Three Consecutive Quarters of Profit

Operating Margin at 1.4% in Q3

Profitability Improvement Challenged by Bad Debt Risks

The risk of bad debt (loss) at Dongbu Construction has emerged as a major obstacle to securing next year's performance. Bad debt is increasing at sites where construction has been halted or sales performance is poor, making profitability improvement (operating margin) a key challenge going forward.

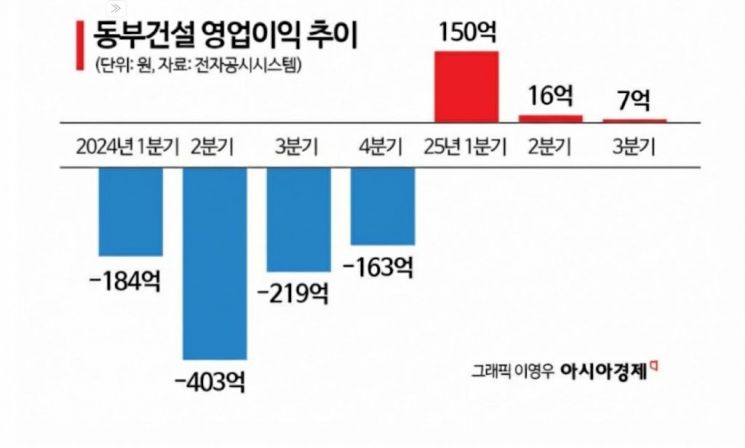

According to the Financial Supervisory Service's electronic disclosure system on December 31, Dongbu Construction recorded cumulative consolidated sales of 1.2349 trillion won in the third quarter of this year. This represents a slight decrease compared to the same period last year (1.2721 trillion won). Operating profit reached 17.3 billion won, marking a profit for three consecutive quarters.

The cost ratio, considered a key indicator of profitability, also improved significantly. The cost ratio, which stood at 99.5% in the third quarter of last year, fell by 10.1 percentage points to 87.4% in the third quarter of this year. This is due to a significant reduction in the proportion of high-cost sites that commenced in 2022, when raw material prices surged.

New orders have also increased, raising expectations for improved performance. Dongbu Construction secured orders worth 4.167 trillion won this year, achieving its highest performance since its founding. Orders for urban redevelopment projects amounted to 735.1 billion won. The order backlog, which represents future work, stood at 12.0643 trillion won as of the third quarter, securing approximately seven years' worth of work based on annual sales.

Profit Streak but Weak Profitability... Bad Debt Provisions Hold Back Growth

However, it remains difficult for the company to strengthen its fundamentals. Dongbu Construction's operating margin for the third quarter of this year was 1.4%, falling short of the construction industry average of about 3%. Although the company posted profits for three consecutive quarters, overall profitability improvement was limited due to bad debt provisions for long-term uncollected receivables.

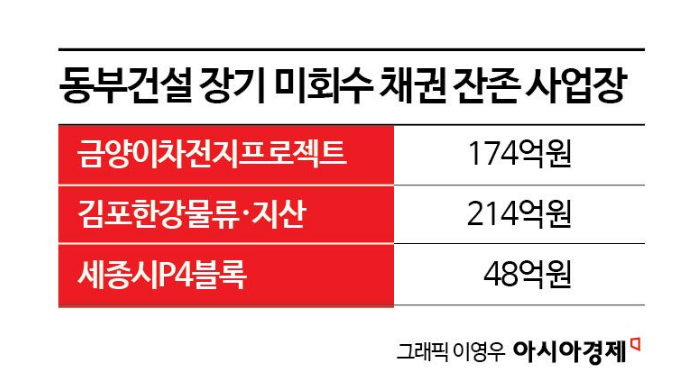

The increase in selling and administrative expenses (SG&A) is also believed to have contributed to weaker profitability. While cumulative sales for the third quarter decreased by 2.9% year-on-year, SG&A expenses rose from 86.7 billion won to 138.8 billion won, a 1.3-fold increase. The main reason was the rise in bad debt expenses. Cumulative bad debt expenses reflected in SG&A for the third quarter of this year amounted to 59.5 billion won. In contrast, cumulative bad debt expenses for the third quarter of last year were only 11.4 billion won. Bad debt expenses are costs recognized as losses for amounts among accounts receivable that are considered difficult to collect, directly impacting operating profit. In the third quarter of this year, bad debt provisions were mainly made for receivables with delayed collection from the Geumyang secondary battery project, the Gimpo Hangang logistics development project, and the Gimpo Hangang knowledge industry center.

The bad debt allowance ratio, which is set aside to prepare for collection uncertainty, also increased. The allowance ratio, which was 16% in the third quarter of last year, rose by 11.1 percentage points to 27.1% in the third quarter of this year. A higher bad debt allowance ratio means that the amount of receivables expected to be difficult to collect out of total accounts receivable has increased.

Furthermore, there are still a significant amount of long-term uncollected receivables at sites where construction has been halted or sales are sluggish, such as the Sejong City P4 project (4.8 billion won) and the Geumyang secondary battery project (17.4 billion won). The possibility of additional bad debt provisions cannot be ruled out.

The ability to resolve the financial burden from future bad debt provisions is considered crucial for improving profitability. Dongbu Construction stated that it will proactively manage bad debt risk to lay the foundation for mid- to long-term profitability improvement. A company representative said, "Although there was some disappointment as operating profit was partially adjusted due to bad debt allowance in the third quarter, we maintained a profit streak and confirmed the stability of our profit structure," adding, "We believe that proactively addressing potential risks will have a positive impact on strengthening our mid- to long-term financial soundness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)