KOSPI Hits All-Time High on First Trading Day of the New Year

Semiconductor Giants Reach Record-High Prices Together

On the first trading day of 2026, the KOSPI marked a fresh start by surpassing the 4,300-point mark for the first time in its history. However, the fortunes of last year's leading sector, semiconductors, and the underperforming secondary battery sector diverged sharply. Analysts in the securities market predict that the performance momentum centered on semiconductors will continue into the new year.

According to the Korea Exchange on January 5, the KOSPI closed at a record high of 4,309.63 on January 2, up 2.27%. Out of a total of 929 listed stocks, 374 ended higher, and 26 stocks in the main market alone hit new 52-week highs on the day.

The 'No. 1 horse' that surged ahead at the starting signal was, once again, semiconductors. Samsung Electronics and SK Hynix, which had closed the final trading day of last year at record highs, both renewed their all-time highs on this day, driving the index upward. The KRX Semiconductor Index soared 6.79%, ranking first among all sector indices.

Na Jeonghwan, a researcher at NH Investment & Securities, analyzed, "The continued upward revision of earnings forecasts for the semiconductor sector, amid expectations for a semiconductor supercycle, is a key driver of the strong share prices," adding, "For SK Hynix, the removal from the investment warning list led to a strong inflow of funds, which contributed to the stock's rise."

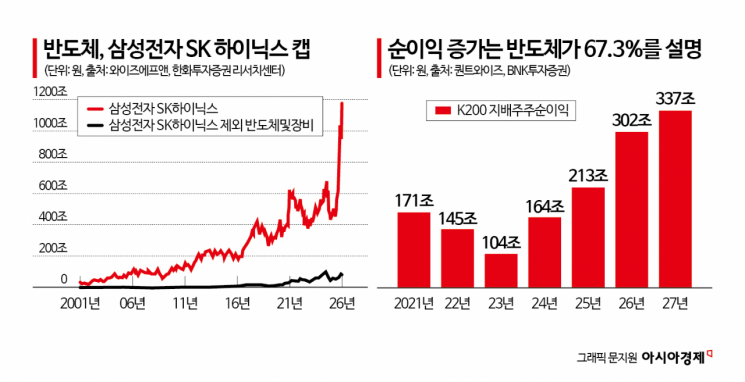

The rosy outlook for the two major semiconductor companies is expected to persist in the new year. Of the 16 target price increase reports released by securities firms on this day, six were for Samsung Electronics and SK Hynix. Kim Seongno, a researcher at BNK Investment & Securities, projected, "Through the first half of 2026, the trend of earnings improvement will continue, centered on Samsung Electronics and SK Hynix," and estimated that "the net profit attributable to controlling shareholders in the KOSPI 200 will increase by 88.7 trillion won in 2026, of which 67.3% (59.7 trillion won) will be driven by the improved performance of Samsung Electronics and SK Hynix."

In contrast, the secondary battery sector, which gave up its gains in the fourth quarter and ended last year on a disappointing note, also started the new year with declines, failing to reverse the trend. Both the 'KRX Energy Chemical' Index and the 'KRX Secondary Battery TOP 10' Index, which include secondary battery companies, fell by 2.06% and 2.31%, respectively, ranking among the lowest-performing indices.

Experts attribute the dampened investor sentiment to a series of supply contract cancellations and reductions by secondary battery companies. LG Energy Solution, which announced the cancellation of a 9.6 trillion won battery supply contract with Ford on December 17, subsequently disclosed the cancellation of an additional 3.9 trillion won supply contract, raising concerns among investors. On December 29, it was reported that a 3.8 trillion won contract between battery materials company L&F and Tesla had been reduced to 9.73 million won, sending shockwaves through the market.

Amid a series of unfavorable developments in the industry, the securities market is lowering its expectations for secondary battery companies. On this day, NH Investment & Securities cut its target price for LG Energy Solution from 640,000 won to 490,000 won, while Hyundai Motor Securities lowered its target from 613,000 won to 500,000 won.

With the divergence in stock price trends between sectors evident from the very first trading day of the year, some observers predict that the market will continue to be led by the existing leading sectors. Noh Donggil, a researcher at Shinhan Investment & Securities, advised focusing on IT and industrial goods stocks centered on semiconductors, stating, "In an environment of reduced foreign exchange volatility, an approach centered on the traditional leading export stocks remains valid." He forecast the KOSPI to range between 4,100 and 4,700 in the first quarter of this year.

Han Jiyeong, a researcher at Kiwoom Securities, estimated the KOSPI will range between 3,950 and 4,380 in January this year, stating, "Performance momentum remains solid, and despite strong stock prices in the fourth quarter of last year, valuation burdens have not increased for semiconductors, shipbuilding, and capital goods sectors, so a favorable trend is expected for these sectors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)