Individual investors who subscribed to the first-ever Integrated Managed Account (IMA) product launched by Korea Investment & Securities have invested an average of approximately 43 million won per person. The number of customers who opened accounts just before the subscription period also exceeded 1,800, leading to the assessment that the IMA has resulted in a tangible inflow of new customer funds.

On the 30th, Korea Investment & Securities announced that its analysis of the IMA No. 1 product subscription data showed an expansion of participation mainly through non-face-to-face channels, an inflow of new customers, and a balanced distribution across various investment amounts.

The subscription for this offering, which closed on the 23rd, attracted 20,239 individual customers. Out of the total subscription amount of 1.059 trillion won, individual investors accounted for 863.8 billion won. The average investment per individual investor was about 43 million won. By subscription channel, online (non-face-to-face, such as smartphones) accounted for the vast majority at 87.7%. However, in terms of amount, the online channel accounted for 40.6%, indicating that larger investments were made mainly through offline transactions such as branch visits.

New customers and fund inflows were also confirmed. The number of new customers who opened accounts after December 15, just before the subscription period, was tallied at 1,830. Additionally, 10,133 customers invested more than 90% of the funds deposited into their Korea Investment & Securities accounts after December 15 into the IMA. A representative from Korea Investment & Securities commented, "It is significant that the IMA product has led to a real inflow of new customer funds."

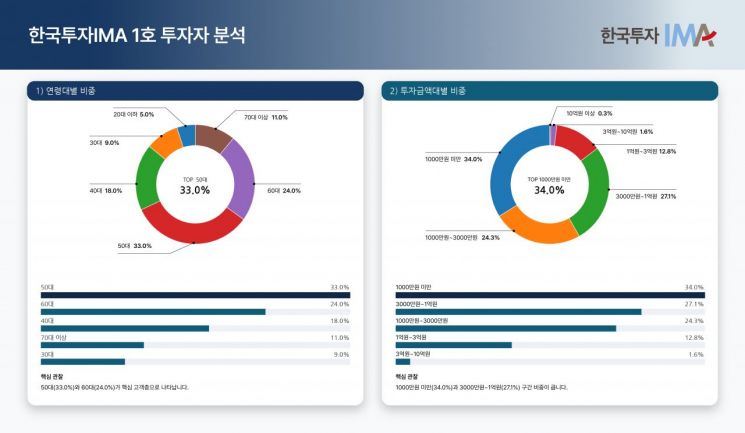

By age group, those in their 50s accounted for the largest proportion at 33%, followed by those in their 60s at 24% and those in their 40s at 18%. Those aged 70 and above accounted for 11%, those in their 30s for 9%, and those in their 20s or younger for 5%. While participation was most prominent among middle-aged and older customers, who typically have a higher demand for stable asset management, those in their 30s or younger still made up 14% of the total.

By investment amount, customers investing less than 10 million won accounted for the largest share at 34%. Those investing 10 million won or more but less than 30 million won accounted for 24.3%, those investing 30 million won or more but less than 100 million won made up 27.1%, those investing 100 million won or more but less than 300 million won were 12.7%, those investing 300 million won or more but less than 1 billion won were 1.6%, and those investing 1 billion won or more accounted for 0.3%. This suggests that a wide range of individual investors, not just high-net-worth individuals, participated broadly.

Additionally, an analysis of IMA subscribers' prior investment experience showed that 47.3% had experience investing in domestic bonds, the highest proportion. Experience with funds was also higher than the average among general investors. In contrast, the proportion of experience with short-term products such as repurchase agreements (5%) was relatively low. The IMA is being recognized not as a simple substitute for deposits, but as an 'asset allocation' product incorporated into portfolios from a medium- to long-term perspective, and it appears to have been chosen primarily for stable management and diversification rather than for short-term turnover.

Kim Seonghwan, CEO of Korea Investment & Securities, stated, "The characteristics of IMA investors have been identified in a multifaceted way across various indicators such as subscription channels, investment amounts, age groups, and prior investment experience," adding, "We see this as a reflection of Korea Investment & Securities' asset management capabilities in meeting diverse investment needs. Based on the confirmed demand and customer characteristics, we will further enhance our management and product design so that the system and products can become established in the market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.