Daishin Securities: Policy Shift Signals Further Gold Price Gains

Energy Prices to Reflect Liquidity Expansion Later

The price of gold continued to break record highs day after day, closing out 2025 at unprecedented levels. This surge was driven by the U.S. Federal Reserve's policy rate cuts combined with declining confidence in long-term government bonds, which together stimulated 'hedge demand' from central banks around the world.

Despite a brief pause at the end of last year due to a margin increase issue at the Chicago Mercantile Exchange (CME), the price of gold remained strong, closing between $4,200 and $4,300 per ounce. In stark contrast to the overall underperformance of commodity indices last year, gold alone led the index upward, delivering overwhelming results.

On January 2, Daishin Securities projected that the price of gold could rise to $5,000 per ounce.

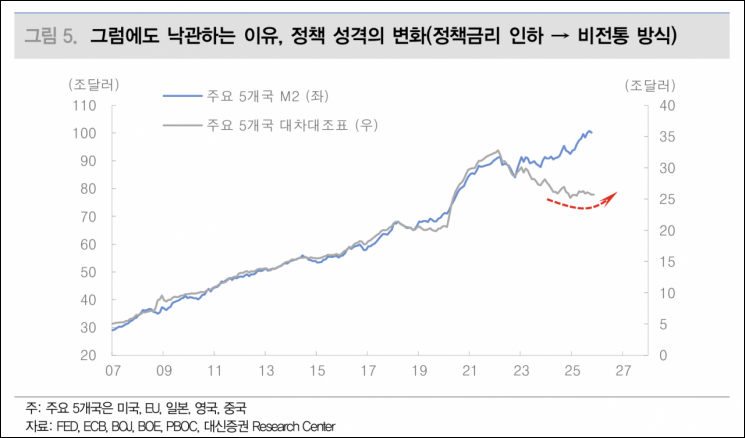

Choi Jin-young, a researcher at Daishin Securities, explained, “The reason for this optimistic outlook lies in a shift in policy direction. While liquidity was previously expanded through central bank policy rate cuts, it is now highly likely to be supplied through non-traditional methods going forward.”

He continued, “The Federal Reserve has ended quantitative tightening (QT) and has started purchasing government bonds. In addition, the supplementary leverage ratio (SLR) regulation, which had been a constraint for investment banks, is being eased as of this year.” He added, “Furthermore, there is speculation that a dovish figure may be nominated as the next Fed Chair by President Donald Trump. Finally, with liquidity expected to expand once more, gold-which reflects this in advance-is likely to see further gains.”

Choi predicted, “The rally led by precious metals could continue through the first half of this year, but in the second half, leadership is expected to shift to the energy sector.”

He analyzed, “The energy sector, which consists of international crude oil and natural gas, tends to lag behind the highly liquid gold price by about 18 to 20 months. Considering that non-U.S.-centered liquidity has been expanding since early last year, the fourth quarter of this year is likely to be the period when this liquidity is reflected.”

He further advised, “Factors that could hinder monetary policy will also act as obstacles slowing the rise in gold prices. Therefore, in the fourth quarter, it will be necessary to increase allocations to the energy sector.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)