U.S. Exports Set to Surpass 1 Trillion Won for the First Time

Supplier Dominance Remains Firm Despite Tariff Variables

United Kingdom Emerges as Next Major Market... Soaring Imports from Korea

This year, South Korea's exports of ultra-high voltage transformers to the United States are expected to surpass 1 trillion won for the first time ever. Despite U.S. tariff barriers, the construction of artificial intelligence (AI) data centers by global big tech companies and the replacement demand for aging power grids have strengthened the market position of Korean-made transformers. As demand for renewable energy transitions grows in Europe, including the United Kingdom, exports are expected to diversify even further in the coming year.

A worker is manufacturing an ultra-high voltage transformer at the LS Electric Busan Plant in Gangseo-gu, Busan. The brown material wrapping the coil, which is made by winding wires like a coil, is wood pulp, a key material that ensures the insulation of the oil-immersed transformer. Photo by Jang Heejun

A worker is manufacturing an ultra-high voltage transformer at the LS Electric Busan Plant in Gangseo-gu, Busan. The brown material wrapping the coil, which is made by winding wires like a coil, is wood pulp, a key material that ensures the insulation of the oil-immersed transformer. Photo by Jang Heejun

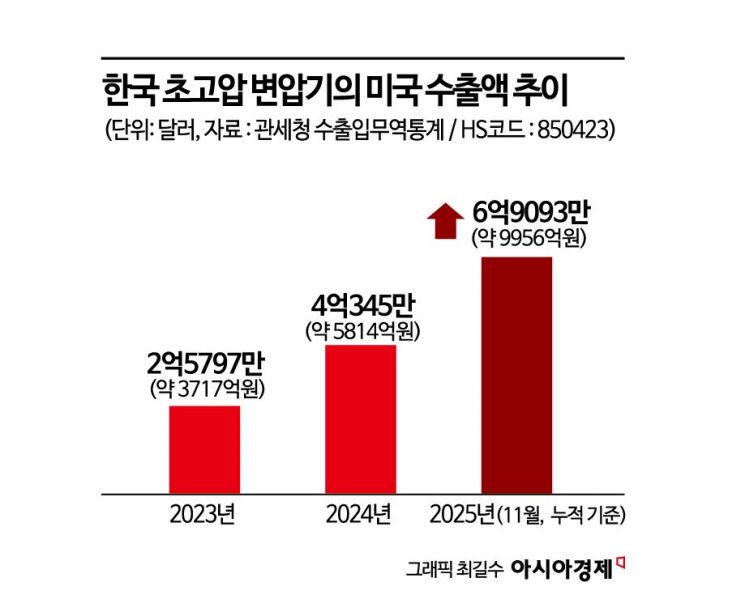

According to export-import trade statistics from the Korea Customs Service as of December 31, the cumulative export value of ultra-high voltage transformers (exceeding 10,000 kVA) to the United States reached 690.93 million dollars (approximately 995.6 billion won) through November this year. Considering the average monthly export trend of around 60 million dollars, it is highly likely that the annual total will exceed 1 trillion won by the end of the year. This marks the first time that exports of ultra-high voltage transformers to the U.S. will surpass 1 trillion won.

This figure has already far exceeded last year’s annual total of 403.45 million dollars (about 581.4 billion won) and more than doubled compared to 2023’s 257.97 million dollars (371.7 billion won). Global exports through November this year totaled 1.16693 billion dollars (1.6815 trillion won).

Major domestic power equipment manufacturers such as HD Hyundai Electric, LS Electric, and Hyosung Heavy Industries have significantly expanded their local production capacity in response to the U.S. "AI boom." HD Hyundai Electric is expanding its transformer plant in Alabama, while LS Electric has completed its plant in Bastrop, Texas. Hyosung Heavy Industries has also announced plans to invest 230 billion won in its Tennessee ultra-high voltage transformer plant to increase production capacity by more than 50% by 2028.

Despite the expansion of local production, exports have surged because it is difficult to meet the soaring demand. Ultra-high voltage transformers are essential for data centers that consume large amounts of power, and the North American market is also experiencing a 30-year cycle of aging power grid replacement. The North American transformer market is expected to grow to 35 trillion won by 2034.

Although there were variables such as the U.S. imposing a 50% tariff on transformer parts in August this year, the industry believes that the "supplier’s market" structure allows companies to pass the burden onto customers. The "big three" manufacturers have already secured several years’ worth of orders. For example, in September, HD Hyundai Electric signed a supply contract worth 277.8 billion won for 765 kV ultra-high voltage transformers and other equipment with the largest power company in Texas, marking the largest single contract in the company’s history.

The power industry expects that strong exports, including transformers, will continue into the new year. In particular, following the United States, the United Kingdom is being highlighted as the next major market poised for a boom. Europe is considered a high-potential market not only due to the expansion of the AI industry but also because of new power infrastructure demand driven by renewable energy transition policies.

According to analyses by the Global Trade Atlas (GTA), a world trade statistics database, and the Korea Trade-Investment Promotion Agency (KOTRA), the United Kingdom increased its imports of power equipment such as transformers, inductors, and converters from South Korea by about 56% last year compared to 2023. While imports from traditional major suppliers such as the United States and China decreased by around 40%, demand for Korean-made power equipment is on the rise.

The numbers also reflect this trend. Exports of ultra-high voltage transformers to the United Kingdom grew from 50 billion won in 2023 to 126 billion won through November this year. This year, HD Hyundai Electric secured the entire order for ultra-high voltage transformers worth 220 billion won placed by the UK National Grid. Hyosung Heavy Industries also recently announced that it signed a contract to supply ultra-high voltage transformers worth 120 billion won to Scottish Power Energy Networks (SPEN), the power grid operator in Scotland.

LS Electric, which has a portfolio focused on power distribution, produces all of its transformers domestically. Based on its newly expanded second plant at the Busan site, completed earlier this month, the company plans to strengthen its efforts to enter markets such as Europe.

An industry insider said, "As structural demand factors such as the spread of AI, power grid replacement, and renewable energy demand overlap, the transformer market is expected to remain strong for the time being. However, with long supply lead times and variables such as costs and tariffs still present, technological reliability and delivery competitiveness will be key to maintaining a competitive edge in the global market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.