, the global system semiconductor market is expected to grow by 10% compared to last year, fueled by the expansion of AI semiconductors. While South Korea's system semiconductor market share remains at about 2%, the competitiveness of system semiconductors is expected to recover as Samsung Electronics' application processor (AP), Exynos, is set to be installed in the Galaxy S26, scheduled for release in the first half of this year.

In the foundry sector, Samsung Electronics is expected to begin securing global orders in earnest this year, marking a turning point for expanding its market share. As of the second quarter of last year, Samsung Electronics' global foundry market share stood at 7.3%, far behind TSMC's 70.2%. However, this year, Samsung Electronics is expected to compete in earnest for market share by securing orders from major clients such as Tesla and Apple.

The biggest factor that could negatively impact semiconductor exports is the United States' semiconductor tariff policy. Senior Researcher Lee said, "There is a high possibility that the United States will clarify its semiconductor tariff policy this year," adding, "Depending on how tariffs are imposed, semiconductor exports may be affected." She continued, "While the United States has announced plans to impose high tariffs to expand its domestic semiconductor production capacity, Korean companies that have pledged to invest in the United States may be relatively less affected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.